Themes for thought

Constructing portfolios that are built to last is in our DNA at 7IM, but we appreciate it’s important to have our finger on the pulse and consider the short- and medium-term challenges that may impact your clients and their portfolios.

To illustrate this, seven members of our investment team have chosen a chart or picture to display their key message for 2022 and beyond.

Matthew Yeates

Deputy Chief Investment Officer

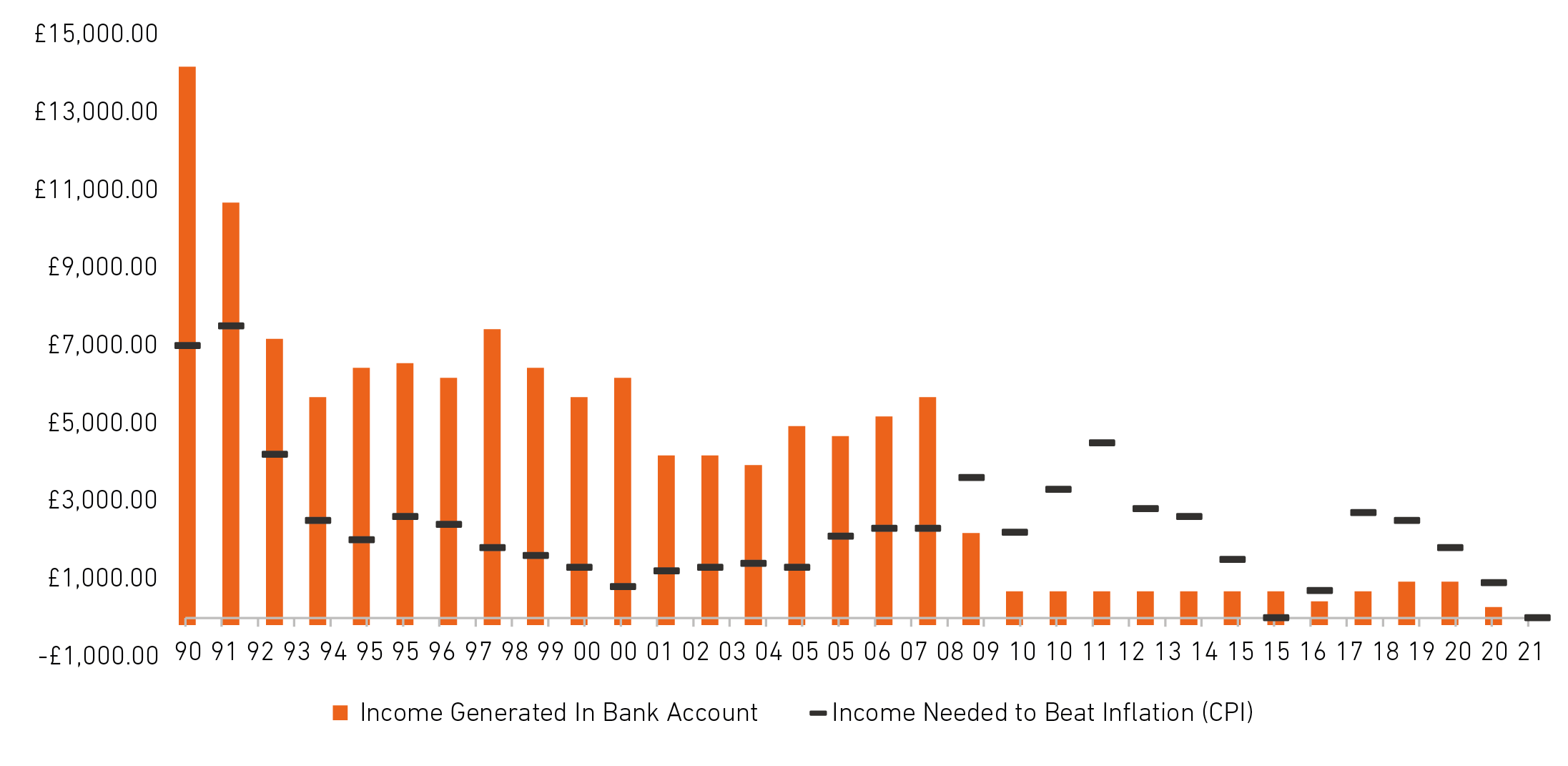

The chart shows the problem for savers in the UK. Ever since the financial crisis of 2008, the interest available on a bank account has been far less than needed to beat inflation. Leaving money in a bank account simply isn’t an option anymore – a well-managed, diversified portfolio is something that savers need to embrace sooner rather than later.

