Quarterly Rebalance Commentary

We rebalanced our model portfolios on 3 December 2025. In this update, we cover:

- Changes to the asset allocation and underlying fund managers

- What’s happening in markets

- 7IM’s investment views

Asset allocation changes

At the December model rebalance, 7IM made the following changes to portfolios:

- Small increase to equity exposure, primarily through US, European and Japanese equities. The global economic environment continues to be positive

- Small reduction of bonds, as expectations for interest rate cuts are already reflected in the current prices

- Rotated some US mid-cap exposure into larger US companies, while continuing to ensure broad diversification within US equities

- Within equity sectors, we decreased our underweight to Information Technology, given continued momentum and analysts expecting higher earnings in the future.

Manager changes

We also made changes to the funds used in the portfolios:

- Added Federated Hermes MTD US Equity to provide extra diversification to the US equity allocation in Active models

- This is a diversified, ‘all-weather’ equity strategy that seeks to outperform by selecting the most attractive companies in the US. It doesn’t rely on a specific style – such as investing in ‘growth’ or ‘value’ stocks

- Added BNY Mellon Global Income to Income portfolios as a complement to the existing global equity strategy in this space

- This is an active, high conviction global income fund that selects high quality companies with durable dividend streams

- Added Capital Group Emerging Market Debt to Income portfolios

- The fund invests in both USD-denominated and ‘local’ currency bonds that are issued by governments and companies in emerging markets

- Added Aviva Sterling Liquidity Plus across all portfolios

- This is an actively managed cash-plus strategy that targets high quality, short-dated instruments.

What’s the Mood in Markets?

It’s been a strange year for investors. Of course, there’s no such thing as a normal year, but the

difference between investment sentiment and market returns has felt particularly stark – the list of

things to worry about has piled up and up and up… and yet stock markets have also continued up and

up and up.

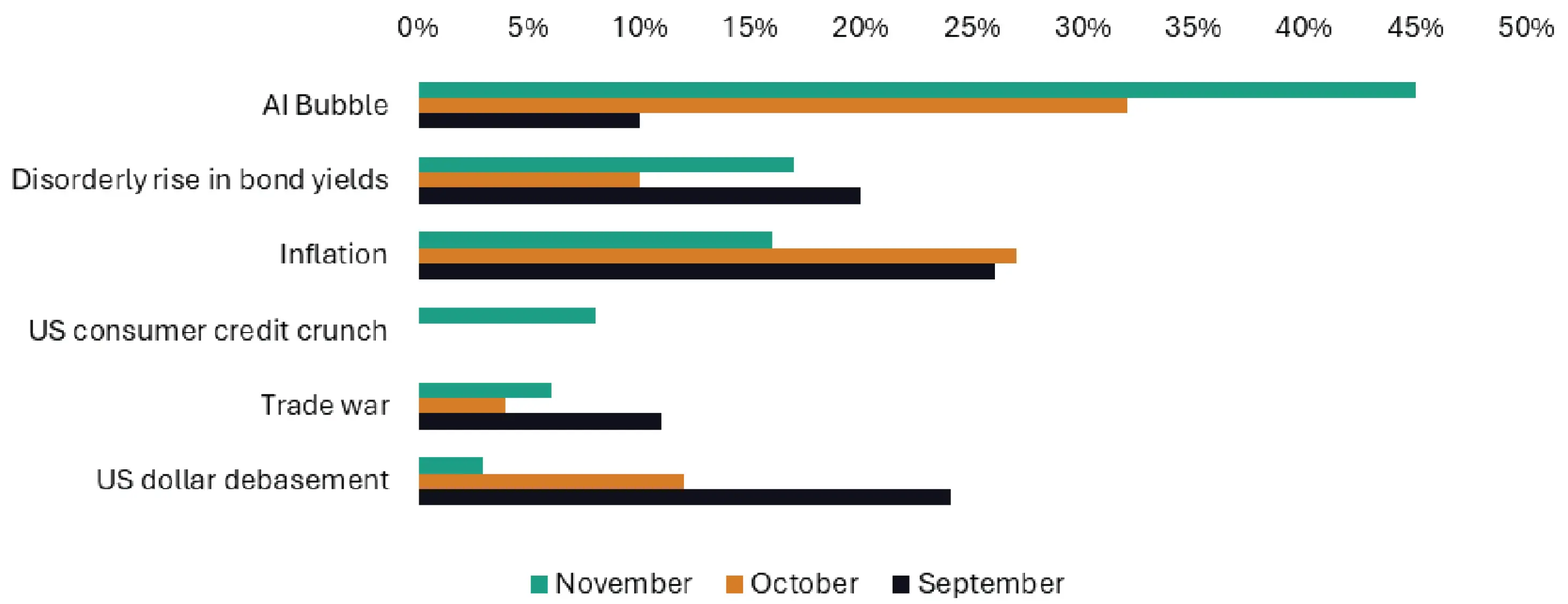

A November survey of global fund managers conducted by Bank of America gives a pretty good

picture of what’s keeping everyone up at night:

Bank of America Fund Manager Survey: What do you consider the biggest “tail risk”

What do you consider the biggest "tail risk"

Source: Bank of America

It’s a good way to see what money managers are worried about, as well as how that’s changed. Back in September, it was inflation and the US dollar weakening vs. other currencies (“dollar debasement”), whereas in November, it’s been Artificial Intelligence (AI). And that’s been the story all year, with fears jumping from one asset class to another; worry-whack-a-mole.

