Quarterly Responsible Choice Rebalance Commentary

Overview

Equity markets have traded sideways since the last model rebalance in August.

After a strong rally for global equities, the financial markets, in August, faced the first monthly decline in US equities since February. The S&P 500 lost 1.6%, while the technology-heavy Nasdaq lost 2.1% over the month of August. It was Nvidia that grabbed the headlines and was the main driver of the ‘Magnificent Seven’s’ performance. US Treasury Yields increased given better-than-expected economic data, dragging down US stocks. The Federal Reserve (Fed) has reaffirmed that they are determined to get inflation back to 2%, meaning interest rates could stay higher for longer. Closer to home, we also saw a decline in FTSE 100 and Eurostoxx 50 as the inflation and interest rate story continued.

Historically, September has a reputation as a month of weak performance. And this September has been no different. Despite falling inflation, global markets have suffered from seasonal weakness on the back of higher-for-longer interest rates, rising oil prices and ripples from China. The artificial intelligence hype has also finally met the challenge of a slowing global economy – the S&P500 returned -4.8% over the month. Stock markets were under pressure as rising bond yields started to worry investors once more. The 10-year US Treasury yields hit a 16-year high, driven by fears of higher-for-longer rates. A few factors have been at play to cause this worry: the unexpectedly resilient US economy defying recession expectations, increased government debt issuance, and the hawkish language emerging from the Fed. China continued to be in the headlines for sluggish growth, a high youth unemployment rate and a crumbling property sector.

Inflation, interest rates, and escalating geopolitical uncertainty… October was a gloomy month, further spooking investors as global markets continued their downward trend. Mediocre quarterly earnings prompted the fall in global equity markets, despite stronger-than-expected economic growth data. The ongoing increase in bond yields has not helped equity performance either. Long-end treasury yields continued to climb, with the US 10-year yield briefly touching 5% for the first time in 16 years and pulling back shortly after. While central banks control short-term interest rates, longer-term rates are out of their reach. This means supply and demand factors and expectations of future inflation have a greater influence on bond prices with longer maturities. So, when the market has to contend with this, this tends to get reflected in higher ‘long-end’ yields. However, there is some good news. October ended with a focus on interest rates as the Fed, Bank of England, and the European Central Bank all maintained unchanged rates. Looking ahead, it is said that markets tend to rebound in November. Let’s see if markets pick up on the Christmas festivities… will there be a ‘Santa rally’ at the end of the year?

Core investment views

At 7IM, we have a number of long-term core views that help to guide our investment decisions and allocations within portfolios.

