Monthly commentary

Monthly Musings: Financial fables

Two and a half thousand years ago, a Greek slave put together a collection of moral lessons disguised as stories. Aesop’s fables have stood the test of time, and many of them are just as relevant today as ever, in life and in the markets.

The boy who cried wolf, for example, might serve as sensible reading for Donald Trump when it comes to tariff announcements. Investors are paying less and less attention when the US President starts quoting punitive percentages and implementation dates, because the policy is usually walked back or watered down within days. Trump’s mid-May social media post about imminent tariffs on all EU goods would, earlier this year, likely have led to a sharp sell-off. But now? After so many shouts of “wolf”? It barely caused a ripple in the financial world; and rightly so – three days later Trump dialled it down.

And yet. At some point, the wolf really might come. Trump (especially after internet jibes about chickening out) might well decide an example needs to be made. Just as we believe the worst outcome is unlikely, we’d caution against expecting the best outcome as well.

Perhaps there’s a lesson in the hare and the tortoise too for the White House. The rapid-fire proclamations and policies issued so far this year have come up against the slow and steady process of US bureaucracy. The constitutional legitimacy of tariffs is being challenged in court. The Department of Government Efficiency has found out that it takes a lot of effort and patience to change existing layers of government. And restarting US manufacturing isn’t as easy as just flipping a switch.

It’s not to say that these changes won’t happen. But it’s a long race. Slow, sensible and steady approaches are likely to deliver more lasting change. Whether the administration has the patience to pursue them is another matter.

There are some big questions for investors this year, which so far remain unanswered. The first is whether the rotation away from the US market will continue, and the second is whether it will happen in a pain-free way (the US rising, but other areas rising more).

So are investors holidaying in non-US stocks, or is there something more permanent going on? There are some signs that the trend might stick; largely because there are pushing and pulling forces. It’s not just expensive US markets pushing money out, it’s the cheapness and future growth available in Europe and Asia pulling money in. That gives us reasons to be optimistic that the rotation will be more than a flash-in-the-pan, and also that it can continue happening in a world of positive absolute returns. Some of the unloved sectors in the market might be getting their decade in the sun – we like financials and utilities in particular.

The final question for investors is on interest rates. Although central bank interest rates are starting to move downwards once more, the bond markets are also trying to price in an expansion in government debt and debt servicing costs over the next decade or more, alongside the potential for higher inflation. We’re starting to see different pricing across different regions – what’s happening in Europe is different to Japan, which is different to India, which is different to the UK.

Aesop’s final fable is the ant and the grasshopper. The ant spends all summer preparing, while the grasshopper takes the easy, lazy option. When winter comes, the ant is all set, while the grasshopper hasn’t got enough time to get ready.

That’s how we think about portfolio construction. Build it well in the good times, and then the hard times aren’t so hard. If the equity markets keep rising, that’s great. If bond markets are steady, that’s great too. But if there’s a bit of a cold spell, a bit of volatility, our investment (should that be investmANT) team are already prepared.

