The Hammer, the Dance and the Endgame

And so we drift towards lockdown. No pubs, no gyms, social distancing. Increased handwashing. Staying at home where possible.

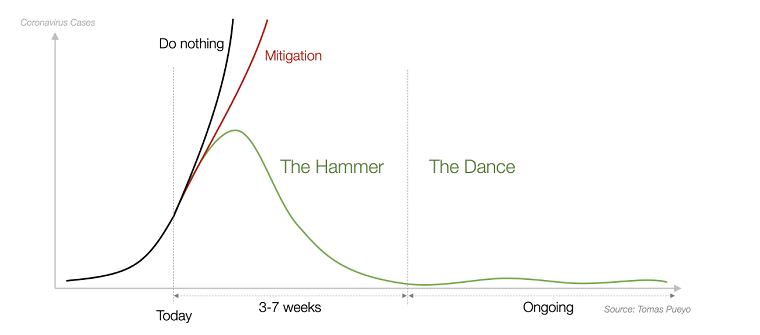

Tomas Pueyo, an astute American commentator, describes this approach to dealing with coronavirus as ‘The Hammer and the Dance.’

And as investors, we are spending a lot of our time thinking about what companies and assets will survive and flourish after the Endgame.

We are currently in the ‘Hammer’ phase. The idea is to crack down on the virus as much as possible. If the restrictions are tough enough, and enough people follow them, then case numbers should begin falling, as pictured below.

Sure enough, coronavirus case growth rates have begun coming under control in countries that acted early and acted big, like South Korea and Sweden. Even in Italy and Spain, daily growth rates are down to 10% or so. There is hope.

Of course, the economic costs of clampdown are huge. Firms close their doors and some won’t open again, people lose their jobs and incomes, kids don’t go to school. So it’s essential that the Hammer be lifted as soon as possible and move into the ‘Dance’ phase. This is where regulations are slowly eased and people begin going back to work, schools open again, and social life resumes. That’s already happening in the parts of China that were worst hit.

If the virus pops up again, then the rules will be tightened again. Up, down, up, down. We’ll see a ‘Dance’ of measures to get our lives back on track, while keeping the virus under control.

The next few months will be hard. They’ll be toughest, of course, for people who are sick, especially if they’re older and vulnerable. It’s also tough for NHS workers, for elderly people, for parents with young children, and for many others.

The good news, though, is twofold. First, the heavier the Hammer is applied now, the sooner the virus comes under control and the sooner the Dance begins. We could be talking a few weeks rather than months.

And second, the government has acted fast. Last week the Bank of England cut rates to 0.1%. Rishi Sunak has only been Chancellor of the Exchequer for six weeks but understands that strong action is needed to limit the economic downturn. He has announced measures to support the incomes of working people and companies of up to 5% of GDP. More assistance will be forthcoming if that’s not enough.

We won’t Dance forever. Sooner or later the ‘Endgame’ will arrive. It will take one of two forms. Either, a cocktail of drugs to help people cope with and recover from coronavirus ― several are being tested already and look promising. They might materialise on a large scale later this year.

Or a COVID-19 vaccine. Normally it takes many years to develop a vaccine but there is such global focus right now that experts think one might be developed by next year. At last count, about 35 vaccines were already being trialled across the world. Hopefully, one of them will be a winner.

We are hopeful about both of these outcomes. Science, human ingenuity and big budgets can do great things… look at the US Space Program in the 1960s! But let’s be realistic. They’re probably six months away, minimum.

The economic growth numbers for the next few months will be ghastly, the worst since the 1940s, but we expect the downturn to be short-lived. It will probably be followed by a strong recovery. And as investors, we are spending a lot of our time thinking about what companies and assets will survive and flourish after the Endgame.

I confirm that I am a Financial Adviser, Solicitor or Accountant and authorised to conduct investment business.

If you do not meet this criteria then you must leave the website or select an appropriate audience.