All-Time Highs

This year (to the end of September) the FTSE 100 has notched up 28 new records.

28 “all-time highs” in nine months, a pace which compares pretty favourably to the previous 28 all-time highs which took seven years to achieve (2018 through to 2024).

It’s a similar story in the rest of the world, with the US and Europe, but also Mexico, Japan, South Korea and many other markets all reaching new levels. It’s a funny thing though; for lots of investors, the phrase all-time highs doesn’t prompt celebration or acknowledgement of a plan that’s working (why else do you invest, if not to grow the assets?!). Instead, it often leads to questions about selling, wondering whether things have gone too far, or worries about an impending crash.

An all-time high doesn’t mean anything

People overstate how important an all-time high is. Maybe it’s a lifetime of hearing analogies between markets and rollercoasters; we have some intuitive idea that a peak is followed by a decline; what goes up must come down.

But markets aren’t rollercoasters, and all-time highs are often misunderstood and overemphasised.

The cynic in me blames lazy journalism. A market at all time highs is worth 500 words. And a market off all-time highs? Sure, have another 500 words. The gift that keeps on giving.

But there are two simple truths to try and remember when the “all-time high” hype train gets going:

- Stock markets go up over time.

- Stock markets bounce around a lot.

Any time something hits an all-time high – that’s just point 1. And any time something falls from an all-time high – that’s just point 2.

Any single all-time high isn’t actually that important. It’s just part of the way markets work.

All-time highs are vital

The thing is people also underestimate how important all-time highs are. Without the occasional all-time high, your investment will go nowhere.

Take the Japanese stock market, the TOPIX. It’s had 15 new highs this year. And it had three new highs in 2024. But before that?

The last time the TOPIX was at an all-time high before 2024, the Berlin Wall had just fallen, a show called The Simpsons had just launched, and the British music scene was dominated by Kylie Minogue and Jason Donovan: December 18th, 1989.

So, for 35 years (about 8000 trading days) Japanese markets made no progress.

Compare that to the FTSE 100: 264 all-time highs between 1989 and 2024. That’s not so many really; around 3% of those 8,000 days.

And yet it resulted in the index being 220% higher than it was on December 18th, 1989 – more than triple your money.

To put it another way; NOT being at an all-time high most of the time (97%!) is ok. That 3% does a lot of heavy lifting. But once that 3% drops to zero, it’s a very different matter – as the TOPIX showed for more than three decades.

Don’t forget the dividends

Compounding creates wealth more efficiently than any other method. Take your dividends and stick them straight back into the market. Make your money keep working for you, and it creates more money!

And most of the attention on all-time highs focuses on stock indices which DON’T INCLUDE DIVIDENDS!