Chart of the month

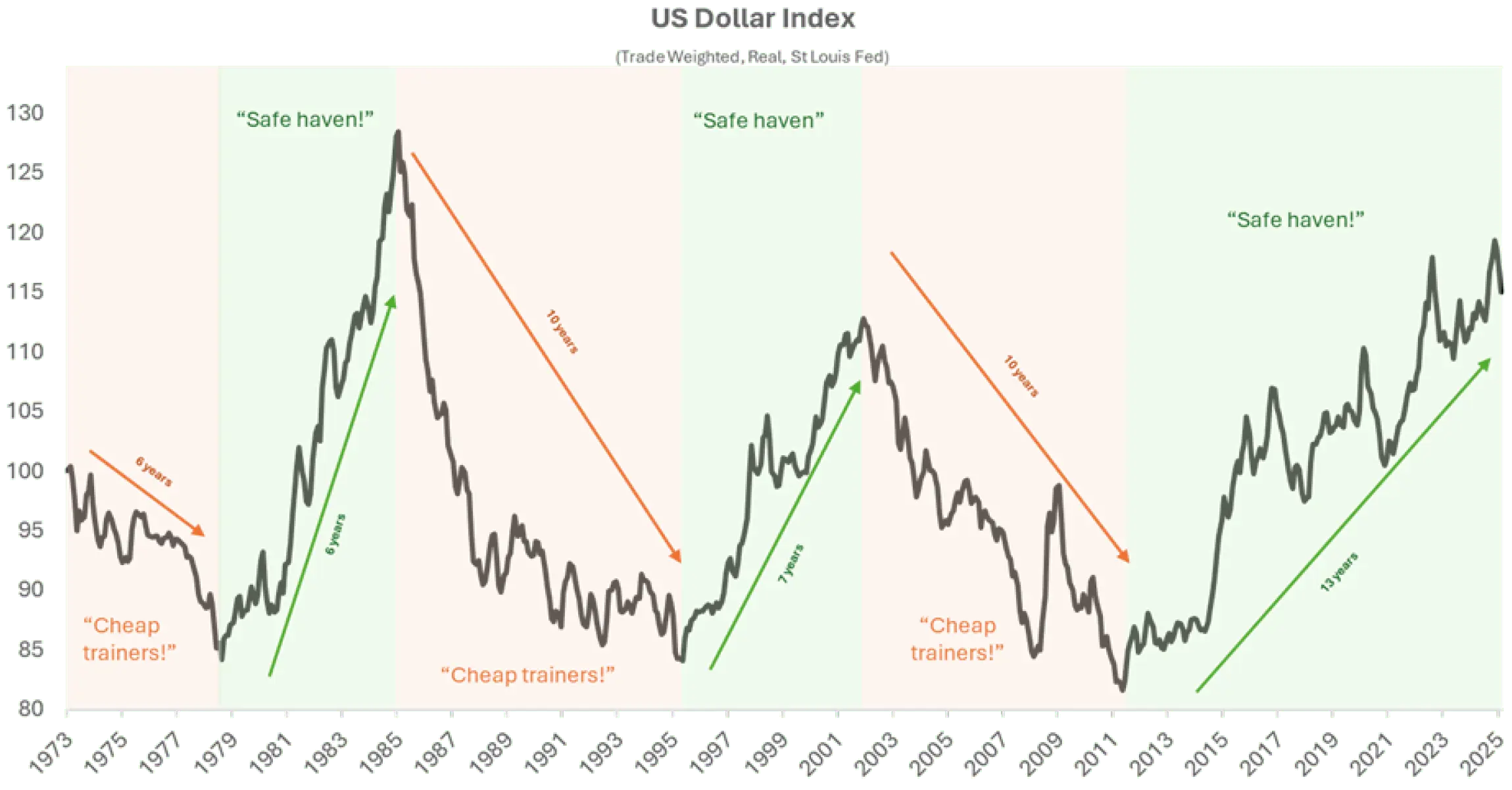

Source: 7IM/St Louis Federal Reserve

Since the financial crisis, investors have thought of the US Dollar as a safe haven – as strong vs. most of the rest of the world.

And yet. For the decade or so before that, the US Dollar was, broadly, seen as cheap. If someone was going to the US in 2005, you asked them to pick you up some new jeans, or trainers, or an iPod.

The Dollar (like all currencies) goes through cycles – usually years long. The cycle changing doesn’t mean the world is ending. It might just mean that the Euros, Pounds and Yen in your portfolio are more valuable than they have been over the past decade or so.

