RIS – New Year, New Me, but not new plan

At 12:00am on the 31st December every year, a strange thing happens in the investment world.

Everyone gets presented with a blank slate; year to date (YTD) returns grind back down to zero. The previous 12 months of hard-earned returns gets transferred to a “discrete annual return” box, where it sits, untouched forevermore. Every time the boulder reaches the top of the hill, it rolls back down again, and we’re left at the bottom asking, “do we just start again now?”

Of course, we don’t just sell everything in our portfolios and start the new year with 100% in cash. But the annual data change does highlight the fixation many place on returns achieved within specific calendar years. Like clockwork, January becomes a month of reflection and reset for life decisions (or at least for calorie and alcohol consumption!) and for personal finance articles suggesting a ‘look back’.

It does make sense to periodically review, of course. Looking back on 2020, a typical balanced portfolio probably returned in the 5-9% range. That return isn't far away from what many would suggest as a reasonable long run guide (if anything, slightly on the high side). However, we also know that 2020 was a very different journey for some investors.

Those in most difficulty would have been needing to take money from their pension pots through the year. They not only had to navigate the storm COVID blew over markets, but also draw income at the same time – perhaps needing periodic sales from investments. Many of the “clever” solutions to this problem such as structured products and “smoothed” investment products simply buckled, causing anguish for people relying on them. Other individuals may have even been told to stop taking withdrawals altogether! For many advisers, this wouldn’t be a problem for just one or two of their clients, but for a large chunk of their business. The problems that market volatility poses for retirement portfolios is the very reason we built the 7IM Retirement Income Service (RIS). The historical model of outsourcing the investment element of clients’ accounts would involve selecting a model or fund from a range, while the advisers controlled the withdrawals. However, this approach provides no input or support when working out how to take income from that portfolio – especially when markets start moving wildly.

The RIS provides a rules based structure, based on a bucketing approach, which ensures a constant and consistent approach for taking income. These rules meant the plan of action for every client in the 7IM RIS was set in advance. Even when markets were falling precipitously through March, we had a pre-defined approach to follow and no client had to deviate or reduce the amount of income they were taking. It means the flexibility and liquidity of a drawdown approach using our investment portfolios, but with our structure and support and an assured approach to providing income.

As well as the benefit this approach offers in terms of consistency, simply removing the administration of withdrawals and bucketing has been a real plus for advisers that used the service. Advisers have been able to focus on their main job – getting clients to think about the long term, even when the going gets tough in the short term.

So when 2020 ticked over into 2021, the advisers and clients using our service didn’t have to make a new plan, regardless of the chaos of last year. A calendar year shouldn’t mean a reset on a plan, no matter what the journey was through the year to get there. The RIS helps advisers achieve just that.

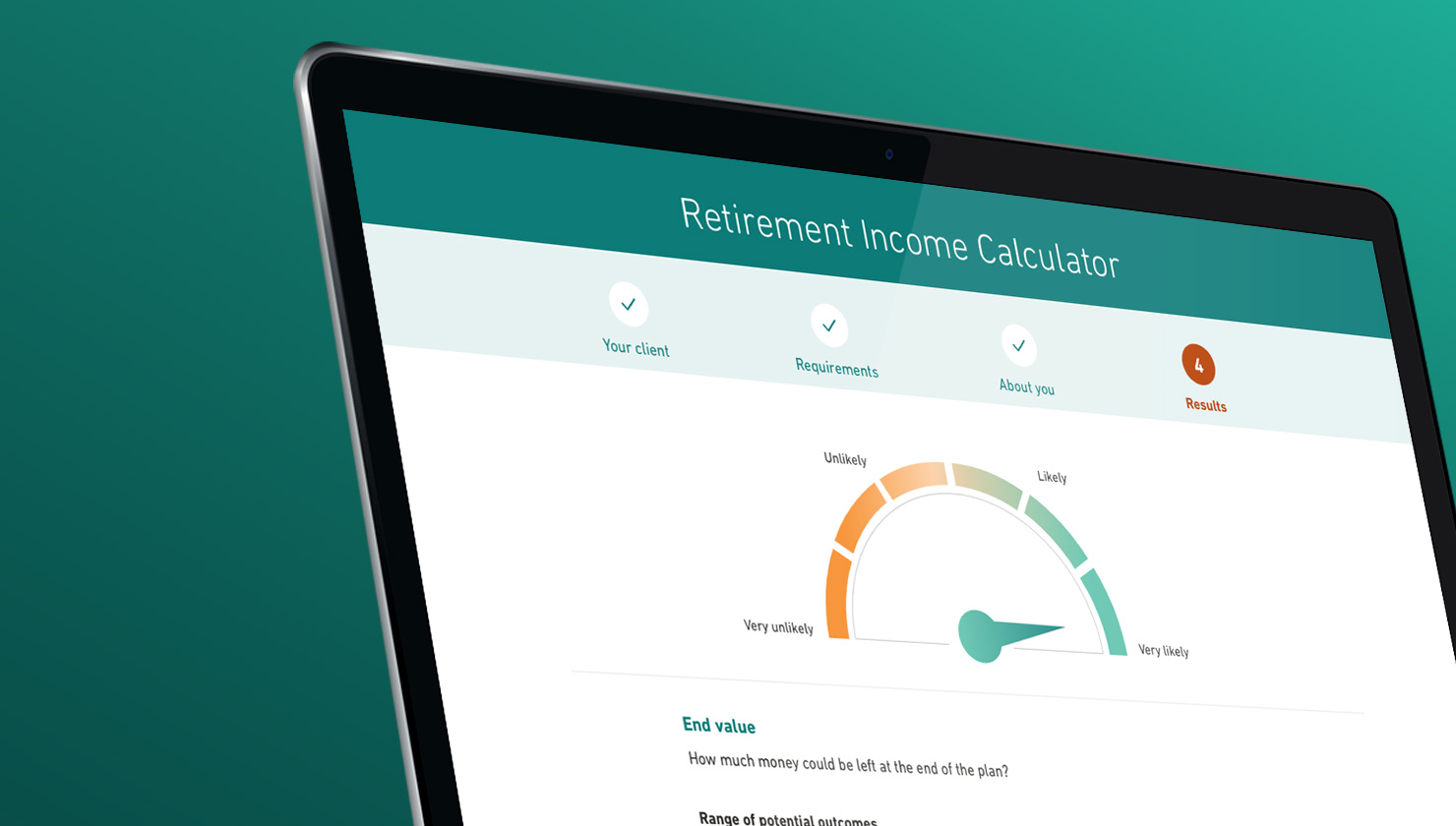

Another key feature of the RIS is the ability for advisers to run goals based risk calculations on behalf of their clients, you can see an example of this and the bucketing approach we use to construct portfolios by using the online tool here.

Any reference to specific instruments within this article does not constitute an investment recommendation. Past performance is not a guide to future returns.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.