Putting ESG at the heart of our business

At 7IM, we have a long tradition of integrating Environmental, Social and Governance (ESG) considerations in the way we manage our portfolios. Our Sustainable Balance fund was launched 15 years ago, and since late 2020 we are also offering a similar proposition (Responsible Choice) to our model portfolio range.

While these investment offerings are subject to a detailed screening process, we have integrated a range of ESG considerations across our whole investment offering. In mid-2021, we commenced a process to decarbonise our Strategic Asset Allocations (SAA), hence reducing the emissions-intensity of all 7IM-managed portfolios.

Last year we tactically overweighted (where our investment mandates allow us to do so) a theme labelled ‘global warming solutions’, including areas like clean energy (solar, wind), electrification (led by transport) and using resources more efficiently (heating/cooling, recycling). More broadly speaking, we have built a proprietary system that allows us to conduct a detailed holdings-based analysis, including to summary of the ESG characteristics of most equity portfolios and indices and the impact that an asset allocation change would have on, say, a portfolio’s carbon footprint. This capability enables us to assess the ESG implications of our Tactical Asset Allocation (TAA) views more broadly, and to identify potential ESG risks in portfolios.

Speaking about risk, our Investment Risk team independently reviews ESG key issue scores and carbon emission data as part of their periodical review of all of our funds and models.

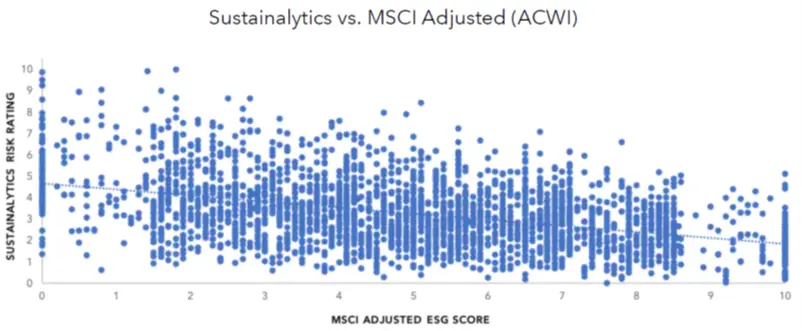

In early 2021, we also addressed the third driver of performance (the first two being our SAA and TAA) in our portfolios, instrument selection. 7IM is largely a fund of funds business and about 95% of its assets are managed by third-party managers in equities, bonds and alternative investments. Any position in our portfolios we are populating through the choice of an actively managed fund or a passive instrument (say, an Exchange Traded Fund or an index future). The choice of instrument depends on the investment management mandate that we have to adhere to, and on the third-party instrument’s side aspects like cost considerations, liquidity, risk management, or the underlying investment process, to name a few. In order to also add ESG criteria to the long list of selection criteria, externally sourced ratings would be the natural choice. The problem is, however, that different providers in this space are arriving at different conclusions, as the following chart illustrates.

Source: Capital Group

Both Sustainalytics and MSCI have well-established ESG rating processes in place, and one would expect both approaches to lead to similar outcomes, i.e. a stock rated well under one approach should be more likely than not to also look good when applying a different methodology. However, there is barely any correlation (if anything, a negative relationship) noticeable under the two methodologies. In addition, no rating provider covers every single fund out there, so we would have had to address gaps in any provider’s covered universe. Hence, we decided to pursue a ‘DIY’ approach. After all, through our investment due diligence and the ongoing monitoring and dialogue with fund houses, we are very close to them and their products, anyway.

So, how do we assess the ESG profile of a third-party fund? We are separating our analysis in to three areas, the firm-wide analysis, the fund-specific assessment and a review of the fund manager’s voting and engagement process.

On a firm level, we are investigating the fund house’s approach to ESG more generally. Have they signed up to the United Nations of Responsible Investing (UNPRI) or the UK Stewardship Code? Are they committed to reducing their firm’s and funds’ carbon footprint? How are they resourced on the ESG analysis side? Is ESG-specific training provided to staff? Does the manager just gather external ESG data, or they have additional proprietary data in-house? Does the manager satisfy 7IM’s exclusion policy, or does he even go above and beyond? What’s the company’s approach to Diversity and Inclusion?

For our fund-specific assessment, we are reviewing the manager’s approach to integrating ESG factors in the day-to-day management of the strategy. Do these play a role in the way the manager tries to identify risks and opportunities? How does the manager respond to ESG-specific incidents? Does the fund manager consider carbon emissions, for example, when selecting stocks?

Equity holdings come with the privilege of owning voting rights, and even bond managers can choose to engage with the issuers of bonds they are holding in their portfolios. Hence, we are seeking to understand how fund managers vote and engage, review voting statistics to understand the degree to which they are challenging management, and look at what tools they are using to inform their voting decision. We are also asking for case studies to understand fund managers’ approach to engaging with company management and other key stakeholders.

We are not limiting ourselves to actively managed strategies. As a consequence of the disproportional flow into low-cost, passively managed products, these firms are sitting on a considerable amount of voting power, and we want to see them making good use of it.

The evaluation of the second round of questionnaires this year has yielded interesting insights: some fund managers have made considerable progress and ‘upped their ESG game’, also as a result of the feedback that we shared with them last year. Others seem to be going sideways in an industry that is rapidly advancing in this regard. As was the case in 2021, there is again plenty of opportunity for us to nudge fund managers towards ‘sustainable’ investment approaches.

Integrating ESG factors at all stages of our investment process is not only ‘the right thing to do’. We are also of the view that, in the long run, this more holistic approach to risk management will result in a better investment outcome.

Interested in finding out more about the suite of responsible investment solutions 7IM has to offer, and the difference you and your client can make? Try our ‘See the difference calculator’ as we look at the reduction in carbon compared to an investment in a global equity index for the 7IM Sustainable Balance Fund or Responsible Choice Model Portfolios.

The past performance of investments is not a guide to future performance. The value of investments can go down as well as up and you may get back less than you originally invested. Any reference to specific instruments within this article does not constitute an investment recommendation.

Find out more

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.