Responsible Choice Rebalance Commentary

Overview

If, at the start of 2025, you had been presented with a list of the events which have occurred so far, you’d probably have expressed a sense of caution when it came to portfolios. Global trade wars, US military intervention in Iran, Ukraine-Russia tensions still bubbling, new cyberattacks seemingly every week, rising temperatures creating crop issues (that’s why chocolate is so expensive at the moment!) and a whole lot more… not things to inspire confidence.

And yet, 8 months into the year, stock markets are continuing to make new highs – not just in the US, but in the UK and Europe too. In August, even China has joined the party, with the onshore market rallying by 10% in the space of a few weeks. What’s going on?

Well, it’s another reminder that politics and newsflow don’t impact reality as quickly as they impact the headlines. Investors who are paying attention to the fundamentals underlying the business sector are seeing quite a healthy picture. Consumption hasn’t been as struck by tariffs as expected, helped by massive stimulus policies across the world and a falling interest rate environment. Inflation in food prices might be high, but industrial goods haven’t seen the same trend – the oil price is around the lows of the last 4 years, for example.

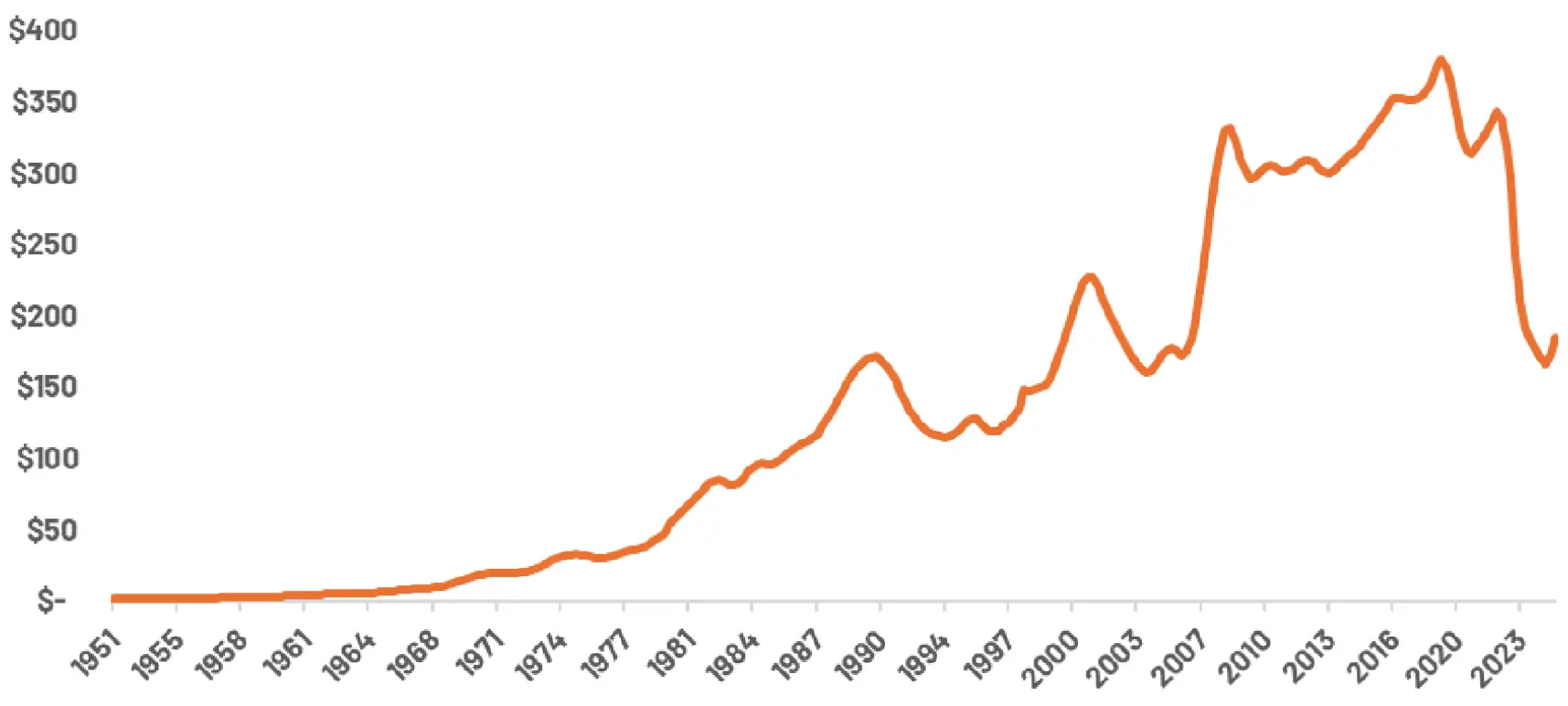

And something which isn’t really discussed, companies are in an incredibly strong financial position; interest payments are the lowest they’ve been for twenty years (see below for the US) – canny financial directors locked in low rates in the past decade and are now reaping the benefit.

Net interest payments by non-financial US Corporates

Source: www.fred.stlouisfed.org

As always, there are some areas of the market which look expensive (tech stocks in particular), and others which are unloved and inexpensive. Our diversified approach to investment means we’re tilting towards the latter areas; whether that’s in the UK, Europe and Emerging Markets. So far this year, these have helped boost returns for portfolios, and we see no reason for that to change.

Spreading our investments across the world also means avoiding an overconcentration in any one currency – in particular, the US Dollar, which may well be at the start of an extended period of weakness (one of Donald Trump’s explicit aims).

