Quarterly Responsible Choice Rebalance Commentary

Overview

Markets have been mixed since the model portfolios were rebalanced in November.

In November 2022, markets performed well in the hopes of easing US inflation and reopening in China with emerging markets bouncing the most.

This did not carry through to December as the trends from earlier in 2022 recommenced – a broad market sell-off with growth assets really struggling. PMIs (an indicator for business conditions) contracted on the month and the Fed continued its hiking cycle, albeit at a slightly slower rate than before.

Markets have started 2023 well with both equities and bonds rallying strongly. Some positive news around China’s reopening has spilled over into global equities while the mild weather has alleviated some of the pressure on European energy crisis.

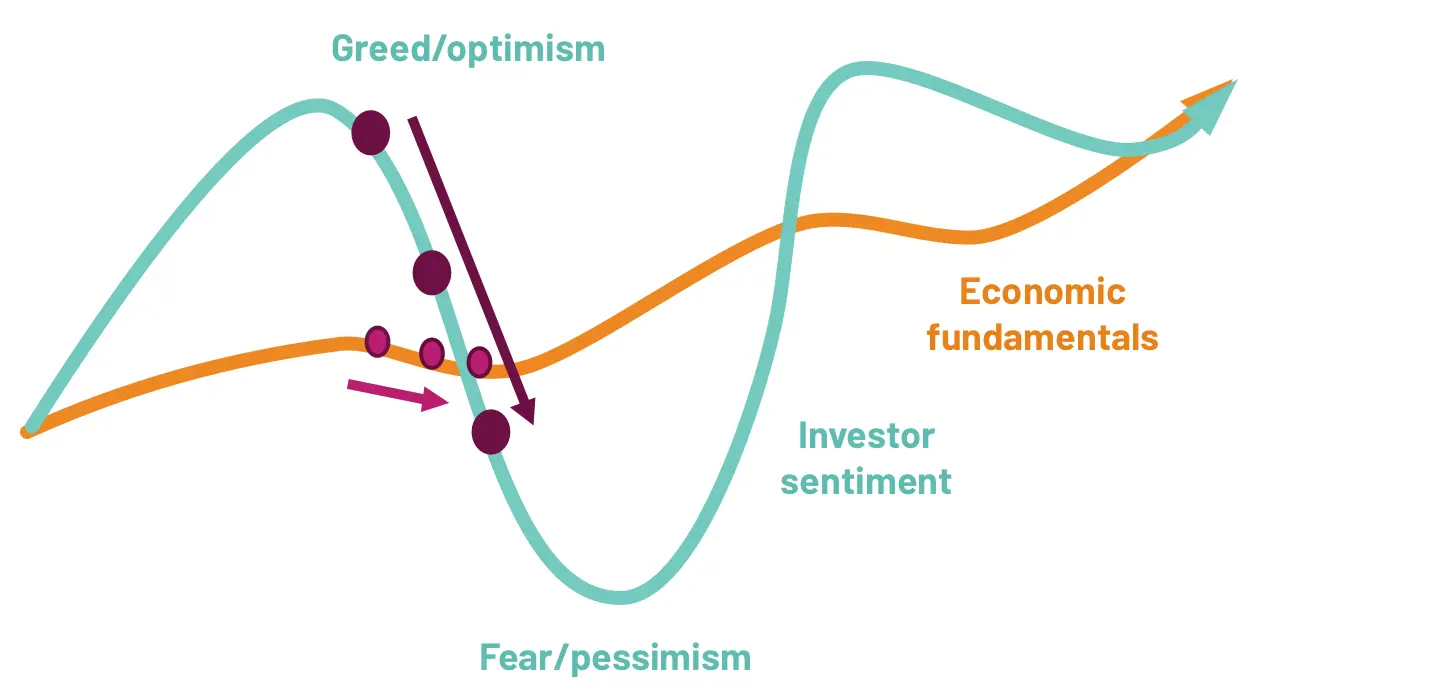

Investor sentiment overreacts to economic turning points …

Source: 7IM

Core investment views

At 7IM, we have several long-term core views that help to guide our investment decisions and allocations within portfolios.

Over the next 12 months, we think markets will generally move sideways with volatility. In this environment, it is important to rely on a stable identity. Economic uncertainty creates fear and investor sentiment tends to overreact to economic turning points. Going forward, we believe that:

- Inflation has peaked and will start to fall through the year

- This means, interest rate hikes are nearing their end, the worst has passed

- But for inflation and interest rates to come down, growth has had to come down

And so, investors are starting to think about what’s next for financial markets. Economic data isn’t likely to bottom for another six to 12 months. Until this happens, the “Sideways with volatility” markets environment is likely to stay with us for a while.

