Monthly commentary

More tech trillions

How do you celebrate your company reaching a $5 trillion valuation? Well, as a friend of mine informed me over the weekend (with pictures for proof), if you’re NVIDIA CEO Jensen Huang, you go out for an afternoon pint in a hipster pub in Shoreditch, London! NVIDIA would now rank 6th on a list of global stock exchanges; bigger than every national market except the US, China, Japan, India and Hong Kong.

Part of the explanation was found in the other big tech companies Q3 earnings reports – Microsoft, Meta, Google and Amazon spent more than $110 billion between them in the three months to the end of September. A large chunk of that flows straight to NVIDIA; and with something like $500 billion of demand already booked for 2026, the spending doesn’t look like slowing.

That level of spending requires a pretty healthy bank balance, but with overall US earnings growing at more than 10% for the fourth consecutive quarter, there doesn’t seem to be an immediate issue with ability to spend.

Worries over private credit have been building a little, so it’s worth a reminder that the high-profile defaults of First Brands and Tricolour appear to have been dodgy-accounting-related, rather than a crack in the overall system. Of course, illiquid, low-visibility loans are likely to be where things do go wrong, but at the moment, we’re not seeing too much to stress about.

Most of the questions we’re getting are about the upcoming UK Budget. And unfortunately, we have no answers or insight (nor does anyone else, despite the perma-headlines). We’d just note that paralysing the country’s financial decision-making for 2-3 months every year isn’t a particularly helpful thing to “get growth going”.

Chart of the Month

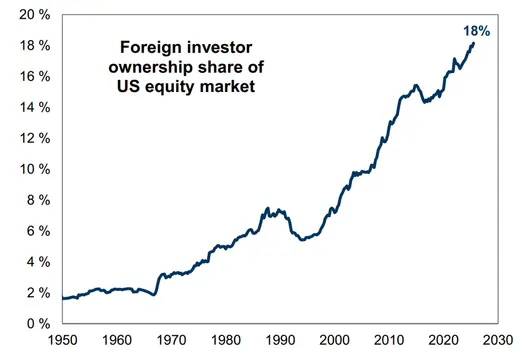

Source: Goldman Sachs/7IM

There has been a lot of chat in recent months around how the US stock market is becoming globalised. The demand for the US technology industry and its wide-reaching tentacles has exploded in the wake of the recent AI trade, leading to global businesses looking to the US for its technological expertise.

But it's not just the market itself becoming a global revenue generator, but also those who are investing in the markets. It is crazy to think that the global exposure to US stocks has almost tripled since the late nineties.

As markets evolve and become more global, so will the investor base!

