Concrete (and steel!) climate plans

I’ve never been one for New Year’s resolutions. I worry that if (when!) I break them, I’ll feel worse than if I’d never started. But research suggests that I might be underselling myself.

A recent YouGov poll showed that 35% of people who made New Year’s resolutions managed to stick to all of them, with around 50% sticking to at least some. And there’s plenty of academic support for the idea that explicitly writing down a goal makes you more likely to achieve it.

And if it works with individuals, perhaps it works with countries too. The COP21 Paris Agreement in 2015 committed countries to pursue efforts to limit the increase in global temperature to 1.5°C above pre-industrial levels. Studies have shown that this commitment did make companies reduce their carbon emissions and spurred investments into new technologies.

At the most recent COP28, after weeks of negotiations in the UAE, there were green shoots of progress to stir the stomachs of the most pessimistic climate activist. And importantly, it resulted in a written goal – a signed text was included that commits countries to transition away from fossil fuels (alongside a further goal to triple the renewable energy capacity globally).

History suggests that these new commitments will have an impact on investments. According to the International Energy Agency there has been a 65% increase in the annual spend on clean energy investments since 2015. The annual spend is now $1.75tr. That is a lot of money that leads to some huge infrastructure projects.

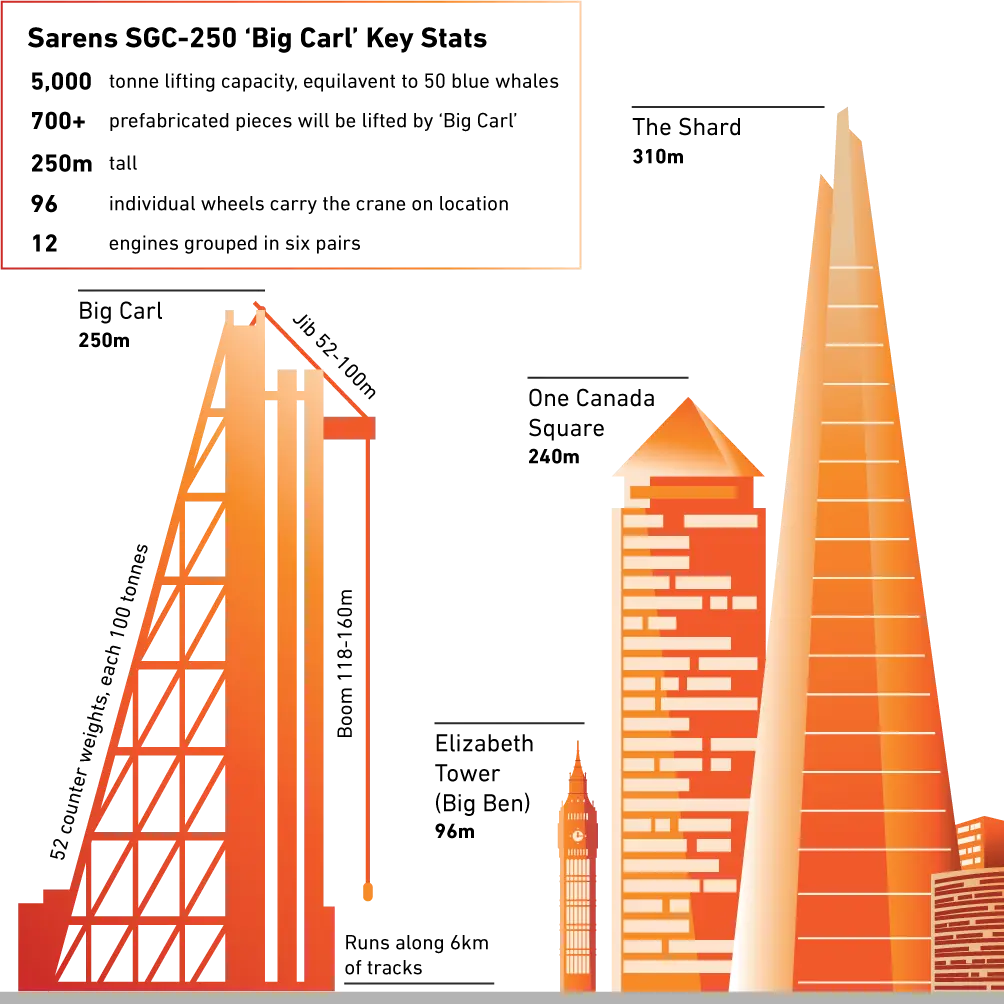

Some of these projects are close to home, take the Nuclear power station at Hinkley Point C which began construction in 2018. The world’s largest crane – called “Big Carl” to its friends – was used to deploy the 245-tonne steel roof, which is wider than the dome of St Paul’s Cathedral. Big Carl incidentally is two-thirds the size of the Shard.

This kind of large-scale construction is one of the underlying reasons for our investments in mining companies. Whether it’s the energy plants themselves, or the machines that help build them – the world will need a LOT more metal.

Policymakers are setting goals that are beginning to have real impacts on our lives. Incorporating climate risks and opportunities into our investment process is important for the environment and also for investment returns. Maybe I should follow suit and dig out that gym membership…

More from 7IM

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.