Structure, strategy, scenarios

As a society, we’re getting over the initial shock of COVID-19.

Things are becoming more structured. We’ve adjusted to new ways of working, shopping and socialising. Little by little people are rebuilding routines and habits. We’re nowhere near normal, but there’s hope that we’re heading that way.

We can start thinking further ahead than the next few weeks and months – we can start building scenarios.

And at a global level, there is a plan. The world agrees on how to tackle the coronavirus. Almost all countries are adopting some version of the Hammer and the Dance that we’ve written about before, other than a few small rogues like Belarus and Nicaragua. This means we can start thinking further ahead than the next few weeks and months – we can start building scenarios.

Scenarios and thinking about the future

Scenario analysis is a way to think broadly about future events. It involves considering alternative outcomes, how they might come about and what the different investment implications might be.

A key measure for judging success or failure in the fight against COVID-19 is the basic reproduction number, R0. This number describes how many people will be infected on average by one person with coronavirus. If R0 is below 1, the disease eventually dies out – and the closer it is to 0, the faster the disease disappears. If the number is above 1, the disease will keep spreading and spreading… until, hopefully, a vaccine is discovered.

The Hammer phase against coronavirus consists of locking down the general population so the coronavirus surge burns out and health services have time to prepare – it squashes R0 by stopping social interactions. The Dance phase entails keeping R0 below 1 as economies and societies return towards normal. Over the last week or so, we’ve been putting together our scenarios for how the Hammer and the Dance could play out. 1

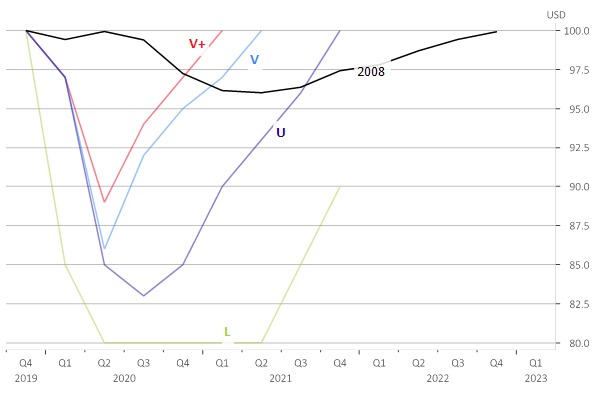

The graph below focuses on the US economy, and looks at what might happen to real GDP in four scenarios that we’ve developed. These range from V+, in which the world escapes coronavirus quickly and easily, through to L, in which the Hammer can’t keep the virus contained and the lockdowns last all year and spill over into next year. For comparison, we’ve included numbers for the 2008 crash and aftermath on the same scale. Note that in all scenarios the current crash in US GDP is far sharper than in 2008, but in most scenarios the recovery is much faster.

Source: 7IM and Macrobond

Currently, we are positioning our portfolios for a world somewhere between V and U – we’ve been buying corporate bonds, rather than equities and keeping some defensive assets in our portfolios.

V+ “The plan goes better than expected”

- The Hammer – Lockdowns across the world are effective at slowing the virus. Health services and essential infrastructure catch up to critical care cases.

- The Dance – Return to normality starts in May. Widespread testing and quarantining of infected individuals is effective; keeps R0 below 0.5. Foreign travel still limited.

- Economy – Gradual reopening of global economy starts in summer. World is mostly back to normal by mid-2021.

- Markets – Huge wave of stimulus and consumer demand supports risk assets, but creates inflation. Equity returns strongly positive, corporate bonds mildly positive. Government bonds negative.

V “The Dance works, but takes a while”

- The Hammer – Lockdowns across the world are effective at slowing the virus. Health services and essential infrastructure catch up to critical care cases.

- The Dance – Social distancing still the key to containing the virus. Non-essential businesses start to open, but still only allow limited entry. Bars and restaurants remain closed through summer. Foreign travel still limited.

- Economy – Gradual reopening of global economy starts in late 2020. World is mostly back to normal by end of 2021.

- Markets – Huge wave of stimulus keeps companies solvent, but lack of consumer demand keeps profits low. Corporate bonds positive. Equities mildly positive, but volatile. Government bonds negative, but volatile.

U “The Dance never gets going. Back to the Hammer”

- The Hammer – Lockdowns across the world are effective at slowing the virus. Health services and essential infrastructure catch up to critical care cases.

- The Dance – Attempts to open up the economy fail. R0 keeps flaring above 1, straining health services again, so the Hammer is reintroduced by autumn 2020, perhaps several times.

- Economy – Shutdown lasts much of summer. Countries like China and South Korea slump again. Recovery only really begins at the start of 2021, but eventually takes hold quickly.

- Markets – Huge wave of stimulus keeps most companies solvent, but further shutdowns take their toll on a significant minority. Corporate bonds positive, but volatile as defaults occur. Equities negative. Government bonds flat, prefer alternatives.

L “The Hammer can’t keep the virus contained”

- The Hammer – Lockdowns struggle to keep cases contained – but are still better than the alternative.

- The Dance – Hardly even begun. Vaccine is seen as only solution, so scientific progress dictates the timeline.

- Economy – Shutdown lasts much of the year, across the world. Recession/depression means governments have to increase the size of stimulus further. Focus is on saving lives, not jobs.

- Markets – Complete capitulation in risk assets. Equities and corporate bonds negative. Bonds and alternatives possible hiding places, but panic in all financial assets creates liquidity squeezes.

1 Along with the rest of the financial world, we use letters for each scenario, as each conveniently describes the shape of the economic recovery.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.