The Global ISA

Knowing where, when, and how to invest can be confusing. Economic variables are hard to forecast, random shocks (like Covid-19) come out of nowhere and markets react to these events in seemingly unpredictable ways. And if that wasn’t enough, governments across the world are trying control these factors that are sometimes uncontrollable.

China, until very recently, has made a huge success of it. Its astonishing economic development over the last few decades owes a large part to deliberate government intervention. This is starting to reverse, though, with investors shying away from Chinese equities. This hasn’t stopped that free-market America giving it a go – as the recent CHIPS and Science Act looks to encourage onshore advanced technology production.

Closer to home, we were interested to see the so-called ‘British ISA’ announced. It looks like we will be given an extra £5,000 allowance (on the top of the existing £20,000), where the allowance is reserved for ‘UK-focused assets’. On the surface, this sounds straightforward – the UK government wants to channel more investment into shares issued by any company incorporated in the UK and listed on a UK-recognised stock exchange.

Whether it will have the desired effect remains to be seen, but it won’t be easy to implement. Encouraging investors to target their capital into a specific region comes with its own challenges. If investing can be confusing, then concentrating that investment in one region may just add to that confusion. We tend to believe client investments should remain diversified across regions and other market drivers.

To see why we think this, let’s ask ourselves a simple question… what exactly is a ‘UK-focused asset’?

Country of listing ≠ Country of exposure

Looking to support growth of UK businesses and the UK economy is the aim of every government, but the reality of investing via a ‘British ISA’ could look very different. Take the FTSE 100 (the largest companies listed in the UK). And let’s specifically look at Company ‘X’, which is one of the largest companies at a weight of around 5%. This company, according to its 2022 report, generates around 96% of its revenues outside of the UK, despite being listed in the UK.

Put another way, if you invested the extra £5,000 allowance into this company, £200 would be invested into a company where just 4% of its workforce are employed in the UK. There are even examples of companies with no revenues or employees in the UK! When combined the largest 100 companies listed in the UK, the portion of total revenues generated in the UK is about 20%. Is this what the government has in mind when it decides what a ‘UK-focused asset’ is?

Exposures come in different forms

The UK is not alone, though. The largest companies in any given equity market will tend be global in nature. These exposures can change through time in unpredictable ways. This is why we prefer to put together a globally diversified exposure of equities which together come closer to what is a sensible global exposure. For instance, 7IM portfolios show significant exposure to the US, which makes sense as the world’s largest economy, but this doesn’t come from investing in companies just listed in the US but rather through revenues from European, Chinese, and South African-listed companies.

We can apply this logic to different types of market drivers as well. Think sectors: in any given period, particular types of sector exposures can give you different results. Are oil prices rising? Then maybe the energy sector is the place to be. Is the economy slowing?

Stable healthcare companies might offer some protection. How strong is global trade? Industrial companies will provide some exposure to the ups and downs.

The challenge is that, predicting oil prices or the economy or trade or any other variables is not easy. Instead, a more prudent approach is to ensure risks are spread evenly, rather than overly concentrated in one area. Staying diversified will ensure some exposure to some of the most positive outcomes, while mitigating the outcomes of the worst. No one could predict that Russia would invade Ukraine in 2022, but those who had some exposure to energy companies (ironically, most likely through the FTSE 100) would have been glad they did.