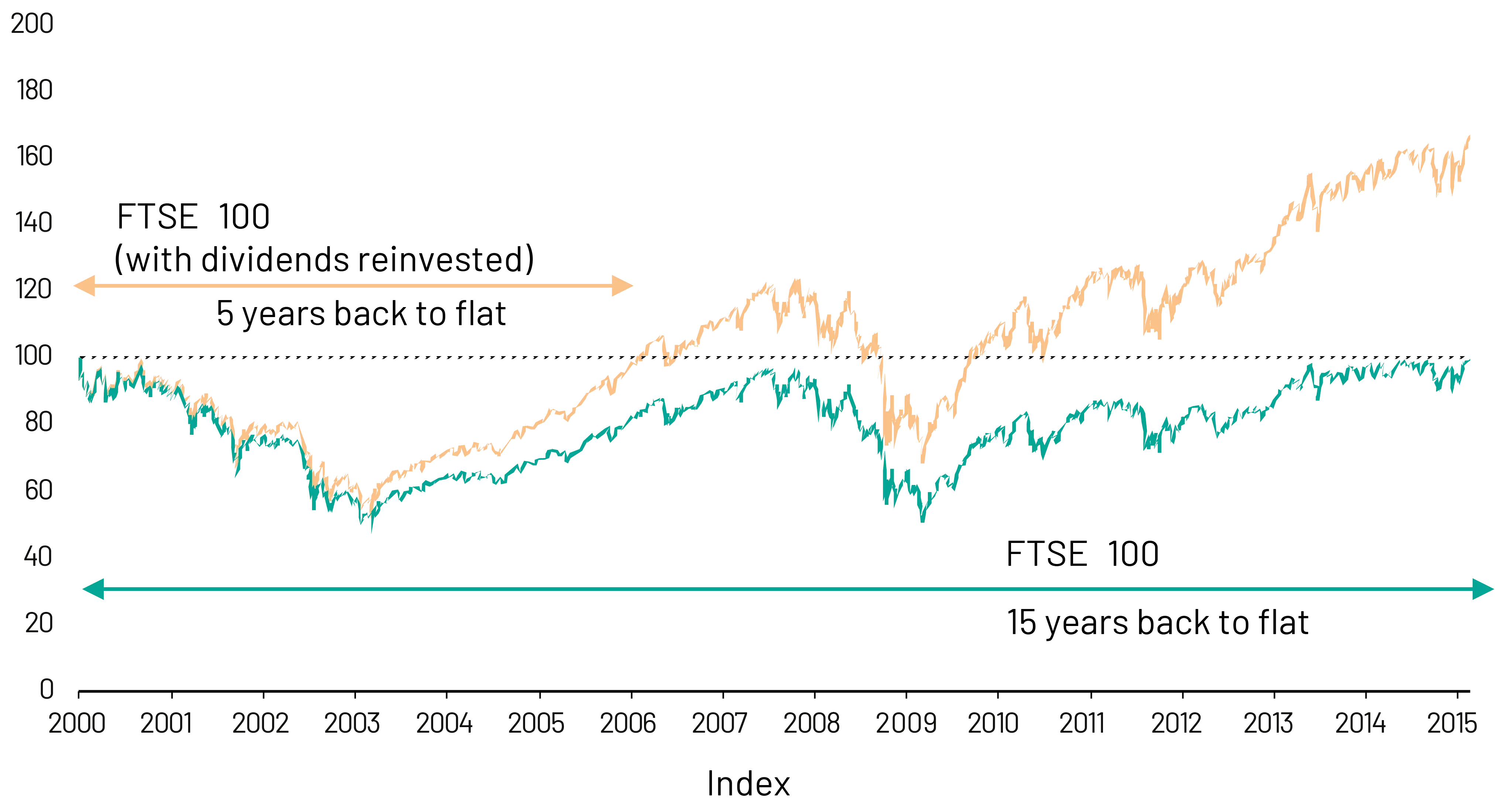

Much like Japan, the FTSE 100 index had a period without any new highs – from December 1999 to February 2015. But if you’d been invested through that period and kept adding your dividend payments back to your holdings, the 15-year wait got a lot shorter. You still had to wait for 5 years, but that’s the risk with any investing!

Source: FactSet

Managing money is about managing emotions

In the investment team, we don’t pay attention to “all-time highs.” I’d love it if the media did the same, but I suspect that’s not going to happen any time soon.

So, instead, the best advice I can give is to reframe how you respond to headlines about the phenomenon.

New all-time high? “Great, that’s why I invest – growth in capital over time, I certainly don’t want my money standing still!”

Market no longer at an all-time high? “Excellent, my dividend reinvestments are buying more stock than they were yesterday!” Or even “Ah! The sale is on! What a fantastic opportunity to invest at a cheaper price!”

Now of course, depending on your time horizon, it might feel a little bit more pressing when stock markets fall. But that’s what the rest of the portfolio is for (and why it’s so important to get the right blend of investment assets for your stage in life). The bonds and alternative parts of the portfolio are there to stabilise things – to give the equity side the time and space to get back on an upwards trajectory!

More from 7IM

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.