7IM General Investment Account (GIA)

At 7IM, we provide our own individual and joint investment account(s), also known as a GIA, for use on the 7IM Platform.

Any client with a 7IM ISA is required to also have an 7IM individual GIA as any new funds for the ISA will need to be deposited into the GIA first. You can sell assets in a GIA or fund a new subscription into a 7IM ISA or JISA using our Bed & ISA tool on the 7IM Platform.

We have put together some useful information about the 7IM GIA below.

New clients

Existing clients

New clients

Payments made to 7IM by bank transfer will be available to invest quicker than those sent by cheque.

Bank: ROYAL BANK OF SCOTLAND

Swift Code: RBOSGB2LXXX

Sort Code: 16-04-00

Account Number: 31266302

Account Name: Pershing Securities Ltd Client Hub Account

Payment reference: {7IM account number}

Cheques

Cheques should be made payable to Pershing Securities Limited with the client's 7IM account number on the back and posted to 7IM, 1 Angel Court, London EC2R 7HJ.

Existing assets held by another provider or by clients directly can be transferred in-specie (also known as re-registering) into an individual or joint investment account. This includes shares listed on a recognised stock exchange as well as collective funds.

Clients will need to complete and sign our Investment Account Transfer form which will be included in the application pack generated online for new accounts or can be sent to us separately for existing accounts. We may also request other paperwork if required.

Where possible we will transfer assets electronically using the Altus system.

You will be able to monitor the progress of every transfer by logging into our platform.

Existing clients

Payments made to 7IM by bank transfer will be available to invest quicker than those sent by cheque.

Bank: ROYAL BANK OF SCOTLAND

Swift Code: RBOSGB2LXXX

Sort Code: 16-04-00

Account Number: 31266302

Account Name: Pershing Securities Ltd Client Hub Account

Payment reference: {7IM account number}

Cheques

Cheques should be made payable to Pershing Securities Limited with the client's 7IM account number on the back and posted to 7IM, 1 Angel Court, London EC2R 7HJ.

Managing Capital Gains Tax using the 7IM Platform

We have a range of reports and tools to help you manage your clients’ Capital Gains Tax (CGT) allowance.

Clients who hold assets in their GIA can make use of their annual CGT allowance.

You can download a CGT summary report from the 7IM Platform covering all your clients:

Reports > Tax > CGT Reports > All Clients CGT Report

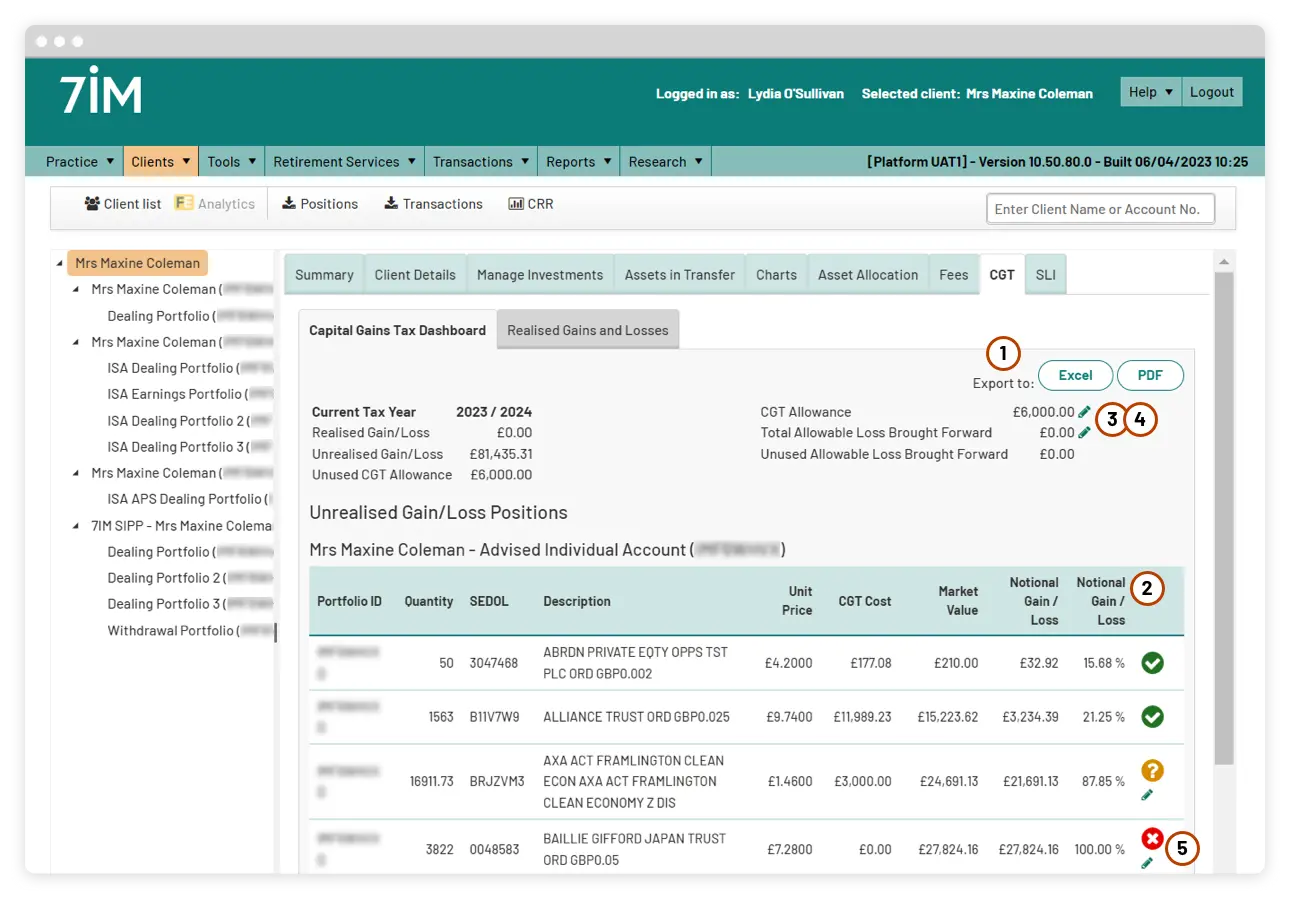

Viewing CGT in the 7IM Platform

In the client account area of our platform, you’ll find a CGT page with two sections:

