Quarterly Rebalance Commentary

Overview

Markets have been mixed since the model portfolios were rebalanced in November.

In November 2022, markets performed well in the hopes of easing US inflation and reopening in China with emerging markets bouncing the most.

This did not carry through to December as the trends from earlier in 2022 recommenced – a broad market sell-off with growth assets really struggling. PMIs (an indicator for business conditions) contracted on the month and the Fed continued its hiking cycle, albeit at a slightly slower rate than before.

Markets have started 2023 well with both equities and bonds rallying strongly. Some positive news around China’s reopening has spilled over into global equities while the mild weather has alleviated some of the pressure on the European energy crisis.

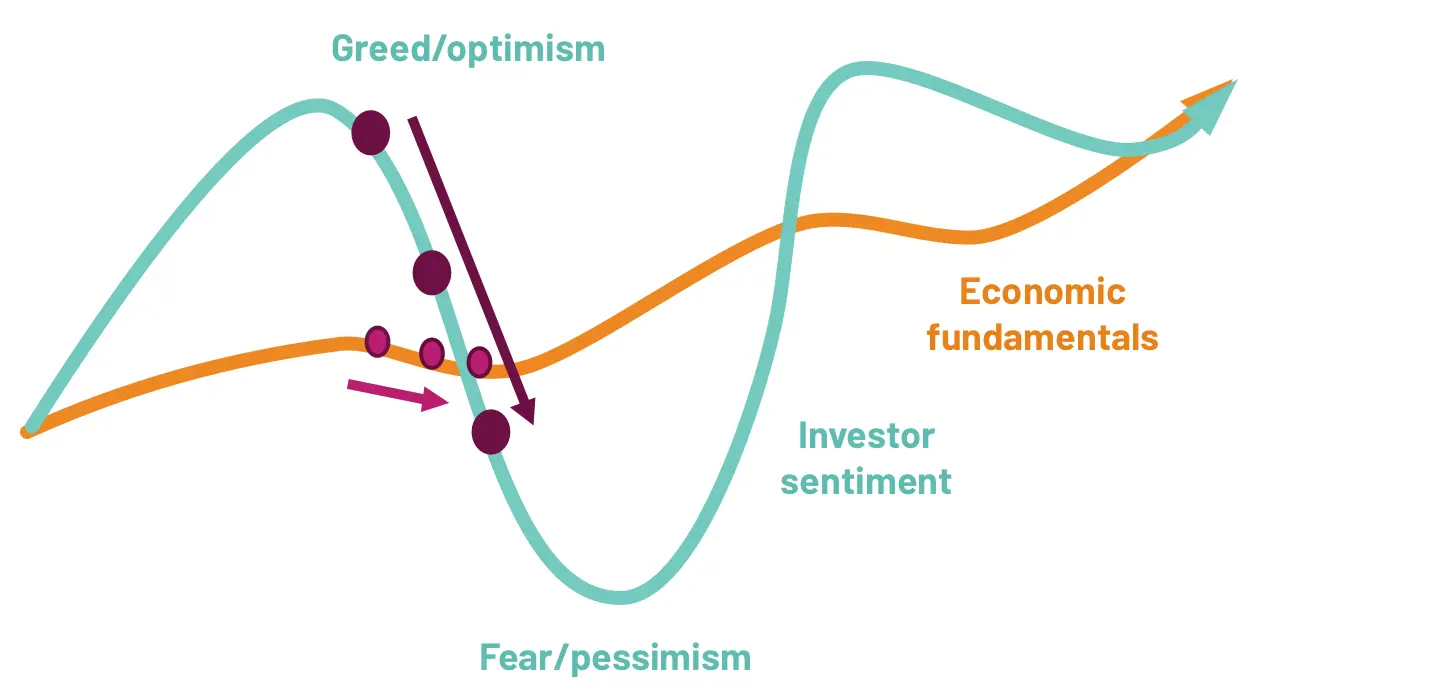

Investor sentiment overreacts to economic turning points…

Source: 7IM

Core investment views