1: Savers need to work harder to reach their goal

Source: 7IM, Bloomberg Finance L.P.

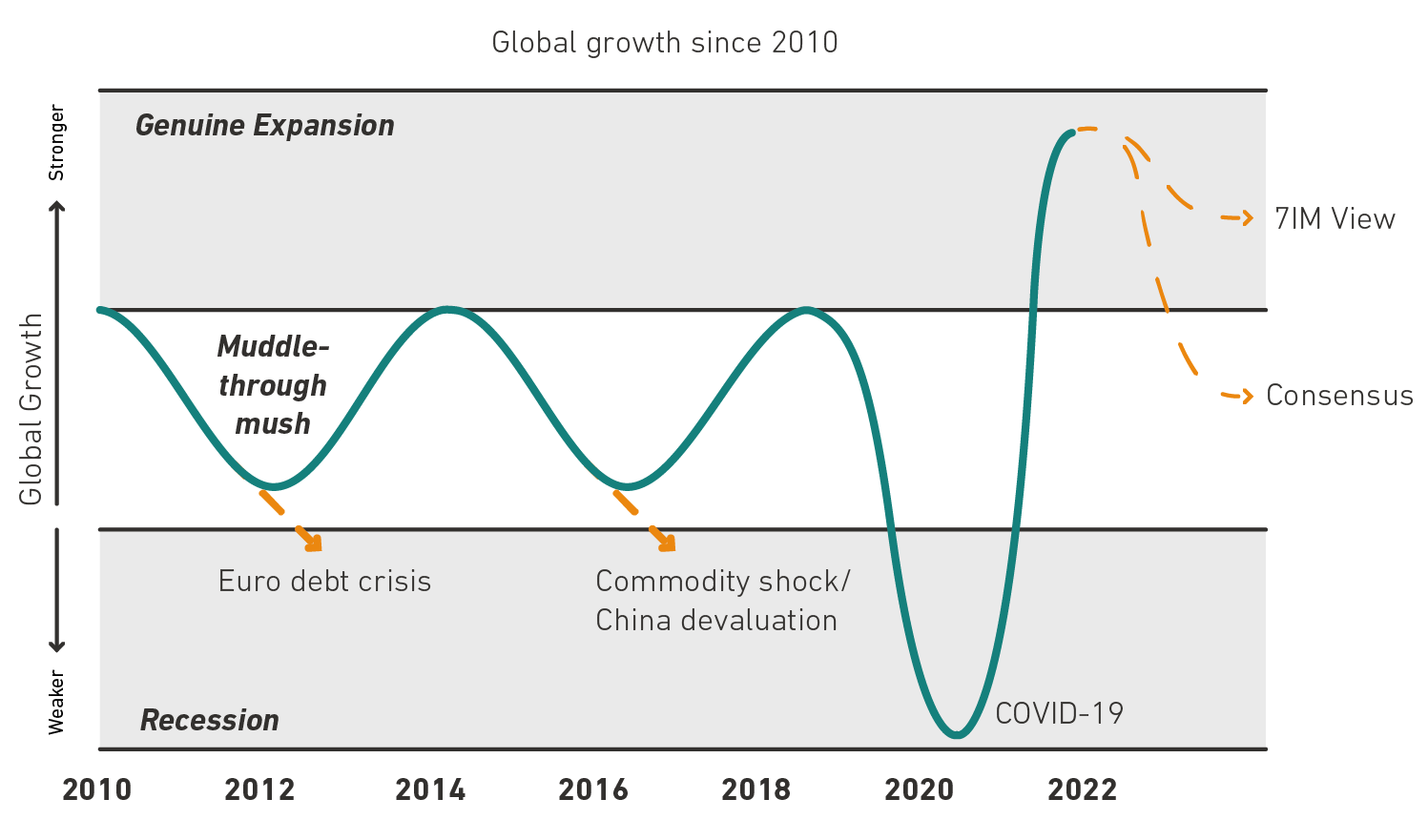

2: The world is entering a new growth cycle

Source: 7IM, Bloomberg Finance L.P.

