What’s the latest on coronavirus?

The recent media noise around the spreading of coronavirus has undoubtedly spooked markets and investors. Investment Manager, Dr Christopher Cowell, highlights how our portfolios are built with a long-term view and why we are not overly concerned about the likely short-term economic and market impact of the outbreak.

At a headline level, it might seem like things have changed for the worst. As of 25 February 2020, the coronavirus has been identified in 33 countries, with 80,239 confirmed cases globally. While most of these cases are still within China, the news of cases in Italy (229) and South Korea (977) was a shocker. Is coronavirus getting worse? And where to from here?

Our portfolios are built with a long-term view so we’re not overly concerned about the likely short-term economic impact of coronavirus

There are some important considerations when trying to forecast the economic and financial impact of the epidemic:

- Major negative economic impacts relate to public health policy countermeasures (shutting down travel and trade, rather than mortality or infection rates), and

- While it’s hard to chart the course of an epidemic, the statistics of epidemiology are well known, assuming that the data is consistent.

The upshot is that whenever the epidemic peaks and begins declining, (a) the odds strongly favour the viral threat continuing its retreat, and (b) public health policy countermeasures will soon be lifted and economic activity will rebound.

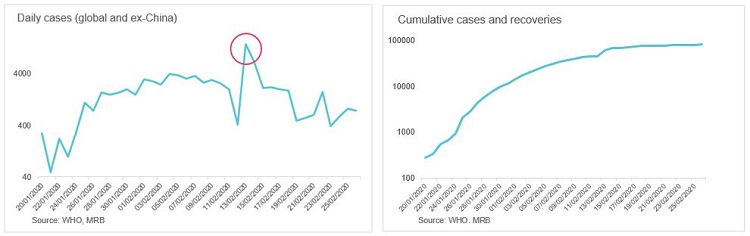

So while the daily China data reports should be met with some scepticism, it does appear that the spread of the virus is under control (see graphs). Daily data on new cases already suggest that the virus peak has been passed.

And once you scratch beneath the surface of these headline numbers, there are some important nuances:

- Despite popular perception, there has been no significant change in the strain of the virus

- The fatality rate in Wuhan remains around a fifth of what SARS was. Outside of Wuhan, the fatality rate falls to less than a tenth of SARS.

- It’s important to remember that symptoms range from mild to critically ill – not everyone who contracts the virus goes into critical care.

- So far, younger age groups are unlikely to fall into a critical condition if they contract the virus.

- The latest number of cases in Hubei (64,786) is in line what was predicted to be a month ago – the virus is not spiralling out of control.

To date, it looks as though containment is largely working. Don’t believe the scary headlines.

Which leads to the key question: what effect will coronavirus have on economic growth in China, and worldwide?

Macro and market impacts?

Policy measures in China have focussed on three things. Cities have been in lockdown, factories have been shut and travel has been curtailed. So we should expect weaker consumption and service sector data out of China over the next month or two. There will be some weaker tourism numbers from places like Japan and South Korea. And given China’s importance to global supply chains (particularly electronic components), we would expect some weaker manufacturing data from countries with strong trade links to China.

These patterns are already showing up in market prices. While headline equity indices are sharply down, it is asset classes most exposed to China and Asia that are bearing the brunt. Chinese airline stocks, for example, are down around 15% year to date. Companies that either source products from China or sell to China, like US technology companies and European car makers, are also suffering.

What are we doing about it?

While public health policy countermeasures are negative for growth, we are optimistic the Chinese and East Asian economic data will rebound soon.

First, a range of fiscal and monetary policy actions will soften the blow. China is already easing monetary policy, implementing tax holidays, encouraging banks to rollover debts, keep credit lines open and postpone pension payments to government entities.

Second, if Chinese consumers have kept their jobs and their wages are paid, then they will have more money in their accounts that they haven’t spent. Once normality resumes, those consumers will spend that extra money on something. So what isn’t spent this quarter or in the next couple of quarters will eventually be spent.

Putting the story together, we think the economic impact of coronavirus will be short-lived and contained. The market volatility of the last few days could present a buying opportunity. So far global equities are down around 7%, which hasn’t been enough for us to move our portfolios. But we are looking at some opportunities and will update you if anything changes.

Meanwhile, remember that the goal of our global multi-asset portfolios is to be diversified. They are not especially vulnerable to this kind of uncertainty. Furthermore, they are also built with a long-term view so we’re not overly concerned about the likely short-term economic impact of coronavirus.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.