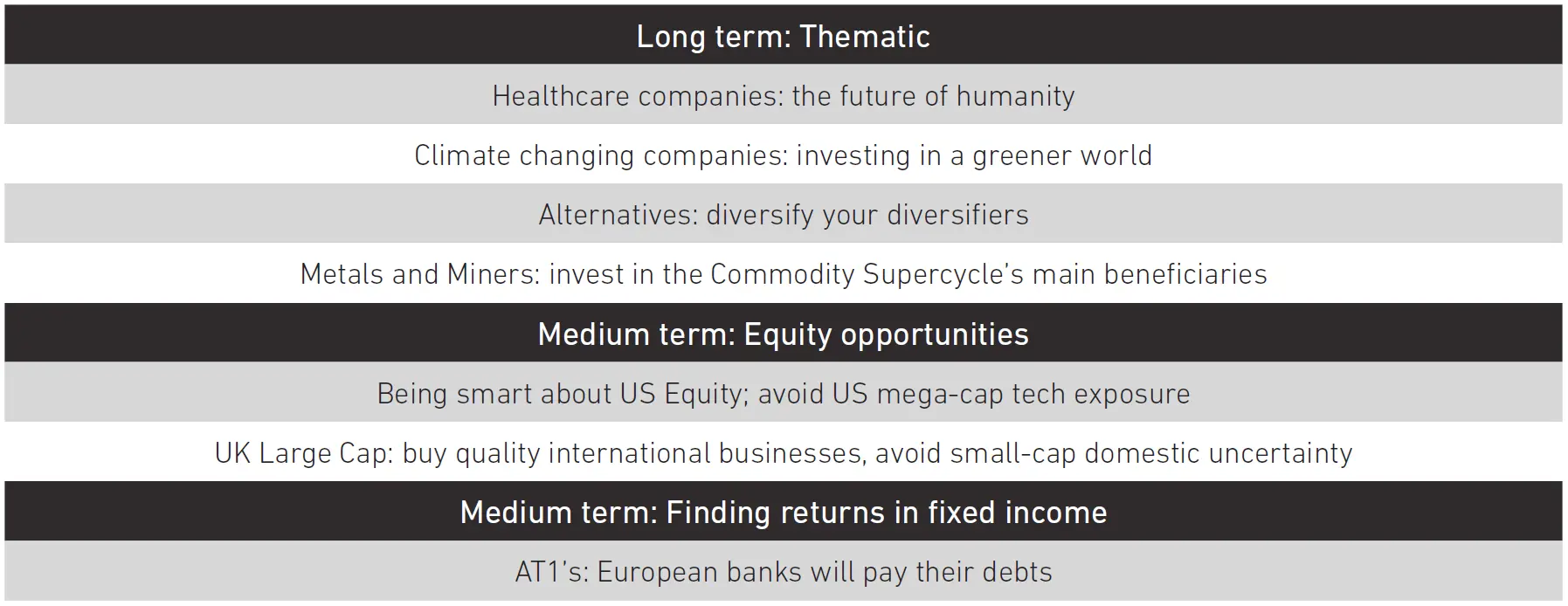

At 7IM, we have several long-term core views that help to guide our investment decisions and allocations within portfolios.

Over the next 12 months, we think markets will generally move sideways with volatility. In this environment, it is important to rely on a stable identity. Economic uncertainty creates fear and investor sentiment tends to overreact to economic turning points. Going forward, we believe that:

- Inflation has peaked and will start to fall through the year

- This means, interest rate hikes are nearing their end, the worst has passed

- But for inflation and interest rates to come down, growth has had to come down

And so, investors are starting to think about what’s next for financial markets. Economic data isn’t likely to bottom for another six to 12 months. Until this happens, the “Sideways with volatility” markets environment is likely to stay with us for a while.