Ahmer Tirmizi

Senior Investment Strategist

Over the last decade, economic growth in most countries has not been able to get going in earnest. Low confidence across all economic sectors meant a gloomy muddle through, rather than an exciting expansion.

We believe that’s set to change. The scars of the financial crisis have healed – governments are abandoning austerity, companies are focussing on more than just survival, and consumers have cash to spare. It might take a year or so to sink in, but this economic cycle is going to be stronger than the last!

Ben Kumar

Senior Investment Strategist

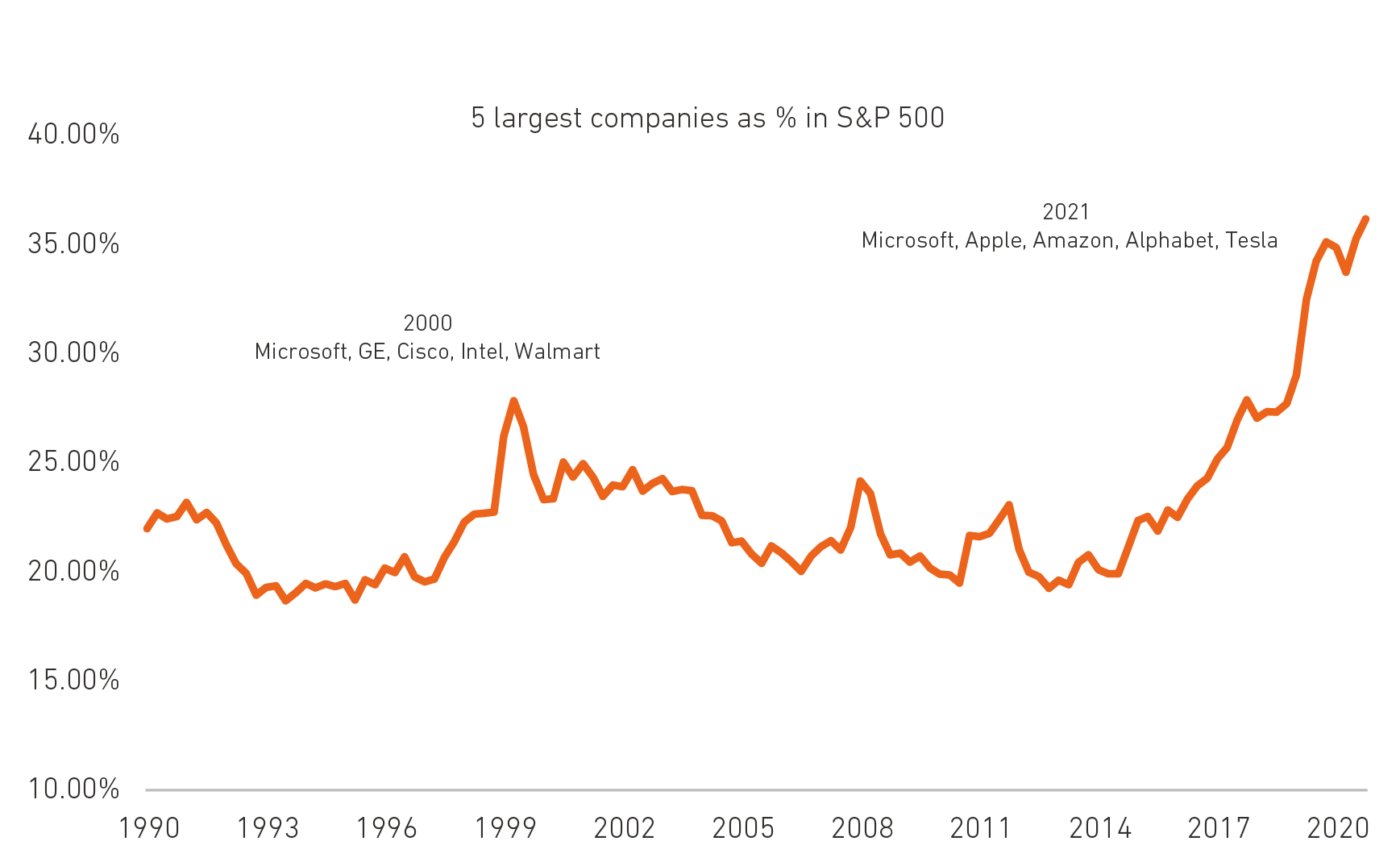

Over the last few years, equity markets have been dominated by a few huge US companies. In a world of sluggish growth, investors wanted the comfort and protection that huge tech businesses offer.

