Monthly commentary

Monthly Musings:

It feels like a loooong time since Donald Trump stood in the Rose Garden of the White House. But Liberation day was just a month ago. Since then, we’ve had pauses, reinstatements, doublings, more pauses, exemptions and clarifications galore.

It has felt like a big month for markets. Lots of panic, lots of statements from authorities, lots of headlines about routs and sell-offs and so on (often from respectable institutions who should know better!). Which is why it’s worth pausing to note that the US stock market is almost exactly where it was at the end of March. As in fact, are US 10-year bond yields.

If you’d gone on holiday for a month, you’d not have noticed much change in the financial world on your return – with the exception of the US Dollar, which I’ll tackle later. You would, perhaps, have observed that the big US tech stocks were still struggling vs other sectors and markets so far in 2025.

And that’s a trend that’s still worth looking at. Not the possible impact of tariffs on Apple, or retaliatory EU regulation on Google, or Nvidia’s legal obstacles in shipping to China though (there’s too much uncertainty on any of that to either worry, or get too excited).

No – when you take Trump out of it, the question remains; have the big tech companies found themselves in an expensive AI-spending war with one another? At the end of April, Microsoft plans to spend $80 billion. And yet there are growing reports of companies like DeepSeek finding ways to achieve similar results for a fraction of the cost and processing power.

If that’s the case, then there’s a lot of wasted investment. It won’t bankrupt the big tech firms. But it will take a huge bite out of future growth, bringing some lofty expectations back down to earth. And when those firms are perhaps 20% of pure passive global portfolios, there could be a lot of price pain coming. Investors might confuse it with Trump-related issues, so it’s important to try and establish what is happening. We’re watching closely.

What about the US Dollar then? 10% down year to date. Is that a stark warning about something nasty brewing?

The US Dollar tends to move in long cycles. Strong from the late 1970s. Weak from the mid-80s to the mid- 90s. Strong from the mid-90s until after the dotcom bubble. Weak again until the 2010s’ Eurozone crisis. And then 13 years of strength until this year.

Weakness is not necessarily a reflection of poor US growth prospects, as much as an acknowledgement of the opportunities elsewhere. A reindustrialisation of Europe, and some interesting moves in Japan (see below) might just mean that the marginal flow of Dollars reverses. The important thing to note is that if the weakness really does become embedded, it’s likely to stick around for a while. Sensible diversification and hedging suddenly become important in a way they haven’t for the last decade. Guess what we’re doing…

Chart of the month

Japan has the world’s third largest stock market.