And yet, as we creep towards Santa’s arrival down our chimneys, stock markets are continuing to hit new highs – not just in the US, but in the UK, Europe, Japan and Emerging Markets, led by China and Korea. Barring any festive fiascos, 2025 will have turned out to be a year of double-digit returns for all but the most cautious of portfolios. Good news!

Looking ahead, we’re not seeing many alarm bells ringing. Across the world, interest rates are likely to drift downwards as central banks continue to balance inflation and unemployment – both of which are at broadly acceptable levels in the US, UK and Europe. Oil prices have stayed near post-COVID lows, and economic survey data reflects rising confidence. Lower interest rates should boost growth and make debt slightly easier for consumers and companies to bear.

While there’s no need to be complacent about a benign outlook, we also don’t see too much of a need to worry. In weather forecast terms, we’re seeing a picture that’s sunny, with intervals of cloud – so we’ll be heading out on a nice, crisp festive walk, but bringing a raincoat just in case. We have our usual amount of equities and bonds (spread widely around the world), alongside a little bit of cash in case any opportunities emerge.

7IM Investment Views

After three or four years where markets were driven by a small group of winners, we are starting to see different drivers of portfolio return. Diversification is being rewarded; in 2025, we have not seen one specific trade dominate market returns, but instead experienced returns from a sprawl of regions and sectors.

Over the next 12 months, we expect:

Economic growth to be positive, but unspectacular. Inflation to continue to be a concern for consumers, but – absent something dramatic in the energy markets – it’s under control from the perspective of a central banker.

So how should we invest for a world which isn’t at extremes, and where diversification is rewarded?

Well, that’s how we’ve been building our portfolios for over twenty years. A framework which lets market forces do the work – spreading our allocations widely doesn’t need a reason. We don’t have much more or less in equities than usual; ‘the usual’ is fine, given the signals we’re seeing. No point in reaching for risk if there’s no need, and no point running scared either.

Given strong returns from the likes of industrials, utilities and financials this year, we’d also expect to see investors continue to re-engage with businesses outside the technology sector, which probably means looking further afield than the United States. A flexible approach to picking different sectors remains key to ensuring a diversified approach to investing.

In an increasingly uncertain world, with various regions starting to decouple and go their own way, diversification is the best (only?!) answer. We’ve been doing it for more than two decades, and we’re just as convinced that it will deliver.

Tactical Asset Allocation

| Macro | Headline risk allocations, reflecting 6-12 month macro outlook |

|---|---|

| Equity | Neutral: Economic data is still noisy in the short-term; whether through the whiplash of tariff-on/tariff-off or the scarcity of data thanks to government shutdowns in the US. Our signals suggest there’s no need to reach for risk. A neutral position, in the context of broad diversification. |

| Fixed Income | Neutral: In uncertain times, defensive assets can prove useful – even if it’s not obvious exactly when. While some people are worried about rising government Neutral: In uncertain times, defensive assets can prove useful – even if it’s not obvious exactly when. While some people are worried about rising government debt burdens, we still believe that in times of stress, safe-haven assets will deliver. Getting paid for protective assets is never a bad idea – even if disaster doesn’t happen. It’s important to note that we hedge the currency of our quality fixed income back into Sterling. |

| Diversifiers | Evidence-based diversifiers, which outperform through multiple market cycles |

|---|---|

| US Equal-weight | This strategy buys an equal amount of each of the 500 companies in the S&P 500 Index. That means it has more in medium-sized companies and less in the largest companies by market value. We believe it can deliver higher returns in the long run than a market-cap weighted strategy. It’s a simple way to maintain exposure to US companies, without over-exposure to the huge technology stocks. |

| Put-Selling | Another diversifying strategy focused on generating income through selling put options on the S&P 500 Index. It aims for stable returns with less exposure to equity volatility. |

| Alternatives | This is a diversified basket of strategies which aren’t correlated to bonds or equities. It continues to deliver returns above the interest rates on cash. It will tend to perform best during dislocations. |

| Tactical Opportunities | Mispriced areas of the market with the potential to deliver meaningful excess returns |

|---|---|

| Global Financials | Investors and analysts are finally getting re-interested in financial companies. And why wouldn’t they? Banks and insurers have rock-solid balance sheets, and there’s a LOT of money sloshing around in the financial system. Despite the recent good performance, there’s still a decades-worth of lost ground to make up on the wider market. |

| Communication Services | Demand for connection and content isn’t going anywhere – and should continue to grow alongside the global economy. Lots of the big businesses are well run, with low debt and solid cashflows, and they’ll be the businesses that benefit from AI adoption. |

Please note: All of the comments in this document refer to the models we run on the 7IM platform, but the models are also available on a range of other platforms. As much as possible, we try to replicate the models we run of the 7IM platform across all platforms, but due to differing security availability, not all of the points outlined in this document may be relevant across these platforms. If you are unsure whether certain changes apply to models on a specific platform, please reach out to a member of the team.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.