But now, those companies are likely to produce sub-par returns. In a competitive, capitalist world, market dominance makes you a target. Smaller businesses start to eat away at their market share, while governments clamp down on monopolies. It happened in the first decade of the 2000’s, and it’s likely to happen again.

When the world changes, the winners change too – and our portfolios reflect that.

3: Huge US tech businesses are becoming a risk

Source: 7IM, Bloomberg Finance L.P.

Terence Moll

Head of Investment Strategy and ESG

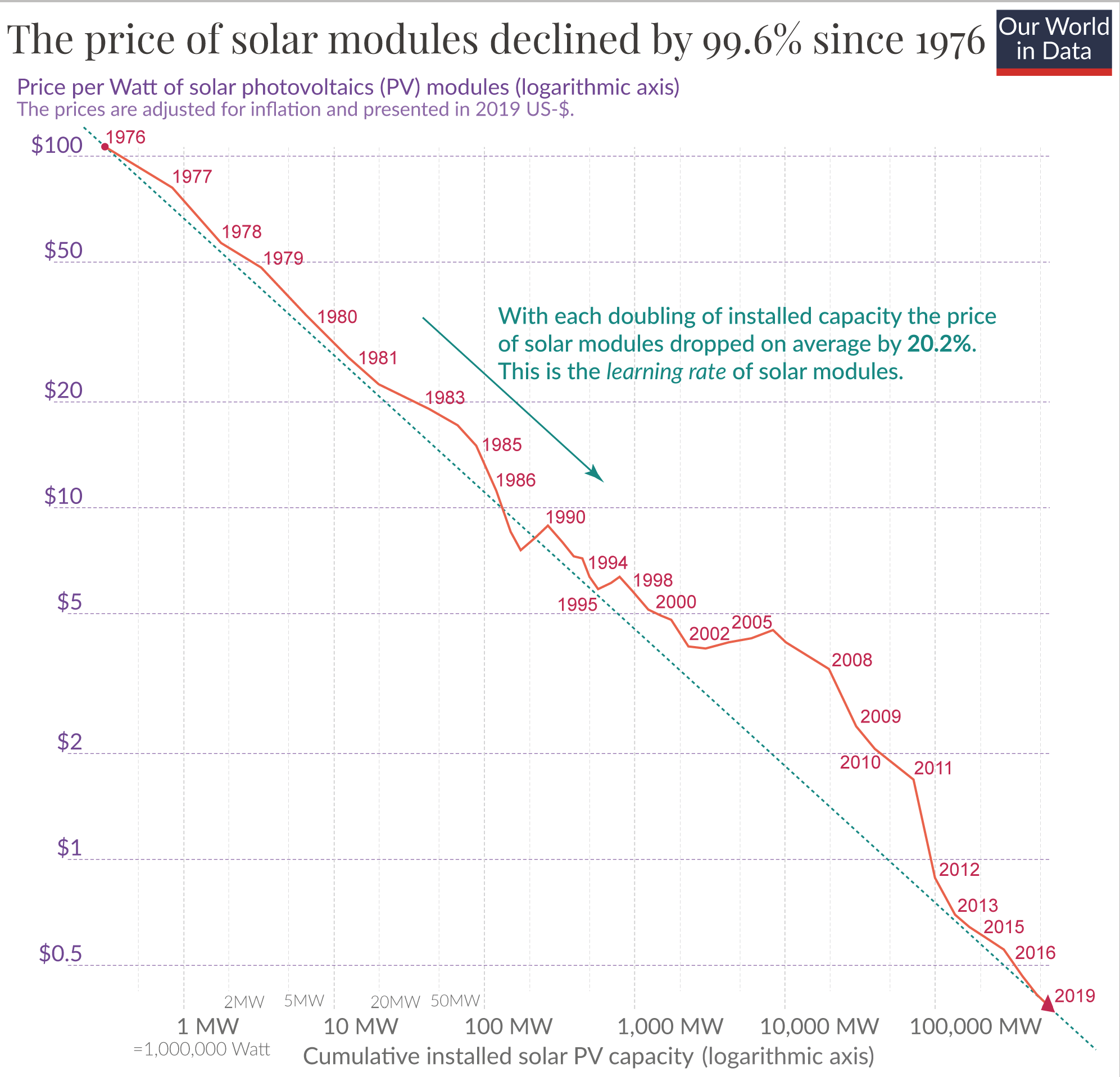

News on climate change can often be very gloomy – and it’s easy to lose sight of the technological progress on the go.

Since 1976, the price of solar power has declined by 99.7%, and the trend is continuing.