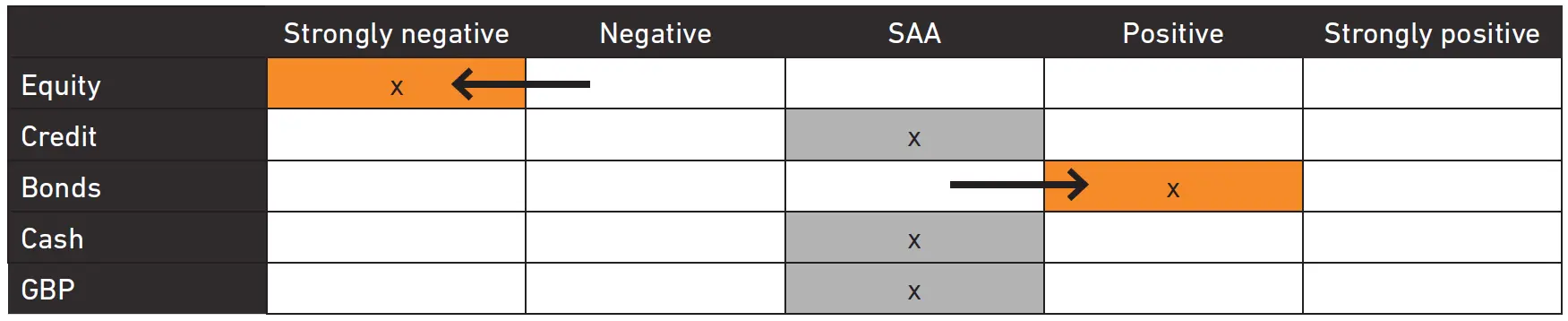

We have positioned portfolios towards assets that can generate returns despite this volatile backdrop. As part of this rebalance, we have moved our equity positioning to further underweight, and our bond positioning to overweight as shown below:

7IM Responsible Choice long term themes

| Portfolio themes | Comment |

|---|---|

| The world is getting older | The healthcare sector is best placed to take advantage of this. The sector still trades at a discount and we believe that the sector is starting to be recognised for its strengths – especially given its importance during the Covid-19 pandemic. |

| Fighting Climate Change | Climate change is one of the biggest threats that humanity faces in the coming future, and without drastic action the planet will warm by more than the 1.5% level agreed at the Paris Agreement. The Responsible Choice Models target companies that are managing their environmental risks and investing in a cleaner future. |

| Emerging markets will drive change | The funding gap to meet the Sustainable Development Goals by 2030 is between USD 6-8 Trillion and 70% of that is needed in emerging markets. This creates opportunities which we access in equity and fixed income markets. |

| Global impact | Impact investments are those that lead to a material and measurable improvement to environmental and social problems. The Responsible Choice Models have access to companies that are driving positive change around the world. |

| Sustainable finance | The private sector will be increasingly leaned on to drive environmental change and find solutions for an aging population. The Responsible Choice Models have exposure to both green bonds and social bonds, which are linked to sustainable projects. |

Asset allocation changes

We have made the following tactical changes to portfolios in this quarterly rebalance:

- Increased our underweight to equities: We still believe that a US recession is the most likely outcome from here. Most indicators that we look at to forecast recessions are flashing red. Housing, manufacturing, policy, and consumer sentiment are just a few of the many indicators pointing to a recession. For this reason, we believe that going further underweight equity is the right move for portfolios.

- Moved to an overweight bonds position: Bonds are not the same as they have been for the past 10 years. Since June 2020, the Fed funds rate has gone from 0.5% to around 4.5%, and higher starting yields on bonds means higher returns for bonds. The relationship is simple! Bonds are now better value and we have gone overweight using the cash proceeds from selling equities.

- Split out our global government bond allocation: Since inflation has gripped the Western world, rates have risen a lot… but Japan didn’t get the memo. The 10-year yield in Japan is still around 0.5%. The global government bond index is around 20% Japanese government bonds. By splitting out our government bond allocation into Treasuries, Gilts, and European bonds, we can get exposure to higher rates in the developed markets without exposing ourselves to lower Japanese rates.

Manager changes

This quarter, we have:

- We added the AB International Health care fund: We switched from our holding in the L&G Global Health and Pharmaceuticals fund to the AB International Healthcare fund across the portfolios. AB have a long history investing in Health care companies and the investment team integrates ESG at every step of the investment process.

- Added Vanguard Euro Government Bond Index Fund: This is our preferred implementation of the European sleeve of our government bond allocation. It tracks the index well and is cost effective.

- Added Vanguard UK Long Duration Gilt Index Fund: This is our preferred implementation of the UK sleeve of our government bond allocation. It tracks a longer duration index and is cost effective.

- Added Vanguard US Government Bond Index Fund: This is our preferred implementation of the US sleeve of our government bond allocation. It tracks the index well and is cost effective.

- Added iShares US Treasury ETF: This is our preferred implementation to get exposure to long dated US Government bonds. It tracks the index well and is cost effective.

Please note: All of the comments in this document refer to the models we run on the 7IM platform, but the models are also available on a range of other platforms. As much as possible, we try to replicate the models we run of the 7IM platform across all platforms, but due to differing security availability, not all of the points outlined in this document may be relevant across these platforms. If you are unsure whether certain changes apply to models on a specific platform, please reach out to a member of the team.

You can download the commentary as a PDF here.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.