May Markets Wrap

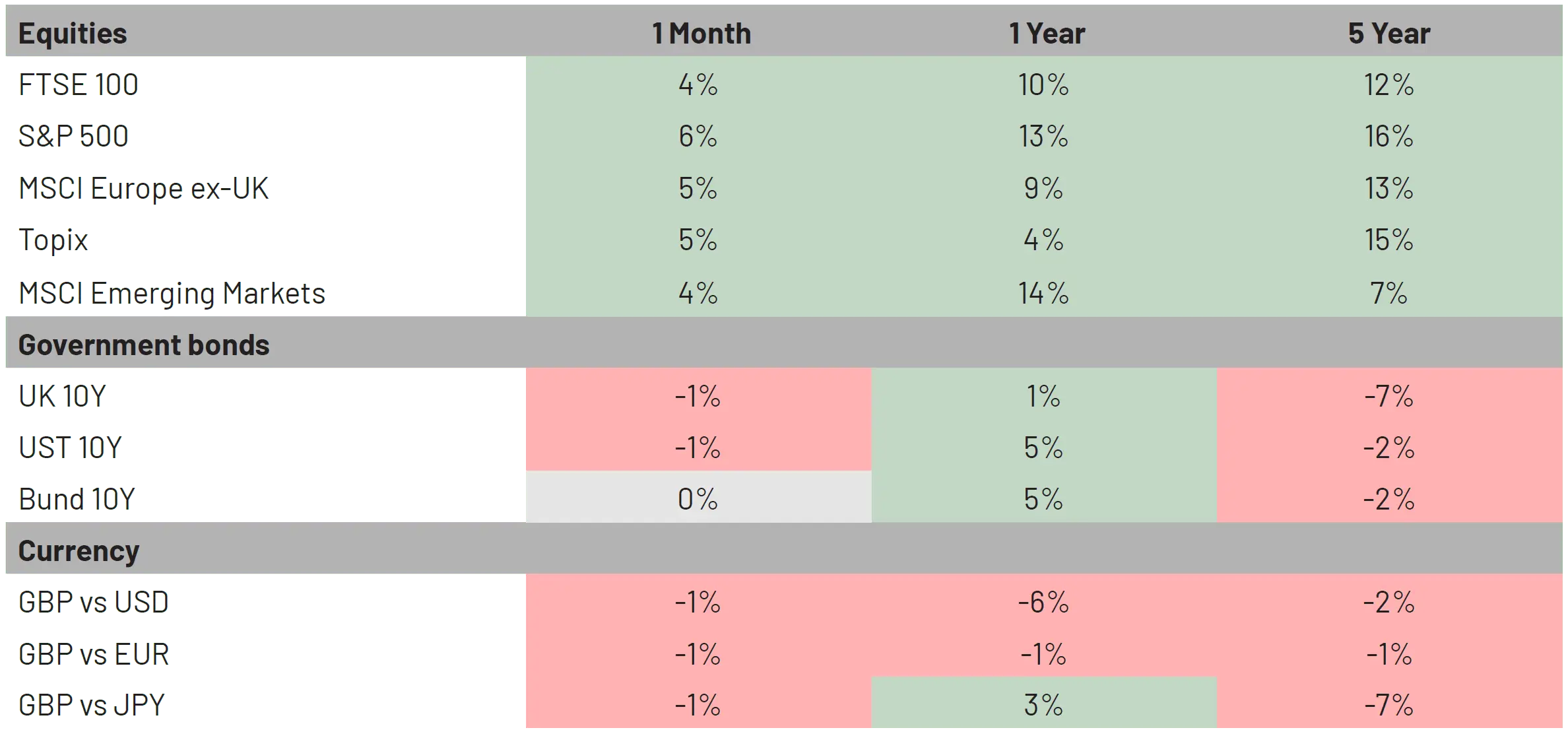

Markets in May swept away the April showers, with all developed equity markets posting strong returns.

The reversal of the negative performance trend seen in April came as President Trump paused, and in some cases removed, some of the costly tariffs that were initially implemented post Liberation Day in April.

As a result, the S&P 500 stormed ahead, with May being the strongest month for the index since November 2023. Investors moved swiftly on the news that tariffs imposed on China would be paused for 90 days, with the economic growth fears that aligned with tariffs easing.

However, despite positivity in the equity markets, sentiment towards Treasuries remained weak given the potential of unfunded tax cuts being posed by President Trump.

Across the pond in the UK and Europe, easing trade policies helped maintain the regions positive run.

Equity markets in Europe were buoyed by trade fears potentially easing, as well as a positive outlook on inflation from the ECB, supporting an environment for further rate cuts.

In the UK, the drivers of equity positivity remained comparable to its European peers. However, in fixed income world, gilts suffered. Yields rose due to servicing concerns and sticky core inflation impacting the Bank of England’s potential for further rate cuts.

Market Moves

Source: Bloomberg. Data as of 30/05/2025.

What we’re watching in June

- 05 June – European Central Bank rate decision.

- 09 June – Costco earnings – just how is the US consumer doing?

- 11 June – US old-school tech giant Oracle reports earnings. Pushing into AI, can it keep up?

- 12 June – Broadcom earnings. Microchip manufacturer.

- 17 June – Bank of Japan rate decision – Inflation in Japan now near 40-year highs. Worth watching.

- 18 June – US Federal Reserve rate decision.

- 19 June – Bank of England Interest rate decision (very low chance of action given cut in May)

More from 7IM

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.