Seven insights for 2023

Halfway through 2023, it's worth highlighting a few things that have caught our attention.

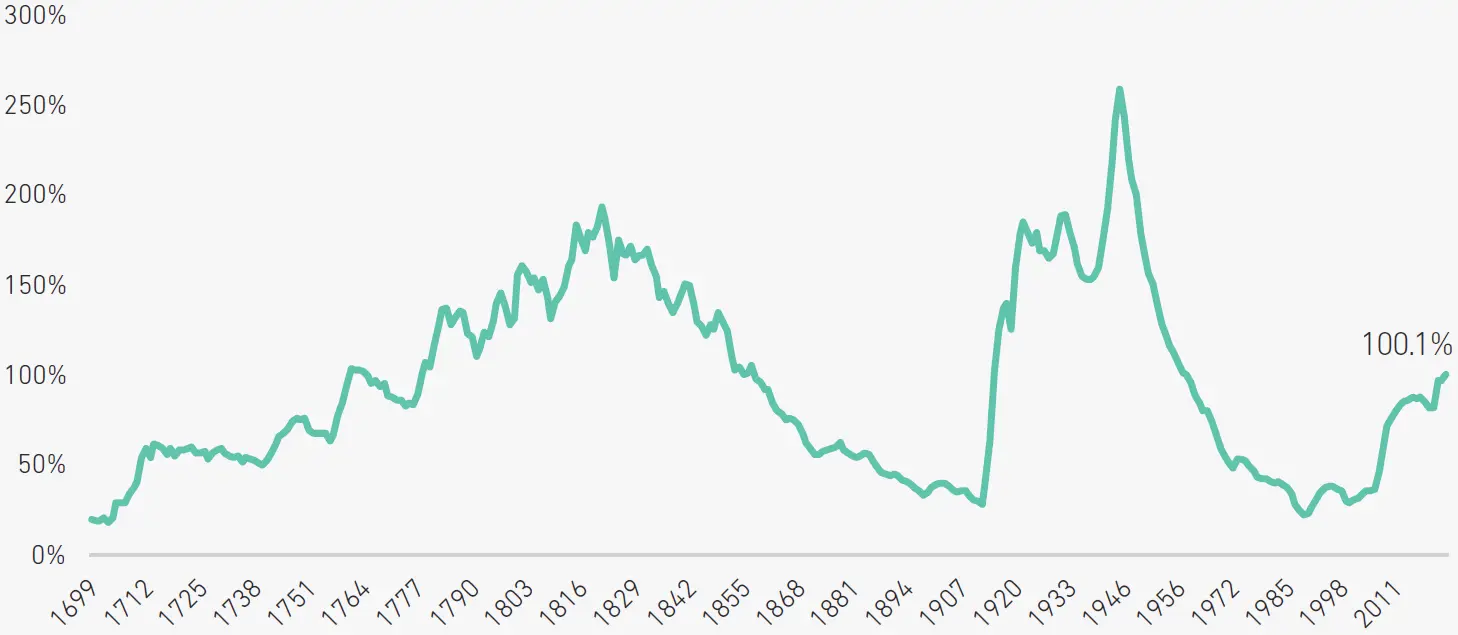

1. UK debt to 1688

You may have seen that the UK government debt/GDP ratio hit 100.1% in May 2023. Lots of people became very excited about this, noting that it was at the highest level since the 1960s, and suggesting that government spending was heading out of control.

But if you’re going to look at history, why not look as far back as possible? Going back to 1699 and the reign of William of Orange, we can see that government debt/GDP ratios have fluctuated over time – usually rising in response to crises or wars, and then edging downwards again. There have been several economic and political crises in recent years; perhaps the rise in debt isn’t that surprising after all…