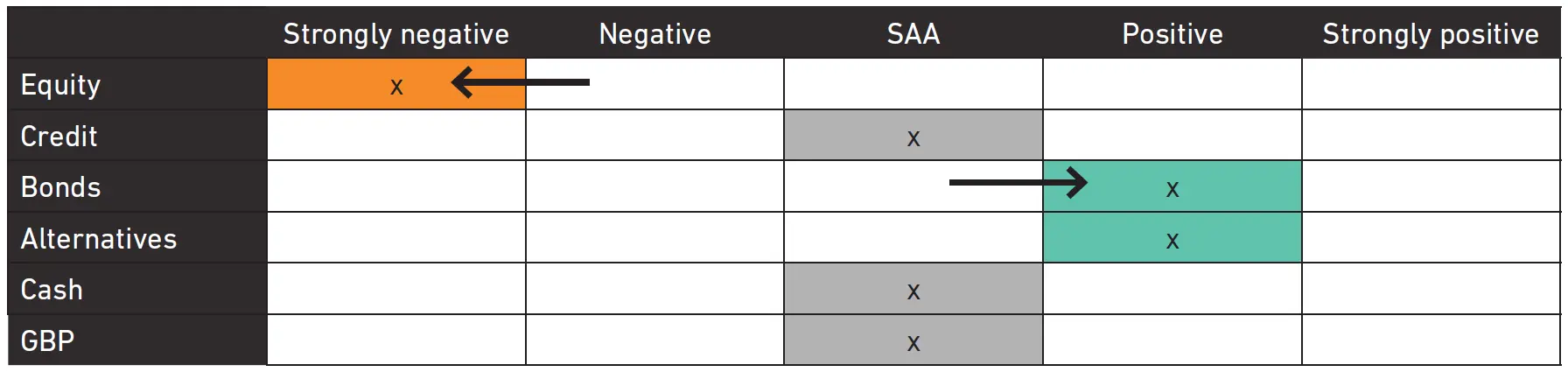

We have positioned portfolios towards assets that can generate returns despite this volatile backdrop. As part of this rebalance, we have moved our equity positioning to further underweight, and our bond positioning to overweight:

Tactical Themes

Asset allocation changes

We have made the following tactical changes to portfolios in this quarterly rebalance:

- Increased our underweight to equities: We still believe that a US recession is the most likely outcome from here. Most indicators that we look at to forecast recessions are flashing red. Housing, manufacturing, policy, and consumer sentiment are just a few of the many indicators pointing to a recession. For this reason, we believe that going further underweight equity is the right move for portfolios.

- Moved to an overweight bonds position: Bonds are not the same as they have been for the past 10 years. Since June 2020, the Fed funds rate has gone from 0.5% to around 4.5%, and higher starting yields on bonds means higher returns for bonds. The relationship is simple! Bonds are now better value and we have gone overweight using the cash proceeds from selling equities.

- Split out our global government bond allocation: Since inflation has gripped the Western world, rates have risen a lot … but Japan didn’t get the memo. The 10-year yield in Japan is still around 0.5%. The global government bond index is around 20% Japanese government bonds. By splitting out our government bond allocation into Treasuries, Gilts, and European bonds, we can get exposure to higher rates in the developed markets without exposing ourselves to lower Japanese rates.

- Introduced a metals and mining position: The world hasn’t realised just how much metal is needed to take us to a net-zero economy. On top of this, supply does not adjust quickly: setting up mines is a huge time-intensive operation. Putting these together, gives you a commodity supercycle – a situation that mining companies are best placed to benefit from.

- Continued our shift from FTSE All-Share to FTSE 100: We have made this change in steps to avoid excessive turnover in model portfolios, and we are continuing this move from last quarter. The FTSE 100 is tilted towards high quality businesses which operate internationally and are tilted towards sectors which we like: healthcare, resource stocks and consumer businesses. The index is attractively valued compared to international peers and the UK domestic exposure is limited when compared to the FTSE 250, which is an added benefit given the prevailing political uncertainty.

Manager changes

This quarter, we have:

- Added M&G Japan to active portfolios: This strategy exhibits a small value bias and has a strong record of adding alpha. We believe they are well placed to produce strong returns going forward with a well-resourced research team and highly capable portfolio manager.

- Added BlackRock World Mining Fund to active portfolios: This is our preferred active implementation of the metals and mining trade. The team has been investing in mining stocks since 1997 and have added consistent value above their benchmark of the MSCI world metals & mining index.

- Added VanEck Global Mining ETF to blended portfolios: This is our preferred passive implementation of the metals and mining trade by tracking the Markit iBoxx EMIX Global Mining index.

- Added Vanguard Euro Government Bond Index Fund to blended and active portfolios: This is our preferred implementation of the European sleeve of our government bond allocation. It tracks the index well and is cost effective.

- Added Vanguard UK Long Duration Gilt Index Fund to blended and active portfolios: This is our preferred implementation of the UK sleeve of our government bond allocation. It tracks a longer duration index and is cost effective.

- Added Vanguard US Government Bond Index Fund to blended and active portfolios: This is our preferred implementation of the US sleeve of our government bond allocation. It tracks the index well and is cost effective.

Please note: All of the comments in this document refer to the models we run on the 7IM platform, but the models are also available on a range of other platforms. As much as possible, we try to replicate the models we run of the 7IM platform across all platforms, but due to differing security availability, not all of the points outlined in this document may be relevant across these platforms. If you are unsure whether certain changes apply to models on a specific platform, please reach out to a member of the team.

You can download the commentary as a PDF here.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.