Combining different types exposures win out in the long run

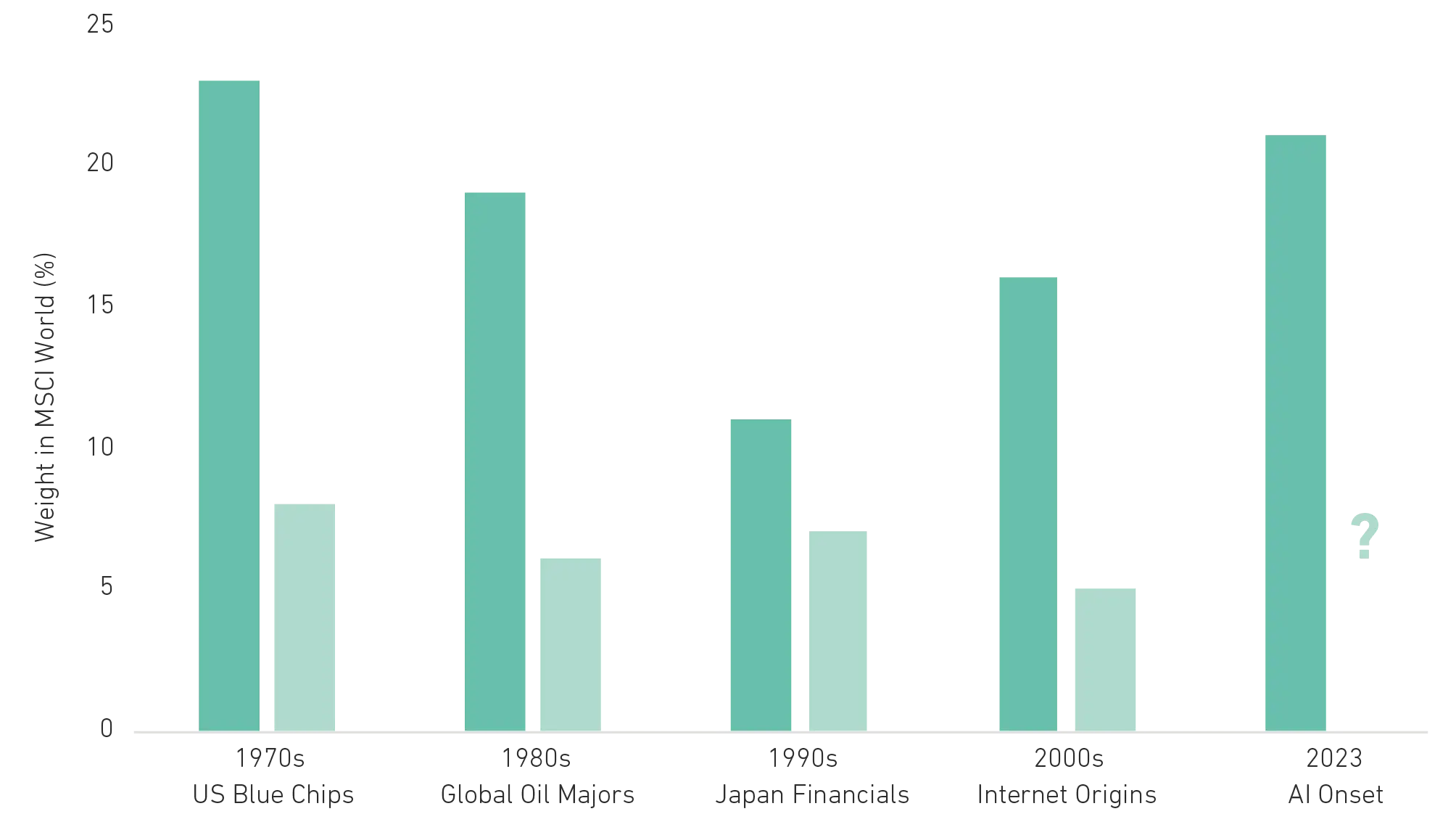

The challenge to staying diversified is when one particular sector, market or theme appears to dominate everything else. We saw this with oil companies in the 70s, Japanese companies in the 80s and emerging markets in the mid-2000s. Today, we are seeing a smaller and smaller subset of companies, usually referred to as ‘Tech’, leading equity markets higher. The temptation is to ask, why bother diversifying?

NB: strictly the companies in question are in the IT, Consumer Discretionary and Communication Services sectors … another reason to diversify across sectors!

In those previous instances, the concentrated themes eventually reversed course. Not because they were led by bad businesses or those sectors don’t exist anymore or the regions they were in fell behind. It was just that the market started preferring something, anything else. We can see this in the way concentration of particular sectors have evolved through time (see Market leaders change frequently section ahead). The market concentration of those leaders changing from decade to decade shows how things can change.

Right now, away from the UK, investors are deliberately increasing their concentration in a narrower and narrower subset of companies.

Investing can be simple though

Thinking about all the different dimensions to investing can be overwhelming. The regions and sectors are just the start. There are so many other factors. From local government regulations to national trade deals, from currencies to interest rates, there can be a lot to take in. The best and simple remedy to this is to spread investments across as many of these different market drivers as is reasonable. It might not feel like this when the headline-grabbing investments are leading the way, but you’ll be glad you did when it turns. And if history is anything to go by, it usually does.

So, the government will have to think hard about how it implements the ‘British ISA’. Steering investors towards a small subset of UK-listed companies won’t be as easy or as desirable as it sounds. Given the global exposure of UK-listed assets, it may end up looking more like a ‘Global ISA’, in which case why just invest in the UK? Instead diversify across multiple regions, just like 7IM portfolios?

Market leaders change frequently

When someone is new to investing, the question they tend to ask is ‘where should I invest my money?’, usually hoping for some insight into the next big thing to profit from. The answer though should be more boring than that… everywhere. While it is tempting to ride the latest excited wave in investments, the forgotten bit is how things can change. Yes, Japanese companies were the best performing in the 80s… but then spent the next two decades lagging everything else. The chart below shows how different leaders have changed through the decades. Timing when this changes is difficult, so having investments spread across different regions and drivers is the most profitable way to invest over the long run.

If investing can be confusing, then concentrating that investment in one region may just add to that confusion. We tend to believe client investments should remain diversified across regions and other market drivers.

Leaders from each era had a smaller market weight a decade later

Darker shades indicate weight of 10 largest stocks at peak concentration (dates noted in article). Lighter shades indicate weight of the same 10 securities one decade later.

Source: MSCI

More from 7IM

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.