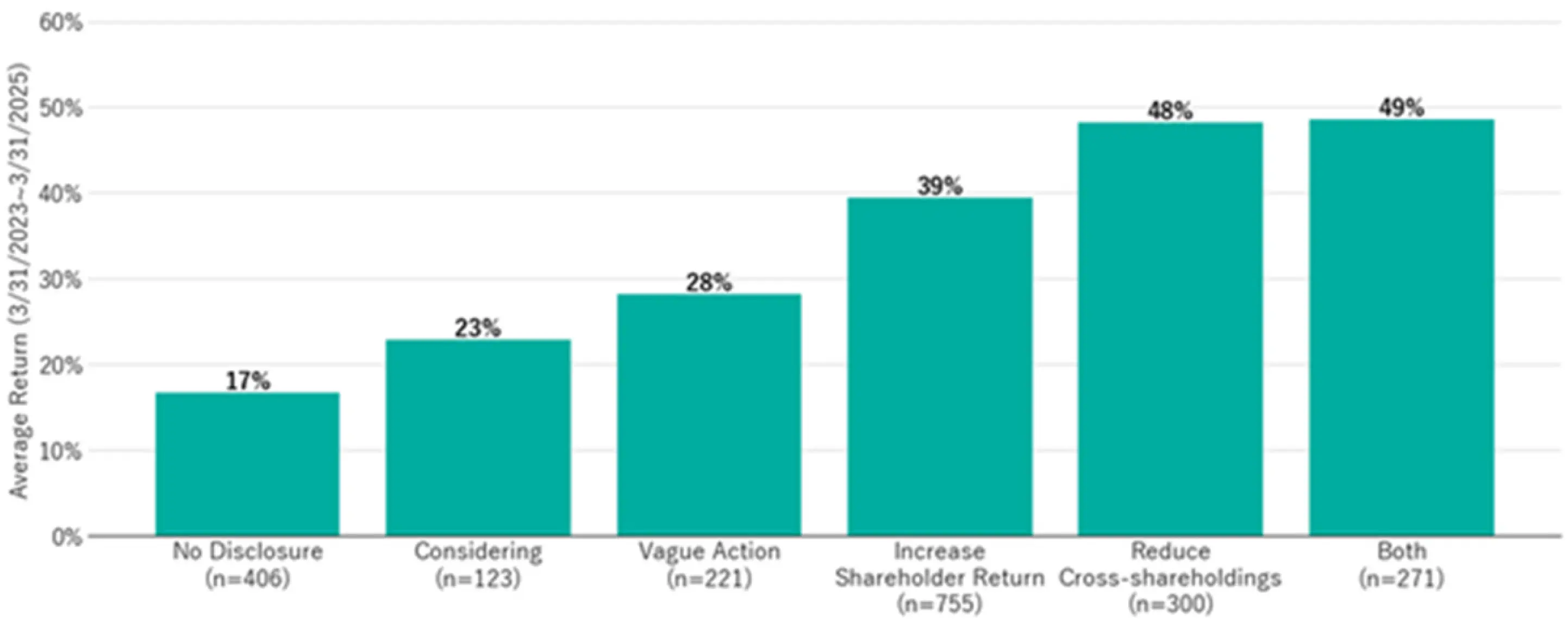

For decades, Japanese companies have been scarred by the market crash in the 1980s. Rather than return cash to shareholders, they’ve hoarded it to be able to survive another calamity. But that’s meant the market hasn’t been attractive for foreign investors. If you’re going to invest £100 in a company, why would you want the company to stick half of that in a bank account, earning almost no interest?

Two years ago, the Tokyo Stock Exchange told companies to, basically, make themselves attractive to investors; to start returning money, rather than hoarding it in huge cash piles or complicated investments in other businesses.

Those companies who’ve taken that seriously have done very well (the right-hand side of the chart below), with share prices increasing by an average of 50%, compared to less than 20% gains for businesses refusing to change.

Source: Verdad Cap

As investors look for homes other than the US, Japan might just have timed things perfectly…