UK Government Debt/GDP

Source: Bank of England: A millennium of macroeconomic data/7IM

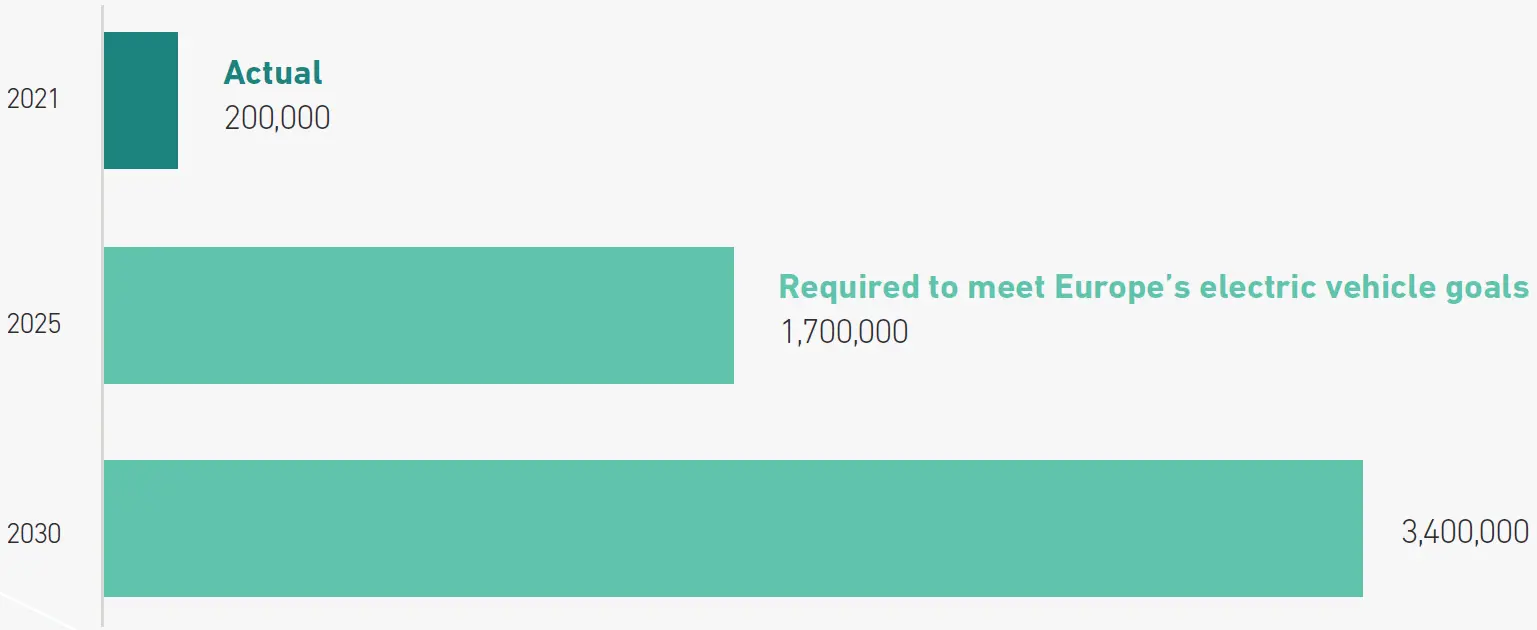

2. Electric vehicle chargers need lots of copper

Europe has grand plans to reduce transport emissions by adopting electric vehicles (EVs). About one in five of its new car sales in 2021 was an EV.

But the EV drive requires lots of supportive infrastructure – to charge the EV fleet, and to give non-EV drivers the confidence to buy an EV.

To meet official emission goals, McKinsey reckons Europe needs 1.7m public charging points to be installed by 2025, and 3.4m by 2030. These are gigantic increases.

That’s one of the reasons we are optimistic about metal prices and mining companies, since every charger requires about 3.5kg of copper, plus aluminium and steel and other metals. Not to mention the metals in solar and wind power stations, power lines, and the EVs themselves. Copper could be the new oil1, says Goldman Sachs, exaggerating only slightly.

Public electric vehicle charging points in Europe

Source: McKinsey, ‘Europe’s EV opportunity—and the charging infrastructure needed to meet it,’ 4 Nov. 2022.

