Trapped in an old way of thinking

Imagine you’re trapped in a deep, dark cave. Miraculously, you find a magic lamp. Obviously, you rub it – and a genie appears. The genie is a little unconventional though; he’s surprisingly focussed on investment returns for someone who lives in a lamp underground.

He makes you an offer. You must choose between investing in the UK equity market or the US equity market for a period of twelve months (told you he was strange). After one year, if you chose the best performing market, he’ll send you home with £10 million. If you make the incorrect decision, you take his place in the cave.

The genie is psychic, so he already knows the answer, and much like those maths teachers at school, he’s more interested in your working out. He’ll answer one brief question about the year ahead to help you make your choice. What would you ask? And no, you can’t ask which is the right answer.

Would you ask about Joe Biden’s first year in charge? Or about Boris Johnson’s challenges as Prime Minister? How about interest rates in the US vs. the UK? Or whether COVID-19 vaccinations were progressing more quickly in one than the other? Would you ask about Brexit or economic growth or relative unemployment levels? Or tax levels?

Any of these might seem appealing, sensible, even, to try and get a feel for which country would come out ahead.

But that’s the kind of thinking that will get you stuck in a lamp for the next thousand years.

Because the most important driver of stock market returns is not the international dialling code.

What the genie wants to hear is a question about the businesses which make up the index. There’s no perfect question to ask – but here’s a few suggestions:

- Will demand for commodities such as copper be higher or lower than last year?

- Will the oil price rise or fall?

- Will computing power demand rise by as much as last year?

- Will the next iPhone launch be more successful than the last?

Because the most important driver of stock market returns is not the international dialling code. The dominant factor in a developed stock market is the blend of industries which it contains – what a company does is as much as three times more important than where it is based1 (in developed markets).

I dug into this towards the end of summer 2020, writing about the importance of challenging some of the traditions and conventions of the investment world. That’s really what the genie is really asking you to do in order to escape.

Looking at 2020 through a sector lens

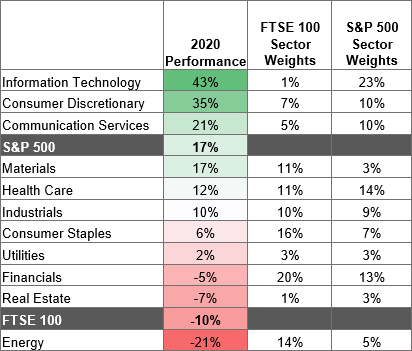

Looking at the performance of sectors over the whole of last year helps to make the point. In the second column of the table below, I’ve ranked the performance of global sectors, and then slotted in the S&P 500 and FTSE 100 index.

In the third and fourth columns, you can see the sector allocations in the two indices at the beginning of 2020. The S&P 500 had one third of its weight allocated to the two best performing sectors over the following twelve months, whereas the FTSE 100 had under 10%. Worse, at the other end of the scale, the FTSE 100 had three times as much in the terribly performing energy sector than the S&P 500.

This is nothing to do with national differences, but everything to do with the activities of the businesses in the indices. So, if you don’t want to spend the next thousand years trapped in a lamp, it’s time to think differently.

1https://www.msci.com/www/research-paper/the-future-of-emerging-markets/01323047429

Past performance is not a guide to future returns, chart(s)/data for illustration purposes and are not for further distribution.

Any reference to specific instruments within this article does not constitute an investment recommendation.

Discover more

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.