While there’s no need to be complacent about a benign outlook, we also don’t see too much of a need to worry – so a neutral stance on both equities and bonds makes the most sense at the moment, alongside a little bit of cash in case any opportunities emerge.

Core investment views

In the past few years, diversification has been punished. Now, we are starting to see different drivers of portfolio return and finally, diversification is being rewarded.

In 2025 so far, we have not seen one specific trade dominate market returns, but a varied sprawl across regions and sectors. Given this broad and varied sprawl, despite the noise, multi asset investors have had a pretty good year so far.

Over the next 12 months, we expect:

Economic growth to be positive but slowing as we start to see political uncertainty, longer term impact of higher rates starts to eat at global growth, particularly when it comes to the weary consumers out there.

Businesses are robust, and in the short term have managed to weather any trade concerns or the impact of any future tariffs.

We’d also expect to see investors re-engage with businesses outside the tech sector – which probably means looking further afield than the United States. Finding sectors or regions that have not felt the love over the last decade remains key to ensuring a diversified approach to investing and looking away from some of those concentrated areas of the market.

So how should we invest for a world which isn’t at extremes, and where diversification is rewarded?

Happily, that’s what our portfolios are built for. Letting market forces do the work. Spreading our allocations widely before there’s a reason to do so – because by then, it will be too late. So, despite the scary headlines, we’ve seen no reason to aggressively cut equity allocations – around neutral’s just fine. And we haven’t felt the need to suddenly sell all our US tech stocks, because we’ve been diversifying away from them for some time. The first half of 2025 has made us look like smart short-term asset allocators – but really, this is a long-term process that’s just starting to play out.

In an increasingly uncertain world, with various regions starting to decouple and go their own way, diversification is the best (only?!) answer. We’ve been doing it for more than two decades, and we absolutely believe it will deliver.