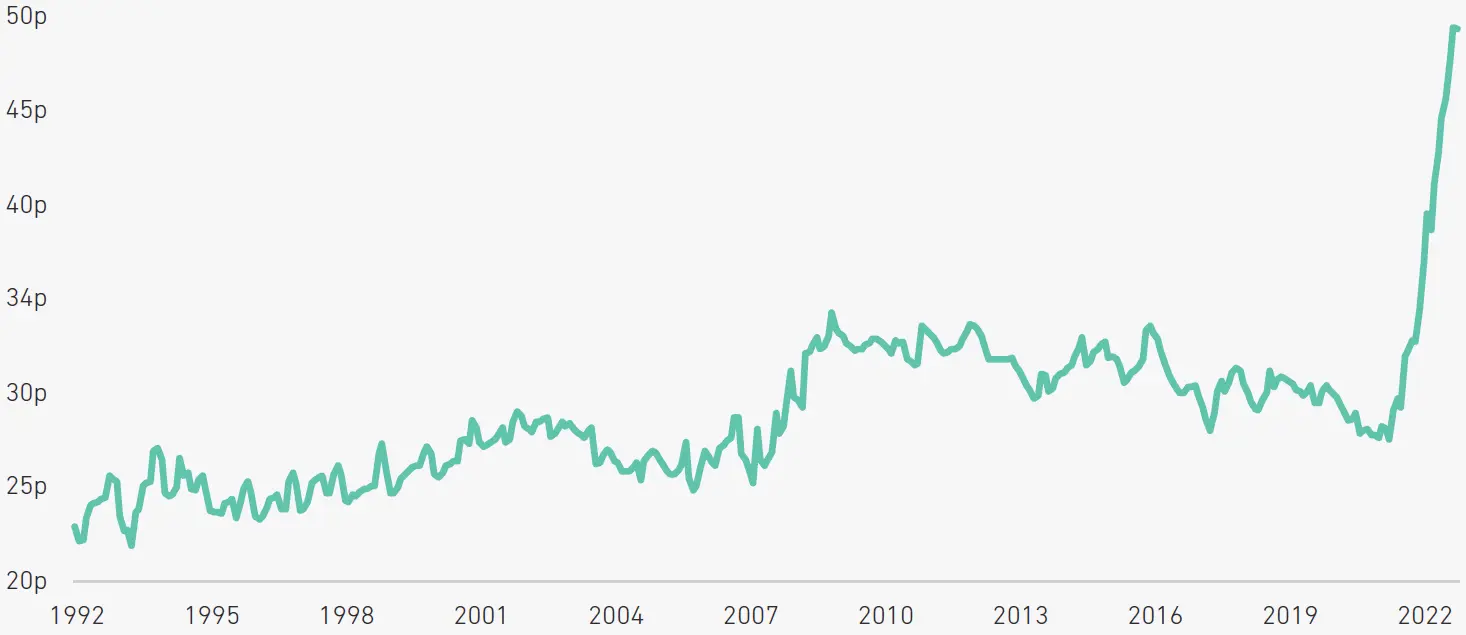

3. Profit-led inflation – have companies been milking it?

Nobody seems to know what has been driving the surge in world inflation of the last two years. Was it global supply chains? Or feckless governments? Labour shortages are part of the story. And Putin’s war. Was the UK’s experience exacerbated by Brexit?

But don’t forget pure, unashamed capitalism. Take the price of milk in the UK. Over most of the last 30 years, the markup that supermarkets charge over the price farmers receive has hovered between 25p and 35p. Then it suddenly shot up just after Covid.

Why? Did lockdowns shift up the demand for milk? Was there a milk shortage? Or were supermarkets taking advantage of inflation uncertainty? When nobody knows what’s going on, why not grab some extra profits?

That uncertainty is starting to settle now – and farmers are already lowering their prices (down 20% from peaks!). The markups could also start falling soon, bringing inflation and profits down too.

The UK milk markup

Average UK retail price of milk less the farmgate price; pence per pint

Source: ONS, UK Dept for Environment, Food & Rural Affairs

4. Saving and investing

Cash rates of 5%-plus are a tempting option for many people. But not for the long run. If Ahmer’s Strategy piece from earlier hasn’t convinced you, how about the wisdom of two successful investors?

How many millionaires do you know who have become wealthy by investing in savings accounts?"

Anyone who is not investing now is missing a tremendous opportunity."

5. The chunky chip at the heart of AI

In late 2020, Nvidia released the A100 computer chip. It has 54bn transistors and is able to process a gigantic amount of info. While iPhone chips are the size of a fingernail, the A100 is a real bruiser.

It costs about $10,000 and has been widely used to develop and train artificial intelligence (AI) systems, leading to Nvidia’s share price more than doubling in the first half of 2023. The stock is now trading at a price-earnings ratio of around 200, which is stratospheric. Investors are spectacularly optimistic about its prospects.

We asked ChatGPT for a poem about the A100 and AI:

The Luminary Chip

In realms of AI, Nvidia's gem gleams,

A100 chip, fulfilling grandest dreams.

With blazing speed, it unlocks new doors,

Unleashing potential, the world explores.

Deep learning's ally, it leads the way,

Revolutionising tech day by day.

Nvidia's A100, a vital part,

Fuelling AI's rise, a work of art.

Hmmm. Not bad, but not great either. AI will have a huge impact on the world eventually, but the human brain is not redundant quite yet.

6. Austria’s 100-year disaster

In 2017, Austria issued a 100-year bond, with a yield of 2.1%. As interest rates fell in the following couple of years, and even further during Covid, the price of the bond went from €100 to nearly €250. Those were generous returns for any asset, let alone a government bond.

But as rates have risen more recently, that bond has become less and less attractive. Who wants to lock in 1% or less for a century? Today, the bond trades at around €70. That’s a big loss if you bought it when it was issued at €100. It’s appalling if you bought it at €230 – down 70% on a government bond!

Price of Austrian 100-year bond

Source: Bloomberg L.P.

And now for something completely different…

7. How thick is the Carpet of Life?

If we took every living thing on Earth, from trees to mushrooms to ferns, blue whales to people to amoebae, pressed them into a thick carpet and spread it around the surface of the globe...

That Carpet of Life2 would be only 4.3mm thick. It would be half as thick as the Samsung Galaxy A13 phone.

On a global scale, the Carpet of Life is very thin indeed.

Why? Because much of the Earth is devoid of life. Most of the seas and oceans are empty, especially far from the coast and in the tropics. Deserts like Antarctica and the Sahara make up one third of the world’s land area… and have just a few penguins, lizards and shrubs.

Meanwhile, human habitats are filled with people, dogs and cats, but are often concrete wastelands for wildlife where only pigeons and weeds flourish.

1https://www.goldmansachs.com/intelligence/pages/copper-is-the-new-oil.html

2More information about the Carpet of Life, including the references used, can be found here: https://www.howandwhy.com/ideas/how-thick-is-the-carpet-of-life

Find out more

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.