Unrealised gains

- See a summary of the client’s CGT position so far (which can be exported into Excel)

- See the notional gain/loss for each fund (which can be useful in calculating how much of which funds to sell to use up the client’s CGT allowance)

- Edit the CGT allowance (for example if the client has used it up elsewhere)

- Edit the Loss Brought Forward (for example if your client has made a loss elsewhere that you would like to take into account with the CGT calculations)

- Edit the book costs of any funds that have been transferred in-specie. This is important to make the CGT calculations as accurate as possible and should be done before you dispose of any holdings.

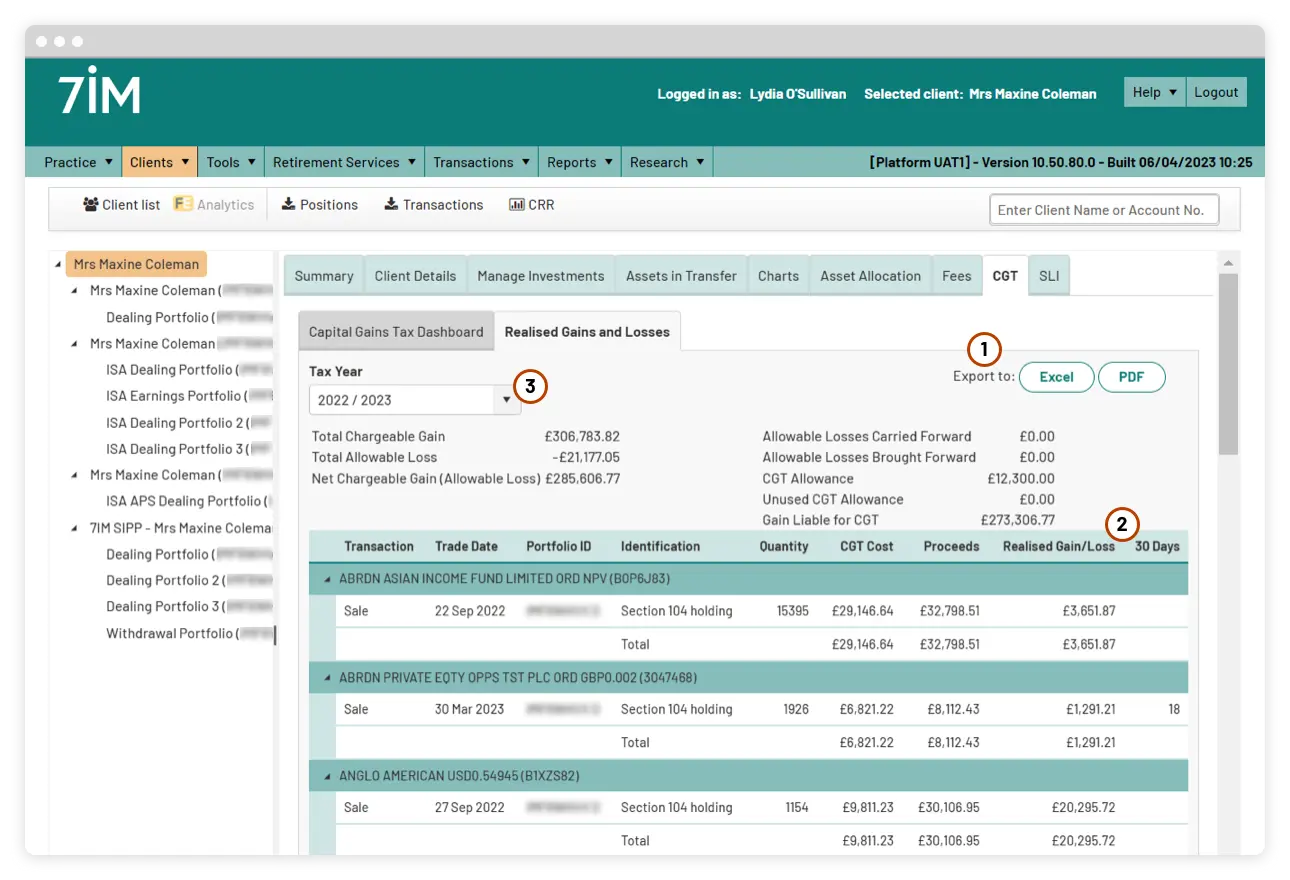

Realised gains

- See a summary of the client’s realised gains and losses so far and the net amount chargeable to CGT (which can be exported into Excel)

- See a detailed breakdown of the gains or losses by fund (including 30 day rule)

- Download CGT reports for previous tax years.

Reporting

All 7IM GIA's will be included in the client’s quarterly statements and visible on the 7IM Client Portal and 7IMagine app.

CGT information is also available online to clients on the 7IM Client Portal.

If the account has received taxable income during the tax year, then a Consolidated Tax Voucher (CTV) will be produced for that account, normally in June. The original paper version of this CTV will be posted directly to clients and you will be able to download a copy from our platform. Please watch our video on how to do this. This report will also contain any Excess Reportable Income.

Find out more on our Capital Gains Tax Guide

Discover more

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.