Over the next few decades, the way we use energy is going to be completely transformed. With a near limitless supply of cheap energy, the world will be greener, cleaner and better off. We’re watching closely.

Jack Turner

Investment Manager

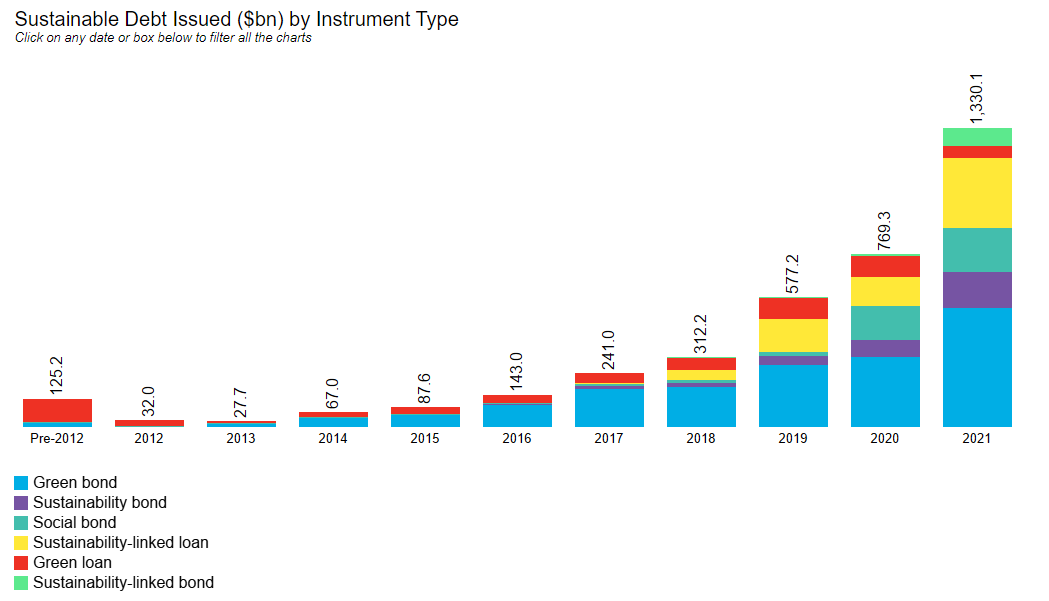

Achieving the UN’s Sustainable Development Goals by 2030 will require huge investment; approximately $8 trillion a year of financing on current estimates.

And that demand for financing will create opportunities for investors like us to generate meaningful returns from important projects.

Sustainable debt issuance is increasing rapidly, as companies and governments look to raise money. We’re already buying these bonds in our Sustainable Balance fund, and as the universe grows, we may well see them elsewhere in portfolios.

