Don’t sell in May

Sayings stick around in finance.

“Sell in May and go away, don’t come back ‘til St Leger’s Day” originated back when senior traders, brokers and bankers used to abandon London’s smoke-filled summer heat, and head for the country hills; perhaps returning occasionally for the tennis at Wimbledon or the cricket at Lord’s. With no-one senior to do business with – the theory goes – markets would drift gently downwards, until the serious players returned in autumn.

How does this financial mantra stack up today? Not well!

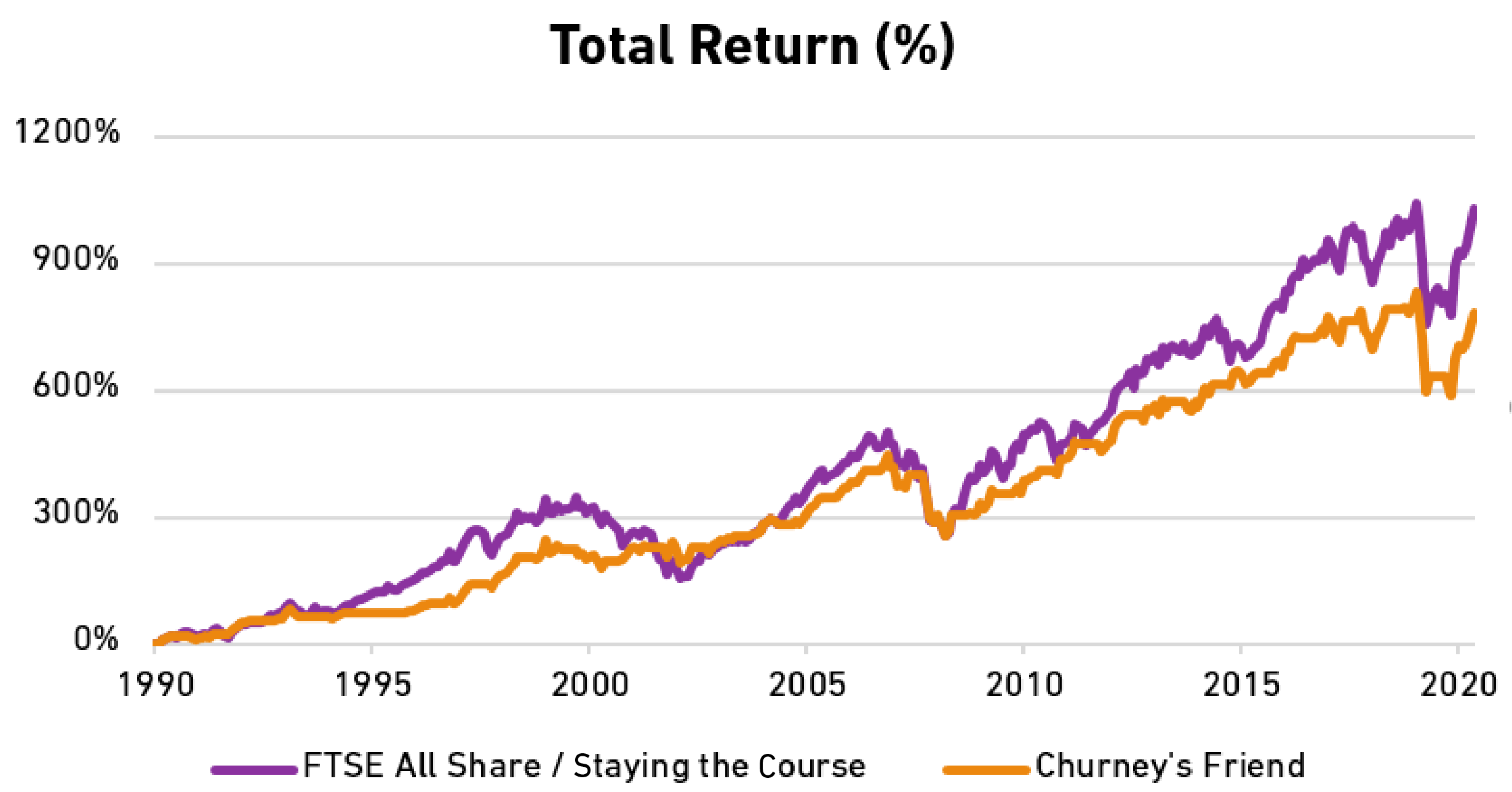

We ran some analysis, setting up our own investment “horse race”, looking at the FTSE All Share from 31 December 1990 to 31 December 2020. One horse – ‘Staying the Course’ – adopted a strategy of investing in the FTSE All Share and leaving their money untouched. The other runner – ‘Churney’s Friend’ – cashes out their investment in the FTSE All Share on 30 April each year and reinvests on 14 September, after the actual St Leger (the world’s oldest classic horse race) has finished.

The results over the thirty-year period won’t surprise readers who keep an eye on the form book. The calm and collected Staying the Course wins, with an annualised return of 8.3%, while despite all of the activity Churney’s Friend returned 7.4%.

Whilst not a significant difference at first glance, cumulatively, over the years, it stacks up. After approximately 30 years, the buy and hold strategy would have turned £10,000 into £112,670, whereas the mantra-following investor, busy as a bee every summer and autumn would have returned £88,110. That’s £24,560 less, for doing more!

Overall, the period between May and September has been in positive territory for 60% of the time over the last 31 years

There’s no evidence to suggest summer is a particularly bad time for markets. Overall, the period between May and September has been in positive territory for 60% of the time over the last 31 years. In those three decades, the FTSE All Share has seen an annualised average return of 4.29% between 30 April - 14 September, and if you strip out 2001 and 2002, two particularly bad years that had nothing to do with the ‘sell in May’ narrative, the figure is 7.71%.

Markets are volatile. They move up and down. Always have; always will. Indeed, there’s a different stock market adage that suggests time in the market is far more effective than timing the market. While many stock market adages should be taken with a pinch of salt, this one certainly has more than a grain of truth to it.

Instead of trying to time the market, a far more effective (and simple) strategy for wealth creation is to stay invested for the long term. By doing so, you will benefit from the phenomenal power of compounding, which Albert Einstein (allegedly) described as ‘the eighth wonder of the world’. The critical component here is time – the longer you give your money to work for you and the longer you leave it untouched, the more pronounced the power of compounding is.

So, despite the temptation to tinker with your savings or your portfolio amidst all the political noise and market gyrations, the best answer to most of the common investment questions I’m asked is to do nothing. If you’re ever unsure, however, then it pays to seek professional advice.

This article does not constitute advice or a recommendation; please consult a financial adviser. Past performance is not a guide to future returns, chart(s)/data for illustration purposes and are not for further distribution.

Any reference to specific instruments within this article does not constitute an investment recommendation.

Discover more

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.