Compelling stories aren’t investment wisdom

A life of stories

Our lives are built around stories. As children, stories send us to sleep each night. As adults, they’re also everywhere. On commutes and on holidays, on evenings out or nights in, we’re reading, watching, and listening to stories. At birthdays, graduations, wedding days, retirement dinners and funerals, we tell stories to our friends and families.

It's been like that for thousands of years. From fireside sagas to Shakespeare to Netflix, human history is storytelling.

Even in our high-tech modern world, stories are incredibly powerful. Advertising is storytelling – and makes up almost all of Google and Facebook’s revenues. Jeff Bezos founded one of the biggest companies in the world as a place to sell stories online. Hollywood is built on stories and populated by the people that tell them. We see heroes and villains all around: politicians and film stars, royals and billionaires, footballers and comedians. Stories are everywhere.

And that won’t change.

Looking for patterns to learn from

Stories are wired into our biology, as part of our evolution. One of the main problems in life is that facts are boring. Memorising long lists of things is difficult and can feel pointless – who’s to know what might be useful or not? Stories tackle both of those problems.

Human beings are incredible at spotting complex patterns in the world. But we’re even better at communicating those patterns to others. The ability to tell a story allowed our ancestors to do something no other species could do – use the past to predict and prepare for the future. To learn, and then to teach in a highly effective way.

Stories stick in the brain better than facts

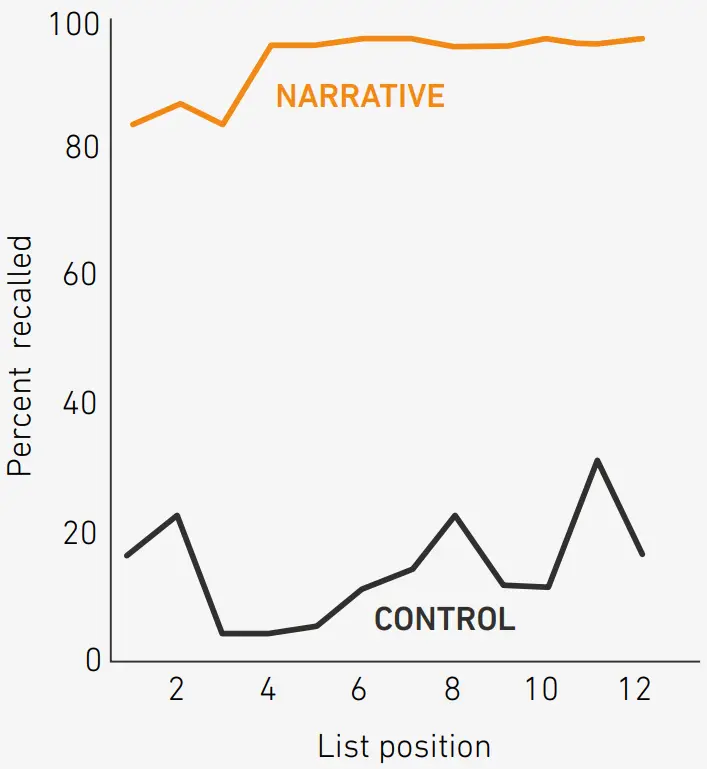

A psychology experiment in the 1960s gave students 12 lists of 10 random words. The control group were simply asked to remember as many as they could. The other group were told to make up stories using the words.

The storytellers remembered 93% of the words, while the list-learners could only remember 13%. Narratives are enormously powerful!

Learning is much easier with stories (see box). A story gives memorable structure to a series of facts, and – if told well – is interesting enough to be worth listening to, whether it’s useful or not. Most people don’t know much about the Wars of the Roses but can happily reel off exactly what happened to who in Game of Thrones or Harry Potter.

In pre-history, these stories allowed generations to pass on useful knowledge, e.g. avoiding dangerous areas through passing down stories of haunted caves and monsters, or sharing successful hunting techniques through heroic tales of victory. Think problem-solving through pattern recognition, and communication. Survival through stories.

Fig. 1. Median percentages recalled over the 12 lists

Data source: Bower, G.H., Clark, M.C. Narrative stories as mediators for serial learning. (1969).

Past performance is not a guide to future returns, chart(s)/data for illustration purposes and are not for further distribution.

Returns and analysis is based on daily total returns. The chart is for illustrative purposes only.

Narrative bias

Patterns and narratives are still a key part of our lives: by some estimates, two-thirds of all conversation is storytelling1. Most of the time, it doesn’t matter whether these stories are true or not – they’re harmless and enjoyable diversions. But from time to time, our tendency to fall for a good story can get us into trouble. Our bias towards a compelling narrative stops us from thinking clearly.

This bias can be deliberately exploited. Conspiracy theorists and cults use it to recruit and indoctrinate believers. Dictators use it to gain power, while con artists use it to steal.

On other occasions, there’s no malevolent force at work – it’s simply that a story becomes widely accepted and leads to irrational behaviour. Take the hoarding of loo-paper at the start of lockdown – would you have thought about it if you hadn’t heard about it? Or hour-long petrol station queues, based on rumours of shortages?

During bull markets, the positive story becomes so overwhelming that no-one wants to sell. But bubbles burst eventually. Seeing past the current compelling story isn't easy. But a long-term investor has to do just that.

In investing, narrative bias often overwhelms common sense – arguably it’s what creates the market cycle of ups and downs. During recessions, the negative story becomes so consuming that no-one wants to buy. But recessions end. During bull markets, the positive story becomes so overwhelming that no-one wants to sell. But bubbles burst eventually.

Seeing past the current compelling story isn’t easy. But a long-term investor has to do just that.

Beyond the story

How can we tackle narrative bias if the love of stories is so inbuilt? On the 7IM Investment Management team, we have a few ways.

The first is simply to remember that the more layers between us and the information, the more storytelling there will be. If something has happened in the financial world, it’s best to look at the original data if possible – rather than a reporter’s interpretation of a press release, or an analyst’s write-up of a company’s results.

We also try to avoid making very specific forecasts; it’s too easy to get carried away in building a story that ends up the way we want, only to be blindsided when the world changes. Instead, we use scenarios to describe more than one outcome, with as little evocative detail as possible.

Where appropriate, we rely on statistical models to help form our views. Numbers don’t tell great stories, but they don’t write fiction either. We have various kinds of model, built on different principles by different people, looking at problems in more than one way.

There will always be a story that sounds compelling. But our best chance of making sensible investment decisions is to assume it isn’t the whole picture, and look for more detail and perspectives.

1 Dunbar, R. Gossip in evolutionary perspective (2004)

Find out more