September Markets Wrap

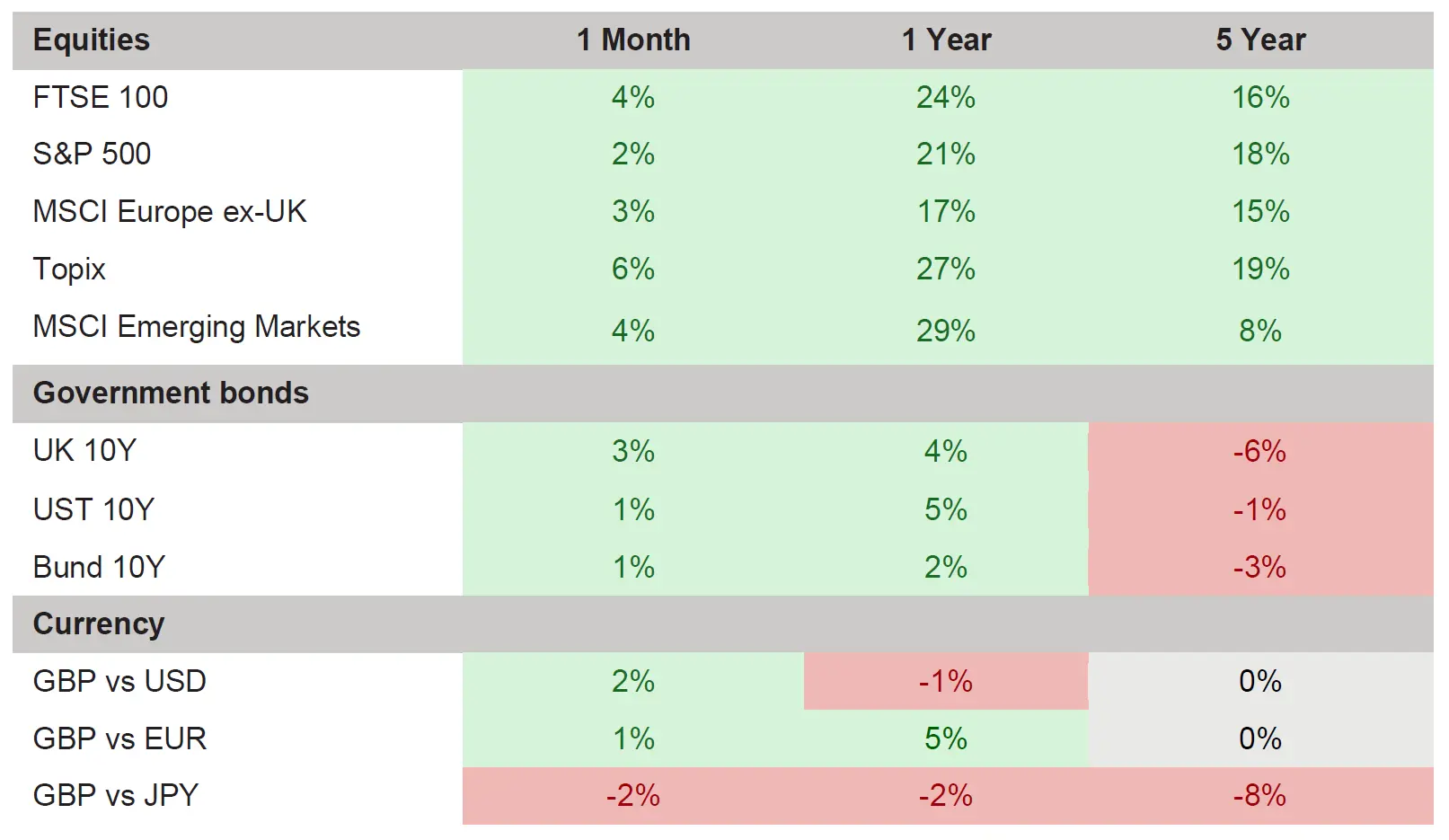

Global equity markets posted strong gains in October, buoyed by optimism around artificial intelligence (AI) innovation, easing inflationary pressures, and central bank policy shifts. The S&P 500 rose 2%, led by mega-cap tech stocks, but Japan’s Nikkei 225 stole the show as it hit a record high following a leadership change and renewed fiscal stimulus. Indeed, the Asia region as a whole led the way, as Korea soared on the back of AI-related spending, plus corporate governance reforms. Emerging markets also rallied, with Latin America rebounding after Argentina’s midterm elections delivered a market-friendly outcome, following Javier Milei’s surprise victory.

Bond markets too had a positive month, which was led by the UK gilt market, as the Chancellor received a boost from softer inflation data that was released for September, providing optimism over further interest rate cuts. This was despite widely expected Office of Budgetary Responsibility (OBR) downgrades on UK productivity, possibly restricting her choices in the forthcoming budget.

Corporate bond markets settled down, following an initial spike in yields fuelled by fears over a potential systemic issue in the sector, after two significant US borrowers defaulted, which proved unfounded.

Market Movers

Source: Bloomberg Finance L.P. Data as of 31 October 2025. Past performance is not a guide to future returns.

What we’re watching in October

- Ongoing – US government shutdown. The longer it lasts, the worse the collection of data gets.

- 6th – Bank of England meeting. A meeting full of uncertainty about inflation, unemployment and the upcoming budget causing some headaches for the Monetary Policy Committee.

- 13th – Walt Disney reports Q3 earnings; if consumers really are struggling, they might cut subscriptions first, but also think twice about going to the happiest place on Earth.

- 26th – UK Budget – what will Rachel Reeves’ budget look like?

More from 7IM

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.