7IM Responsible Balanced Fund

We've been running the 7IM Responsible Balanced Fund since 2007 - a long period in an area where many funds are not able to boast such an extended track record.

Many people are worried about global warming and the future of the planet. The media and politicians talk about the environment, human rights, inequality and the responsibilities of business. And there is good reason to believe that ESG –environmental, social and governmental – issues can influence company and investment returns in the long run.

7IM Responsible Balanced is designed to invest in companies that demonstrate positive and sustainable conduct.

Constructing the portfolio

At the heart of the 7IM Responsible Balanced portfolio are three rigorous processes we use across all our funds and products. We believe these processes provide the fundamentals of a well-diversified investment portfolio.

Onto these robust foundations, we apply our responsible investing approach

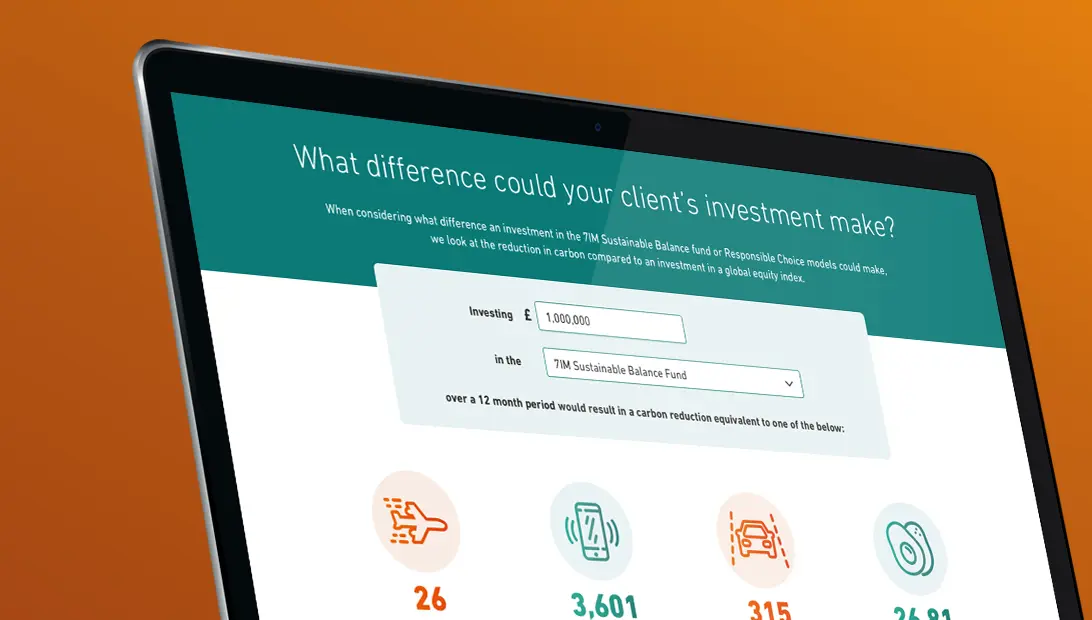

What difference could your client's investment make?

When considering what difference an investment in the 7IM Responsible Balanced Fund will have, we look at the reduction in carbon compared to an investment in a global equity index.

You can invest in the 7IM Responsible Balanced fund via the 7IM Platform as well as a number of leading investment platforms.

Scroll to explore the full list of available options.

If the investment platform you use is not listed, please get in touch with our team

Interested in the fund but want to speak to our team of experts? Get in touch today.

Related news and views

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.