Preparations (not predictions) for 2024

Come December, predictions for the following year are as traditional as a turkey for Christmas dinner in the UK. From sports journalists to newspaper columnists to TikTok vloggers, everyone has a go. Despite markets and economies not really working in discrete calendar years, financial analysts are also compelled to get in on the action.

What will growth be?

How will central banks act?

Where will the stock market end the year?

Lots of people are going to tell you the answers to those questions.

But the thing is that while making predictions is easy, making accurate predictions is very, very hard. Almost no one took Covid-19 seriously when you read 2020 forecasts. Ukraine wasn’t mentioned in 2022 “outlooks”. And at the start of this year, Gaza didn’t feature. The world changes unexpectedly, and quickly.

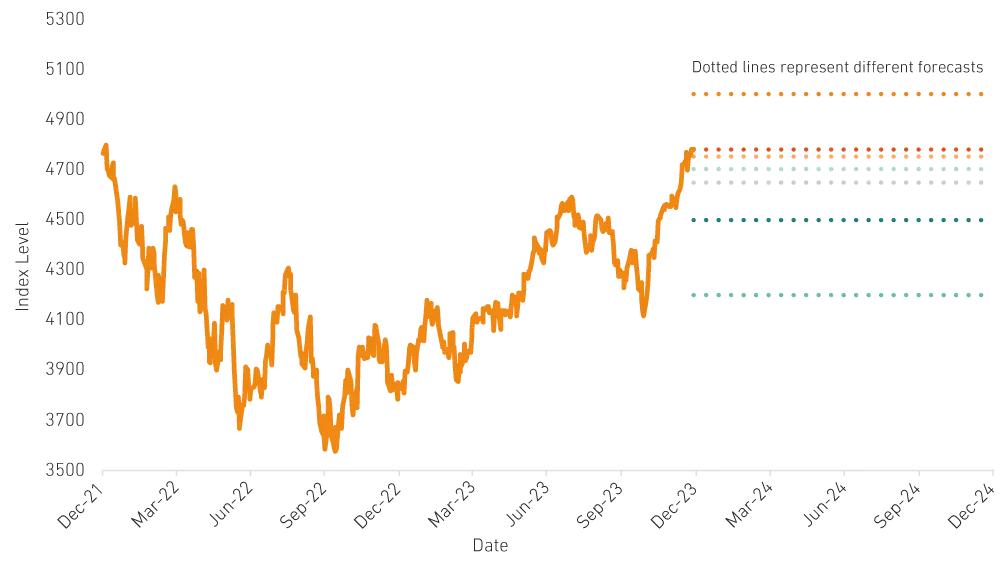

So, it’s perhaps no surprise that as of December 2023, the S&P was already at the level that most investment banks had forecast it would hit in December 2024 [see Why bother with Wall Street predictions? at the end of this article].

This gets to the heart of one of the most important principles of investing. Preparation, not prediction. If Wall Street analysts, with all their know-how, experience and resources, can’t predict what will happen or when, it might be worth spending your time doing something else.

We look to prepare portfolios for a range of outcomes. Find assets that balance each other, some doing well in one world, some doing well in another. We won’t get it exactly right… but we won’t get it exactly wrong either.

Here’s how we’re preparing for 2024:

1. Preparing for falling interest rates… buy bonds.

Inflation across the world has been the highest in decades. As a result, central banks globally have hiked interest rates to the highest in decades. If rates go up, the cost of borrowing goes up. Bringing demand down this way will make it harder for companies to pass on price increases.

While it would be too early to declare victory, inflation appears to be falling fast… even in the UK!

So central banks will become more and more comfortable reducing interest rates. Owning bonds in this environment is an obvious preparation step – which doesn’t require a prediction. Even if rates don’t fall, yields are high enough that you’re being paid anyway!

2. Preparing for a hard landing… the safe-haven Yen.

Never underestimate the power of the status quo – even in currency markets. If a currency gets too cheap, exports will rise, eventually pushing the currency back up. Timing is tricky, but holding on to cheap currencies pays off in the long run.

At the time of writing, the Japanese Yen is the cheapest it has ever been – ~40% below its fair value estimates – driven by Japanese interest rates staying at zero while interest rates in the rest of the world have been hiking. But that situation is changing. Falling US inflation, and thus falling rates, will be a strong driver of returns.

In a world in which the US economy starts to struggle, the Yen would benefit even further as its safe haven status becomes in-demand.

3. Preparing for a soft landing… Metals and Mining companies.

Good portfolio construction means thinking in opposites. Part of that exercise is looking for companies that should do well in an upturn. We look for attractive opportunities in cyclical sectors, which shouldn’t hurt (too much) if a downturn comes instead. And Metals and Mining stocks provide that opportunity.

Valuations are as cheap as they have ever been, following a decade of serial underperformance. But the companies have reacted and restructured – net debt is close to zero, profit margins remain elevated and dividend yields of 6% shouldn’t be sniffed at. Add on to that, these companies will be at the centre of the climate transition. The long-term tailwind in clear. And we’re paid handsomely to wait.

4. Prepare for any kind of landing… Healthcare companies’ resilience.

The market has priced in strong double-digit earnings over the next two years – as if Covid and rate rises and inflation never happened. If profits grow, great – we all love positive surprises! But how can we guard against potential disappointment?

Looking for earnings resilience tends to mean you don’t have to. The Global Healthcare sector remains one of our favourite long-term investments. Earnings stability is more certain (and less connected to the economic cycle), valuations are attractive and it’s coming off one of its worst runs of performance in decades. In other words, we’re being given an opportunity to own stable businesses ready to perform in a range of outcomes. That’s proper preparation.

5. Prepare for the changing sentiment… equally-weight your equities.

Of course, preparation won’t cover all eventualities. We went into 2023 positioned for investor sentiment to swing wildly from excessive optimism to deep pessimism. And it did, from a banking crisis in the spring to a ‘back to the races’ expectation as we closed the year. Historically, one of the best ways to position for this is to shift away from most recent cycle winners (this time, large tech companies) and towards those stocks that have been forgotten by the hype-machine.

We did this successfully in 2022. But, with the AI excitement, the strategy hurt portfolios in 2023. Going forward, the uncertainty over where growth and inflation are headed will continue to see those swings in sentiment.

And we continue to be guided by long-term historical patterns rather than short-term trends. Holding a basket of equally weighted stocks in the US, rather than just piling into the biggest, has been a historically profitable investment strategy over time, and especially at times like this.

Holding bonds at inflation beating yields should lead to strong positive returns in most worlds. Putting together a collection of equity exposures that balance each other in different scenarios, while remaining strong investment opportunities by themselves, should deliver a smooth outcome.

One prediction for 2024 is certain to come true. No one knows what will truly happen. Once we accept that, we can focus our efforts on preparing properly. And we have.

One prediction for 2024 is certain to come true. No one knows what will truly happen. Once we accept that, we can focus our efforts on preparing properly. And we have."

Why bother with Wall Street predictions?

The dotted lines below show industry forecasts for the S&P 500 by the end of 2024. Some of the brightest and most highly paid people in the industry all agreeing that… meh, could be up, could be down. If that isn’t a clear recommendation to prepare for anything, I don’t know what is! (In the first two months of 2023, a well-known US investment bank updated its year-ahead market predictions seven times…)

Source: John Authors, Points of Return

More from 7IM

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.