Our brains are built for bad news

Here we are in July 2021, with COVID-19 vaccine production estimated to hit 13 billion units this year, an economic recovery underway and consumer confidence back to pre-crisis levels.

These developments are miraculous compared to 12 months ago.

Yet the world doesn’t feel calm. Investing isn’t a no-brainer. Talking to finance professionals about the outlook isn’t relaxing. It never is. Why is that?

I sometimes wonder whether an evil alien created financial markets as part of a plan to discombobulate much of humanity for much of the time. After centuries of experimenting with ray guns, UFOs and crop circles, they found something far more subtle and effective, which targets our common psychological weaknesses as a species.

Worse still, the pain we suffer is chronic, rather than acute. Markets don’t just stress us during crises. It’s a permanent state of being, because it is built-in to our biology.

Negativity bias and fear conditioning

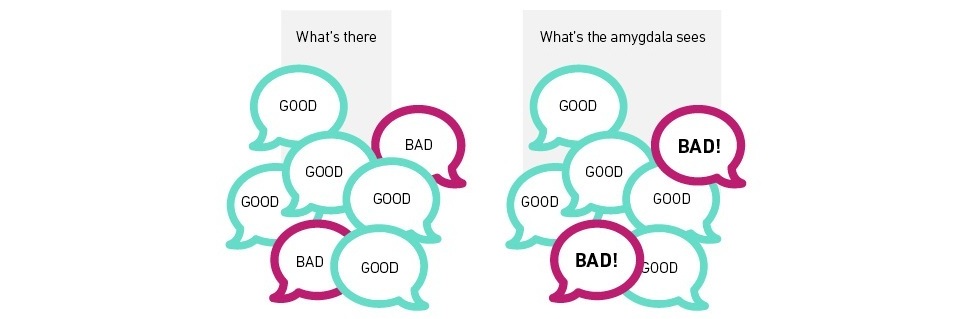

Our brains are wired to remember bad news. There’s a part of the human brain called the amygdala that commits our experiences to memory. We actually have two amygdala – one on each side of the brain. The amygdala in the left hemisphere of the brain deals with positive or negative stimuli. But the one on the right only processes negative events – and ignores all happy experiences.1

So, there’s a negativity bias simply in what our brains choose to record and store. But things get worse.

The amygdala isn’t just a gloomy librarian, cataloguing and storing memories. It goes further, seeking out common themes in memories, and then suggesting appropriate responses. It acts like a very intrusive Netflix – looking at things you’ve watched already, recommending similar things, then coming round to your house and forcing you watch them.

Over time, your amygdala teaches you to respond automatically to certain events in the world. You start to associate certain things with specific outcomes and behave in particular ways. Where the associations are negative, you become scared, and behave fearfully. Given that the amygdala tends to look for negative events, you’ll end up scared more often than not. That’s fear conditioning.

This approach evolved over millions of years – it’s better for survival on the African savannah to be more scared than less scared.

But not being scared isn’t necessarily a good thing.

Living without fear – SM-046

In 1994, Nature published an account by four psychologists2 of a 30-year old American woman (known as patient SM-046). SM-046 suffers from a rare disease which, towards the end of her childhood, completely destroyed both amygdalae, but left the rest of her brain untouched. The main consequence for SM-046 has been a complete absence of fear in her day-to-day life – her brain just does not make the right connections.3

Her life experiences are a perfect demonstration of how important fear conditioning is. Most of the time, she is mildly happier than most people – she has the full range of other human emotions, isn’t scared of spiders or snakes or the dark, and rarely feels stress.

But, on occasion, her lack of fear has caused her real problems. SM-046 is unable to recognise and avoid dangerous situations. She’s been held up at knifepoint and gunpoint multiple times and suffered near-fatal injuries due to domestic abuse. Although she remembers these events, and the negative consequences of them, she’s unable to recognise similar situations as they start to occur.

So, although she spends most of her life content, she’s also in danger more often – even in the modern world. It seems that the amygdala is still pretty useful, even though we’ve left the savannah behind.

Fear in finance

SM-046 would be a great client to have as a financial adviser. You wouldn’t ever receive a phone call from her worrying about market declines or bad headlines. My evil alien would be mystified by SM-046’s indifference to financial stress.

But the rest of humanity have functioning amygdalae. Our brains are permanently scanning the world for bad things, reminding us of the negative consequences and prompting reactions. That’s great for avoiding dark alleyways, or angry looking snakes, but bad when it comes to financial markets.

Markets are symmetrical. If someone is buying something, then someone else is selling – they can agree a price because while the buyer is positive on the asset, the seller is equally negative. But our brains, primed for negative news, don’t see the balance though. The brain sees a buy vs a SELL. Good vs BAD. Which triggers the fear conditioning, and makes us panic.

Understanding the biology of it all is a start, but as investors it’s all about walking the line. We want to know when we’re really in danger, while remaining sanguine like SM-046 for the rest of the time. After all, the one flaw in the evil alien’s design is that over the long term, markets go up.

Beating millions of years of evolution isn’t easy. At 7IM we have processes in place to try and overcome this negative bias. We have a fixed strategic framework which keeps us invested. We view tactical decisions through a quantitative lens as well as a qualitative one – computers have no amygdala to provoke. And we have a cognitively diverse team; people who think differently about the world perceive “good” and “bad” in different ways (more about that in a couple of months). On top of that, there’s a risk team, whose job is not only to monitor when we’re taking too much risk, but also when we aren’t taking enough. When we put all this together, we end up with a process that isn’t positively or negatively biased; simply looking at the world in a balanced way.

1 Lanteaume L, Khalfa S, Régis J, Marquis P, Chauvel P, Bartolomei F (2007) Emotion Induction After Direct Intracerebral Stimulations of Human Amygdala. https://academic.oup.com/cercor/article/17/6/1307/414918

2 Adolphs R, Tranel D, Damasio H, Damasio A (1994). Impaired recognition of emotion in facial expressions following bilateral damage to the human amygdala.

3 Feinstein, Justin S. et al. (2010). The Human Amygdala and the Induction and Experience of Fear. https://www.cell.com/current-biology/fulltext/S0960-9822(10)01508-3

Any reference to specific instruments within this article does not constitute an investment recommendation.

The brain sees a buy vs a SELL. Good vs BAD. Which triggers the fear conditioning, and makes us panic.

Discover more

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.