Goals risk

It’s been a rollercoaster year for many investors, with global markets impacted by Russia’s invasion of Ukraine, inflation soaring to the highest level seen in 30 years, multiple interest rate hikes and some of the largest US technology stocks taking a tumble. What’s even more remarkable is that all these events have taken place before we’ve entered the second half of the year.

Many multi-asset investors, in particular, have felt the impacts of these events, especially those in ‘lower risk’ portfolios. Amidst a more inflationary environment, bond markets have been among the worst hit and those tend to appear in greater size within lower risk profiles. A goals-based view of risk can be a powerful tool in contextualising the impact of this for clients, especially those that are in retirement and taking a regular income. This approach could suggest that the impact of recent market volatility may well be less than many think.

At the core of the 7IM Retirement Income Service (RIS) is a goals-based model, which allows us to look at the probability an investor can reach their goals for a given set of assumptions. Below, I run through an example.

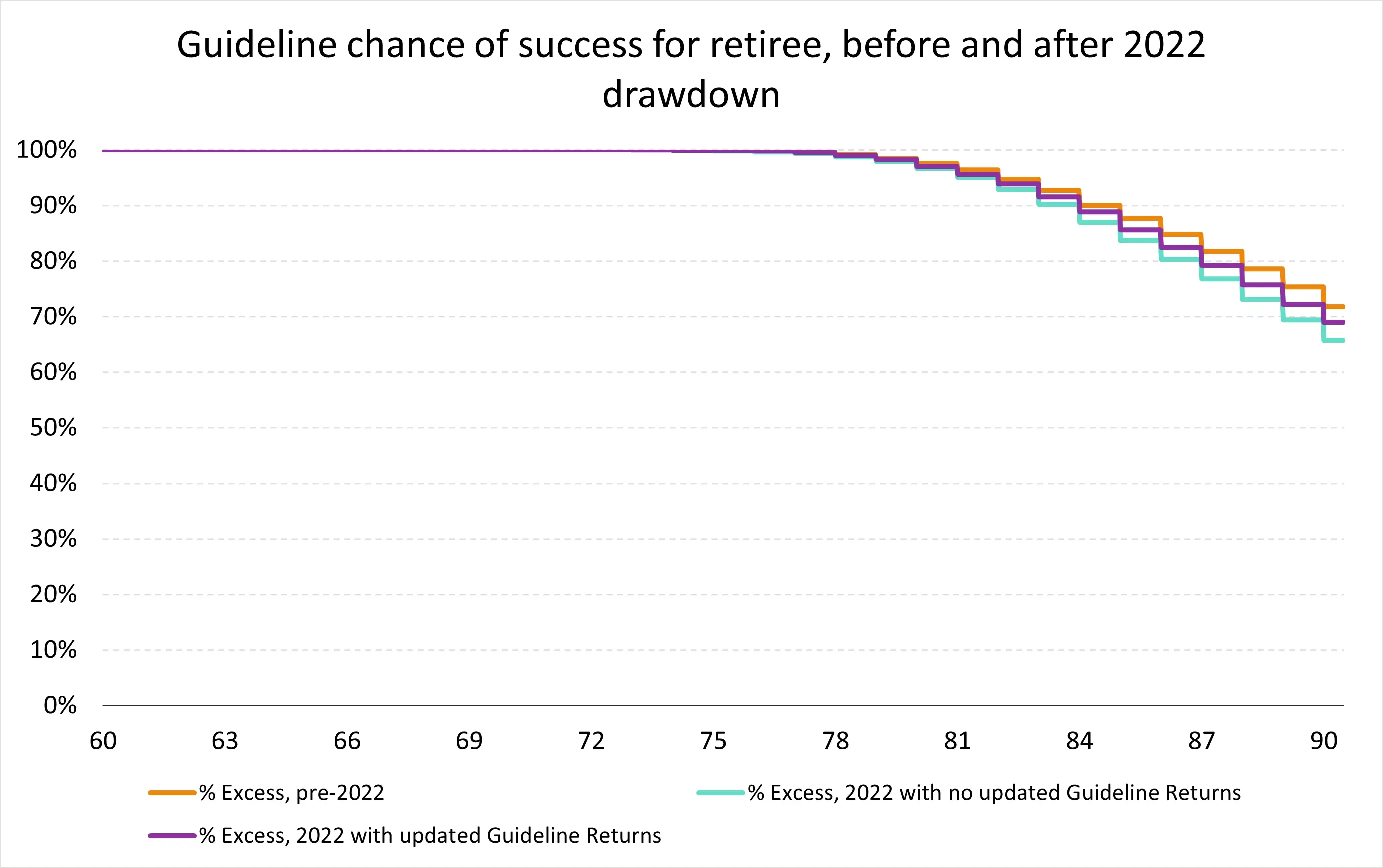

For this exercise, we take an ‘average’ client that wants to take a £4,000 income from their £100,000 starting pot, escalating at 2% per year. Invested in 7IM’s Balanced portfolio, the chart below looks at how likely it is for that individual to achieve that income over their desired periods, using a couple of different sets of assumptions:

- The orange line looks at the likelihood of reaching the income goal for various age ranges as of the end of last year, before the recent drawdown.

- The turquoise line looks at the impact of a fall in portfolio values of 5% but with the same guideline returns.

- The purple line uses a portfolio, with the same fall in value of 5%, but updates forward-looking returns for the impact of recent market movements since our last Strategic Asset Allocation refresh to the end of April.

In each case, we run the set of assumptions through 10,000 simulations, and then calculate the likelihood of the goal being reached. The number of simulations allows us to incorporate numerous different potential market scenarios from here; some better than others.

Given the size of moves in many market factors over the last six to twelve months, the update in the purple line can be important. The fall in bond values from higher interest rates has been accompanied by greater forward-looking returns for those asset classes, as well as cash rates in general. We can see that, although there is a fall in the chances of excess capital to provide income, it may not be as significant as many think, even for an investor with a relatively demanding index-linked target, starting at 4%.

Source: 7IM, summary of percentage of simulations exceeding 0 value at each point in time based on an investor in a Balanced risk profile taking £4,000 income from a £100,000 starting pot (orange line) or £95,000 starting pot (purple/turquoise line), escalating at 2% per year. Simulations follow a simulation approach overlaying simulated market volatility around trend returns and cashflows over 10,000 simulations.

This process highlights the importance of using goals-based tools, as well as having up to date and robust portfolio guideline returns as part of that process. Both of these are core elements of the RIS, which also has specific rebalancing rules specified for exactly the sort of environment many portfolios currently face. Although the specifics of each client’s needs, wants and portfolio returns may be different, the RIS gives a consistent framework for how to react and communicate the impact for clients of market events. This, rather than the specific numbers for this case study, is the key point. The Retirement Income Service combines:

- Risk tools using a goals-based framework

- Innovative Income delivered using bucketing

- Sustainability via stress-tested rebalancing rules

Get in touch to find out how a conversation about the Retirement Income Service and goals-based risk profiling can help you with clients taking income.

The past performance of investments is not a guide to future performance. Forecasted or guideline returns are not a guide to future returns. The value of investments can go down as well as up and you may get back less than you originally invested. Any reference to specific instruments within this article does not constitute an investment recommendation.

Discover more

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.