Monthly commentary

Summary

Joining the dots between economic data and markets over any period of time can be stressful. Trying to do this over the short term can be infuriating.

The amount of analysis you can do trying to second-guess the next economic data release is endless. And even if your prediction is correct, you may end up tearing your hair out when the data comes out and markets react in a way that you would never have predicted.

What happened in February

In January, markets soared as falling inflation fuelled positive sentiment around a potential end to the rate hiking cycle. In February, the positive short-term economic data kept flowing, but markets didn’t seem to follow:

- US unemployment came in slightly lower than forecasts

- The Purchasing Managers’ Index showed a general improvement across the US and the UK

- Energy costs continued to fall across Europe

- A Chinese reopening continued to progress

| Index | Feb 2023 Return |

|---|---|

| S&P 500 | -2.4% |

| FTSE 100 | 1.5% |

| MSCI EM | -6.5% |

| EuroStoxx 50 | 1.6% |

| Global aggregate bonds | -3.3% |

If you had positioned your portfolio for positive economic data and invested your money accordingly, you would probably be left scratching your head over why some markets suffered.

Why did this happen?

If you read enough market commentary, you can start to form a narrative of why markets might have done this… perhaps markets were looking forward to faster rate cuts and the positive economic data means these wouldn’t come as soon… but the very reason for the rate cuts is to get more positive economic data… you end up tying yourself in knots. So, what has actually driven these price moves?

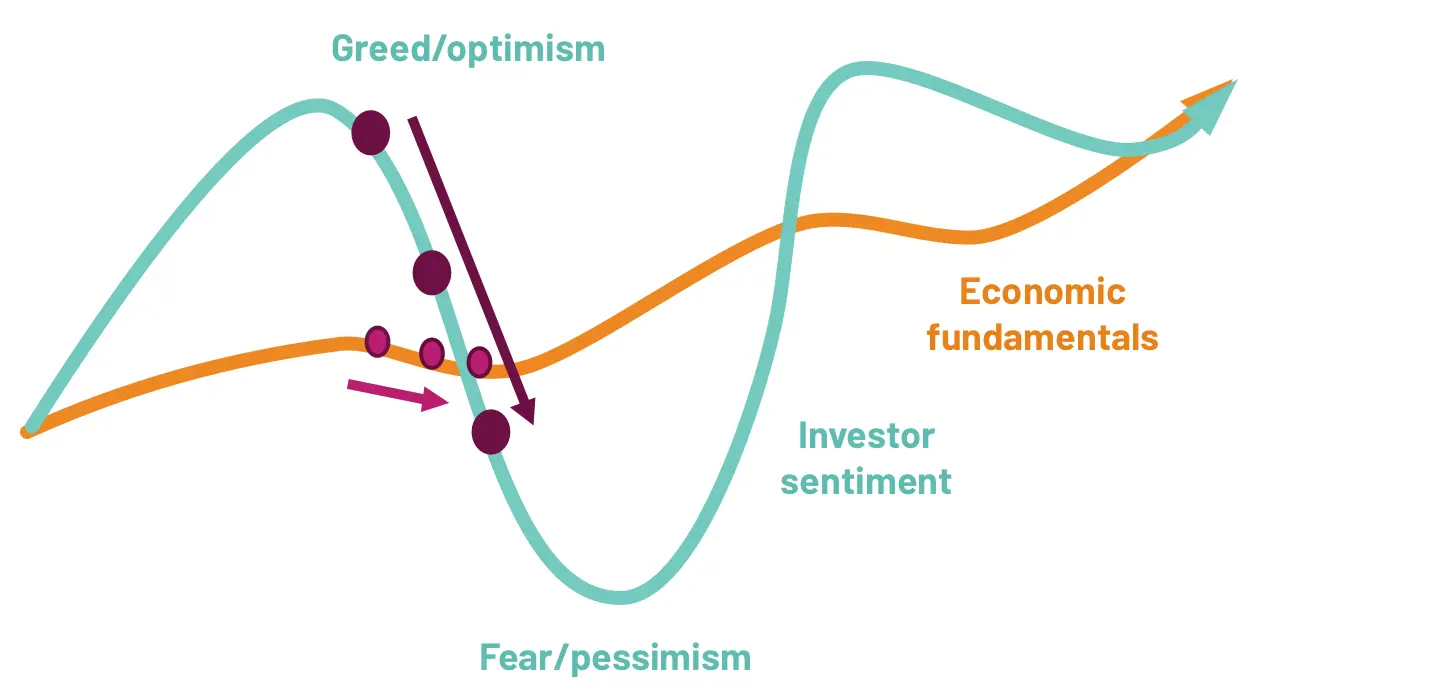

Animal spirits – over the short term, asset prices often rise and fall off the back of human emotion as opposed to any actual change in intrinsic value. If anything, the economic data suggests asset prices should be rising, but instead, they have fallen.

If asset prices move irrationally, what should investors do?

Stick to your guns. If you correctly predict next month’s economic data release and invest accordingly, you might not be rewarded for your smarts right away. But once you have an idea of a range of the most likely economic outcomes stretched over longer time periods, and then invest accordingly, you are much more likely to be rewarded.

Markets can make irrational moves in the short run, but they tend not to be irrational for long periods of time.

Actions taken

During February, no major changes were made to portfolios.

Core views

At 7IM, we have a number of long-term core views that help to guide our investment decisions and allocations within portfolios.

Over the next 12 months, we think markets will generally move sideways with volatility. In this environment, it is important to rely on a stable identity. Economic uncertainty creates fear and investor sentiment tends to overreact to economic turning points. Going forward, we believe that:

- Inflation will come down. Goods inflation is slowly normalising, and supply chain pressures are easing.

- Central banks are getting close to the end of their hiking cycles, but there is still a bit more work to do.

- A US recession is highly likely. Most leading indicators point towards a recession, but the recession shouldn’t be too long or deep.

Investor sentiment overreacts to economic turning points…

… with slightly weaker data leading to panic right now

Source: 7IM

And so, investors are starting to worry about what’s next for financial markets. Economic data isn’t likely to stabilise until next year, so ‘Sideways with volatility’ is the most likely scenario for the next few months.

We know our investment identity helps us to deliver in just these kinds of environments. We have positions that can generate returns despite this volatile backdrop.

You can download the commentary as a PDF here.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.