Monthly commentary

Beyond the budget

Finally, UK investors can move on. It feels like we’ve been holding our breath since about July, waiting to find out what the Chancellor had in store.

So. Exhale.

Where we can, we try to leave the politics out of our investment analysis. Everyone will have their own personal views on what the UK budget was and wasn’t trying to do, and what it did or didn’t deliver. From a simple, immediate, market-based perspective, the 2025 Budget should probably be classed as a narrow win. The Pound didn’t crash, UK Government Bonds didn’t implode, and UK-listed stocks and shares barely noticed the event.

Of course, a narrow win isn’t the same as a thumping victory. One comes with a sense of relief, and of disaster averted. The other instils a healthy dose of confidence and momentum – bring on the next match/fight/challenge.

That impetus is still missing from the UK economy. Consumer and business confidence indicators are bumping along the bottom; and retail sales over the festive period should give us a good idea – come January – of what’s really going on in households across the country.

However, as we start to think about the coming year, we’re trying to be careful not to let domestic issues dominate our wider perspective. After all, the UK is very much a global economy, and the stock market is the same (with most companies doing more business abroad than in British towns and cities). And, although it doesn’t feel it, the world is actually in good shape.

Maybe the most tangible thing you’ll notice is that the 2025 harvest for coffee, cocoa, olives and oranges – all key culprits for price rises in your supermarket basket – has been good. That doesn’t solve any problems, but it might make life a little tastier, for a little less money than recent years. Never a bad thing!

Chart of the Month

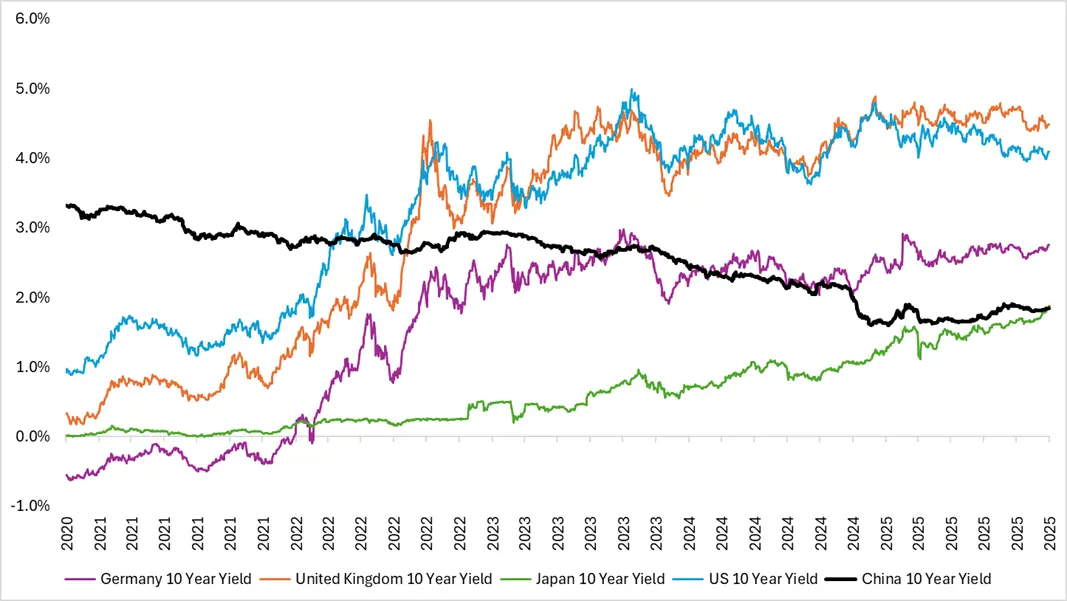

New World Order – China doesn’t pay more to borrow anymore

Source: 7IM/FactSet. Past performance is not a reliable indicator of future results.

For years, China stood out as the high-yielding outlier among major economies. Investors looking for income could rely on Chinese government bonds offering rates at a premium well above those in the US, Europe, the UK or more notably Japan.

On the opposite side of the fence, Japanese Government Bond yields have sat at record lows, making investing in them a laughable concept.

This assumption that China offers an extra yield premium no longer holds, with global fixed income looking a little more balanced.

The key question is whether this is purely a short-term change in the monetary policy environment, or a deeper realignment of economic expectations. Only time will tell.

November Markets Wrap

Markets paused for breath in November after a strong Q3.

Global equities were broadly flat, with developed markets eking out modest gains while emerging markets lagged. The key drivers of the sensitivity in equity markets were the continued concerns around the lofty valuations seen in the market. The flagship event of equity investors calendars, Nvidia results. Despite a strong earnings release, the continued uncertainty led to a seesaw of market sentiment, with markets concerned about how long the AI trade could last. This was a key detractor in those AI exposure emerging market regions, with South Korea and Taiwan hit the hardest.

Bond markets were similarly subdued, as expectations for further central bank easing were tempered by mixed economic signals and lingering fiscal concerns. A well-advertised Budget in the UK saw some of those fiscal concerns tempered through the announcement of additional tax-raising measures introduced across the board.

Market Movers

Source: Bloomberg Finance L.P. Data as of 30 November 2025. Past performance is not a guide to future returns. Quoted returns are in the local currency of the market

What we’re watching in December

- 9th – US Federal Reserve Meeting. After a split decision across the group tempering market expectations of aggressive rate cuts, the December meeting will be a focus point for markets.

- 12th – Costco earnings; if consumers really are struggling, they tend to look for a better deal. Costco tends to be a key bellwether for the strength of the US consumer.

- 18th - Bank of England meeting. A meeting full of uncertainty with inflation, unemployment, and the first post-Budget meeting will cause some headaches for the Monetary Policy Committee.

More from 7IM