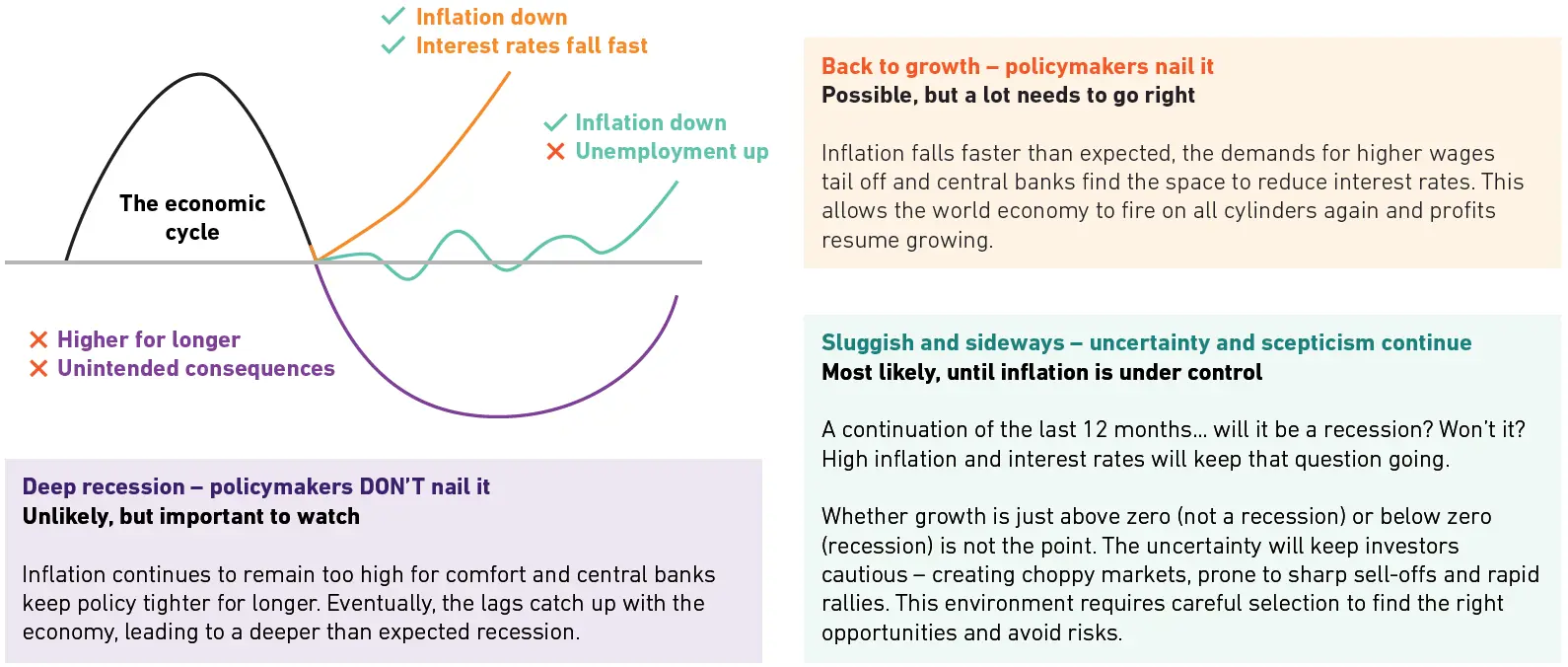

Over the next twelve months, we think there are a range of possible outcomes that investors will need to contend with. The possible scenarios are laid out below:

Tactical Asset Allocation

Headline Asset Allocation

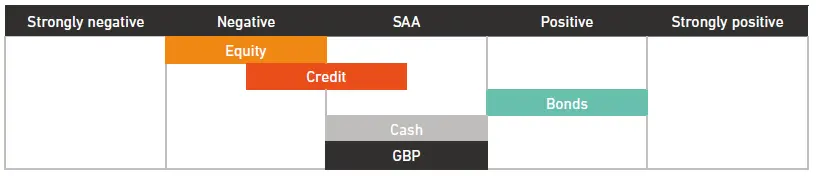

In an environment with lots of uncertainty and a lack of confidence, we want to make sure portfolios are insulated against shocks, while still generating sufficient returns to make investing worthwhile. And we think our portfolios are set up to do just that.

7IM Responsible Choice long term themes

| Portfolio themes | Comment |

|---|---|

| The world is getting older | The healthcare sector is best placed to take advantage of this. The sector still trades at a discount, and we believe that the sector is starting to be recognised for its strengths – especially given its importance during the Covid pandemic. |

| Fighting climate change | Climate change is one of the biggest threats that humanity faces in the near future; without drastic action the planet will warm by more than the 1.5°C level agreed at the Paris Agreement. The Responsible Choice Models target companies that are managing their environmental risks and investing in a cleaner future. |

| Emerging markets will drive change | The funding gap to meet the Sustainable Development Goals by 2030 is between USD 6-8tr and 70% of that is needed in emerging markets. This creates opportunities which we access in equity and fixed-income markets. |

| Global impact | Impact investments are those that lead to a material and measurable improvement to environmental and social problems. The Responsible Choice Models have access to companies that are driving positive change around the world. |

| Sustainable finance | The private sector will be increasingly leaned on to drive environmental change and find solutions for an ageing population. The Responsible Choice Models have exposure to both green bonds and social bonds, which are linked to sustainable projects. |

Asset allocation changes

We have made the following tactical changes to portfolios in this quarterly rebalance:

• Slightly reduced our position in Ninety One Global Environment fund: We continue to have strong conviction in the climate change theme. However, in an uncertain macroeconomic environment, with a reasonable risk of recession, companies within the Ninety One fund tend to be smaller in size and more sensitive to economic conditions. These factors may be more challenged in the shorter term. We still access the wider climate change theme through equities and bonds held through other strategies in the portfolio.

• Added to bonds: Following the rise in yields across global bond markets, we added to our bond duration overweight.

Manager changes

This quarter, there have not been any major manager changes across our model portfolios.

Please note: All of the comments in this document refer to the models we run on the 7IM platform, but the models are also available on a range of other platforms. As much as possible, we try to replicate the models we run of the 7IM platform across all platforms, but due to differing security availability, not all of the points outlined in this document may be relevant across these platforms. If you are unsure whether certain changes apply to models on a specific platform, please reach out to a member of the team.

You can download the commentary as a PDF here.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.