5: The ESG opportunity set keeps growing

Source: Bloomberg New Energy Finance

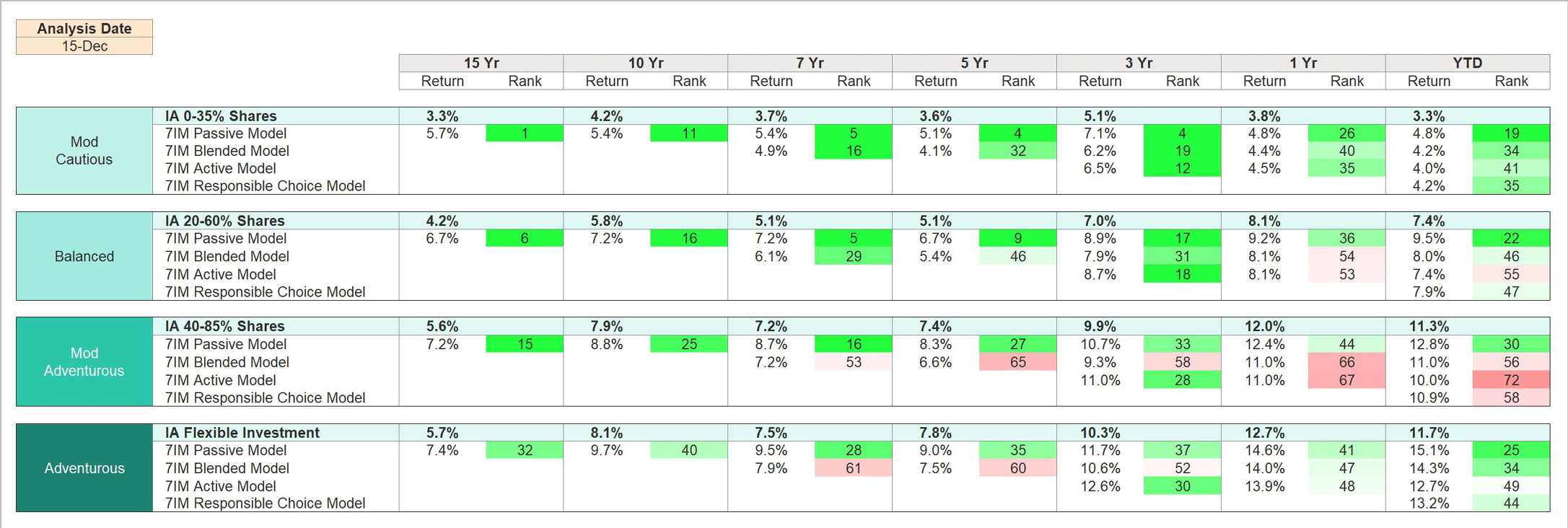

6: Manager selection – process, not luck

Source: Morningstar, CFA Institute, 7IM

Uwe Ketelsen

Head of Portfolio Management

In a changing, growing world, we think that active managers are going to find lots of opportunities to beat passive benchmarks. However, we need to find the good ones. There are lots of parts of our manager selection process. A key aspect is knowing where to focus. The table below shows the percentage of active managers who have beaten the benchmark over a 10-year period.

Areas such as Japan or Emerging Markets, or in the smallcap area of the market are far more fertile ground for our active manager search than markets like the US. We’ve got a great line-up for the next decade.

Martyn Surguy

Chief Investment Officer

7: 7IM Model Portfolio Performance

The events of the past couple of years have been extremely challenging in ways we could not have foreseen. So it’s gratifying to see our model portfolios continue to deliver positive returns for our clients – in both absolute terms and relative to peers.

You’ve read how the various members of our investment team are thinking about the next cycle, in terms of both the opportunities and the risks.

Thinking differently – whether that’s about solar power, the economic cycle or manager selection – has always been one of the things we’ve done best as a team, so we expect that to continue.

Of course, we also know that trying to predict the future precisely is impossible. Something always comes out of nowhere. So, over the next decade, our investment approach will be the same as it has been for the last two decades.

We’ll generate strong investment performance through robust long-term portfolio construction, through being prepared to react and adjust if needed, and through process-driven manager selection.

Of course, we’ll also keep our focus on risk management, making sure our clients have the investment journey they expect, not just the ultimate outcome, giving them peace of mind.

We firmly believe that talking to clients is one of the most important things we can do as investment managers. And so, as we move into 2022, we’ll make sure we communicate with the same level of honesty and clarity as we always have.

Source: 7IM, FinEx, Past performance is not a guide to future returns, chart(s)/data for illustration purposes and are not for further distribution

Capital at risk

You should be aware that the value of investments may go up and down and you may receive back less than you invested originally. Past performance is not a guide to future performance.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.