April Markets Wrap

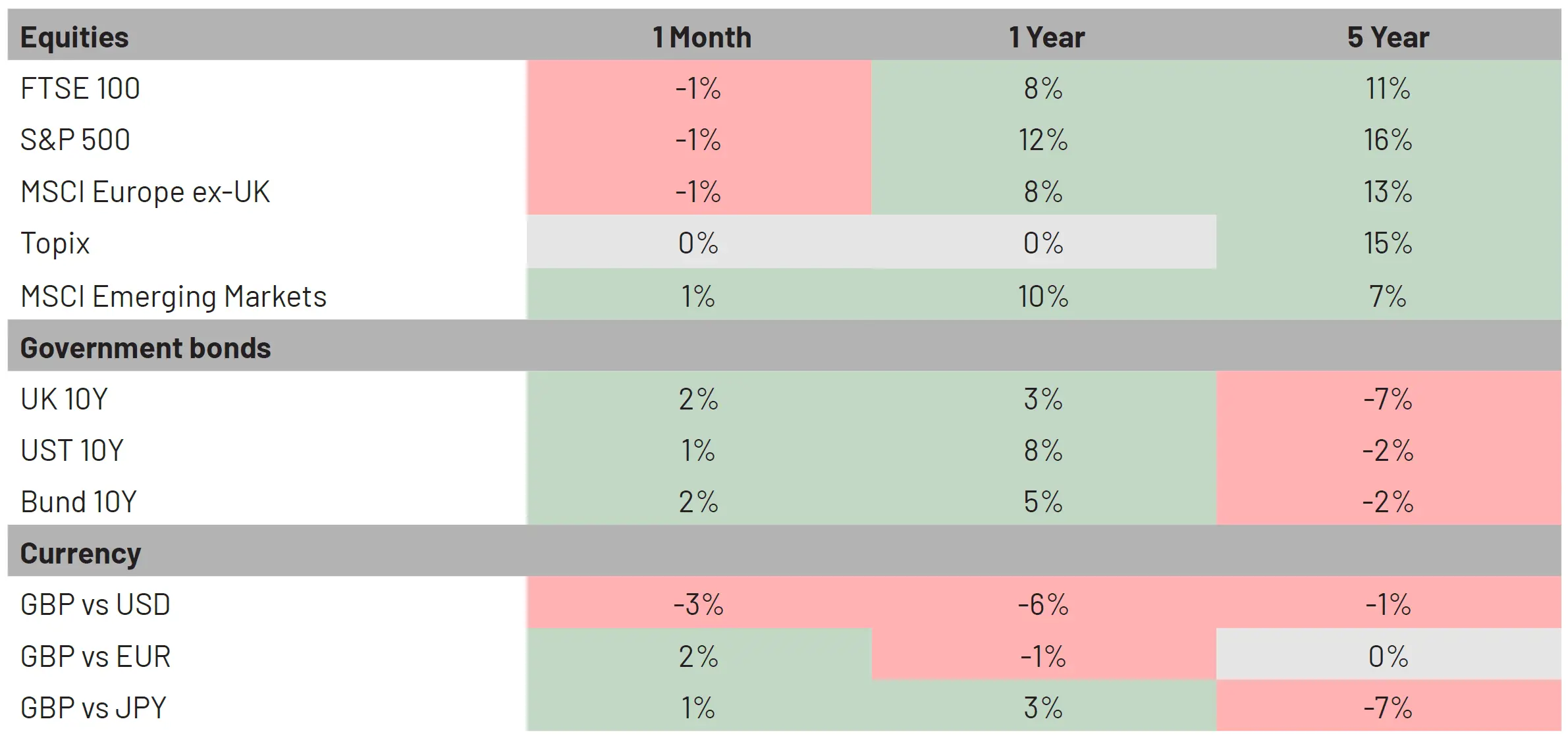

After a whirlwind March for markets, April saw Liberation Day, scary headlines and mixed economic data come and go without any significant shifts in market performance. Despite some noise intra month, April saw markets finish where they started at the end of March.

In the UK, the FTSE 100 continued to show renewed investor interest amid global trade policy uncertainty. A rocky start in the month driven by global trade tensions quickly settled, buoyed by strong corporate earnings and some stability in domestic economic data.

The story for Europe in April can be told using a similar one to that in the UK. Resilient corporate earnings and easing of political tensions in the largest nations proved to be the offsetting factor to the trade concerns that have rippled across the globe. Economic conditions in the region look favourable for markets moving forwards. Fears of lingering services inflation keeping rates higher for longer have begun to ease in the wake of Trump’s tariff agenda, with an ECB rate cut in June currently being priced in the market.

For the US, the Trump agenda continued to confuse and impress investors in equal measure. The S&P 500 finished the month marginally lower on a total return basis, despite a significant sell-off in early April as a result of President Trump’s tariff announcements.

Yet during difficult times for stock markets, government and corporate bonds have done their job – nothing spectacular, simply paying coupons as expected and providing stability in the wake of market volatility.

We expect to see more volatility in the next few months, as investors reprice the risks and opportunities available to them. We firmly believe that diversified portfolios are likely to smooth the journey and maximise return potential over the longer term.

Market Moves

Source: Bloomberg Finance L.P. Data as of 30 April 2025. Past performance is not a guide to future returns.

What we’re watching in May:

- 1 May – Apple and Amazon report earnings

- 7 May – Disney reports earnings/Federal Reserve monetary policy meeting

- 8 May – Bank of England monetary policy meeting

- 19 May - UK-EU Defence and Energy Pact announced (TBC)

- 28 May – Nvidia reports earnings

More from 7IM

You can download the commentary as a PDF here.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.