Tactical Asset Allocation

| Macro | Headline risk allocations, reflecting 6-12 month macro outlook |

|---|---|

| Equity | Neutral: Economic data is still noisy in the short-term; whether through the whiplash of tariff-on/tariff-off or the scarcity of data. Given that equity markets are now mostly positive on the year, our signals suggest there’s no need to reach for risk. A neutral position, in the context of broad diversification, should be fine for the summer. |

| Government Bonds | Neutral: In uncertain times, defensive assets can prove useful – even if it’s not obvious exactly when. While some people are worried about rising government debt burdens, we still believe that in times of stress, safe-haven assets will deliver. Getting paid for protective assets is never a bad idea – even if disaster doesn’t happen. It is important to note that we hedge the currency of all of our quality fixed income back into Sterling. |

| Diversifiers | Evidence-based diversifiers, which outperform through multiple market cycles |

|---|---|

| US Equal-weight | A diversifying strategy with a higher expected return than market-cap weighting over the long term, with recent underperformance accelerating the likelihood of that outperformance being frontloaded. A sensible, simple way to maintain exposure to the US, without over-exposure to the huge tech stocks, which are starting to be the most volatile parts of the index. |

| Diversified Sustainable Leaders | Companies leading in areas such as environmental innovation, social progress, and governance best practice are central to driving economic growth while supporting the development of a more sustainable global economy. This also includes responsible companies which are currently underappreciated by the market. Targeting such leaders allows the portfolio to capture opportunities across multiple sustainability themes, combining financial performance with positive contributions to sustainable development. |

7IM Responsible Choice long-term themes

| Portfolio themes | Comment |

|---|---|

| The Future of Humanity | The COVID crisis has shown how important healthcare is and, in a world where nearly a quarter of Europe’s population will be over 65 by 2030, healthcare will become more and more important. Over 50% of new drugs under development are targeted at the over-65 cohort. |

| The World is Getting Warmer | Climate change is one of the biggest threats that humanity faces in the future. Without drastic action, the planet will warm by more than the 1.5% level agreed at the Paris Agreement. Clean energy opportunities will emerge through solar, wind and hydropower. Control of energy supplies is becoming increasingly important – governments are only going to invest more money in the area. |

| ESG Transition Leaders | Companies are cleaning up their business models (even if not helping directly with climate change), such as when a bank cuts the use of paper, or an airline goes lower carbon. |

| Automation and Digitalisation | Companies are designing products/solutions which improve processing, connectivity and production and help clean up the world. Think AI, electric cars, food chain technology and supply chain management. |

| Evolving Consumption | Companies looking to design their products around consumption that fits health and wellness, the circular economy, travel and experiences and consumer lifestyles. |

| Global impact | Impact investments are those that lead to a material and measurable improvement in environmental and social problems. The Bluebay Impact Aligned Bond Fund is a global corporate bond fund that invests in both ESG-labelled bonds (green and social bonds) and bonds issued by ESG leaders. We also have the Amundi Emerging Market Green Bond fund, which helps finance much-needed environmental projects in emerging markets. |

Asset allocation changes

At the September model rebalance, 7IM has undertaken the following changes to portfolios:

- Small reduction to duration in portfolios, preferring shorter dated holdings and a diversified spread of fixed income holdings.

- Small increase to equity beta, primarily through Emerging Markets and Japan

- Reduction to Credit exposure for lower risk profiles

Manager changes

This quarter, the following holdings have been introduced to portfolios:

- Added Janus Henderson Global Sustainable Equity Fund for multi thematic exposure across the environment and society, contributing to the development of a more sustainable global economy while maintaining compound growth and financial resilience.

- Added Brown Advisory Global Leaders Sustainable Fund to target sustainable companies with strong leadership and high returns on invested capital. The fund is run by an experienced and long running team with a consistent framework for fundamentals and sustainability.

- Removed Ninety One Global Environment Fund. This position has been held since 2021 to benefit from opportunities arising from the climate transition solution providers. Amid near-term political uncertainties, we continue to view climate transition as a critical long-term theme. To enhance resilience, we have diversified into a broader set of sustainability opportunities through Janus Henderson’s allocation.

Please note: All of the comments in this document refer to the models we run on the 7IM platform, but the models are also available on a range of other platforms. As much as possible, we try to replicate the models we run of the 7IM platform across all platforms, but due to differing security availability, not all of the points outlined in this document may be relevant across these platforms. If you are unsure whether certain changes apply to models on a specific platform, please reach out to a member of the team.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.