Keeping your pension on track amidst rising inflation and volatility

After a tumultuous 2020 and 2021, you’d have been forgiven for thinking things might quieten down in 2022. But six months in and it’s been anything but. We’ve had the crisis in Ukraine, market volatility across the globe, rapidly rising inflation and central banks trying to keep a lid on price rises by hiking interest rates.

There’s no shortage then of things to be concerned about when it comes to your pension pot (and any other portfolios you may have!). But, as my colleague Ben Kumar touched upon recently, while it might be tempting to move your pension assets to the perceived safety of cash when markets get choppy, cash is most definitely not king.

This is especially the case with rampant inflation, which recently hit a 40-year high, pushing up the cost of living for everyone and eroding consumers’ purchasing power. And while the Bank of England may be hiking rates at an almost unprecedented pace, the rates offered on cash deposits are almost certainly not going to be able to keep pace and combat the corrosive effects of inflation.

So, what can you do?

We think the best strategy, particularly when it comes to your pension, is to stay disciplined and stay invested.

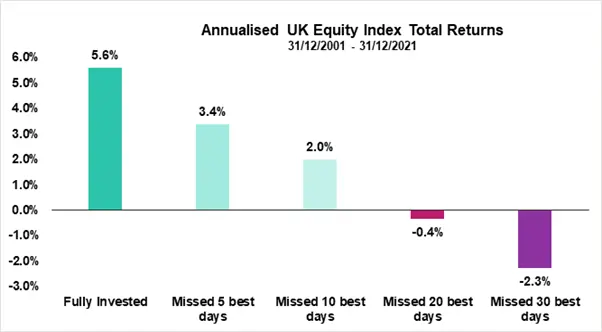

A pension should be seen as a long-term plan, and a very long one at that. Pulling your investment to retreat to cash in response to short-term market volatility can result in significant losses over the long term. As our research shows, those who remain invested over the long term typically do better than those who try to cash out when volatility strikes. That’s because the best days in the market often closely follow the worst days. Indeed, 21 of the 30 best days came within two weeks of one of the 30 worst days. As the adage goes, what matters is “time in the market, not timing the market”.

Even if you’re approaching retirement, with the average life expectancy in the UK currently at 81.65 years and set to climb to 85.48 years by 2050[i], it’s likely you’ll need your pension savings to keep working hard for you for many years after you retire – and cash just won’t cut it. And while an annuity might seem like an attractive alternative option due to the guaranteed income they offer, they lack the flexibility that many retirees need these days.

Of course, we understand that investing doesn’t come without its risk. But in the current climate, with inflation hovering at around 9% and expected to reach double digits this year, moving to and staying in cash is arguably even riskier, as the chances are, you will be making a loss in real terms for the foreseeable future.

While your pension and its investment strategy should be seen as a very long-term plan, simply setting your strategy and leaving it untouched is not a sensible idea either. Over time, the asset allocation of your pension pot is likely to shift due to market movements and become out of kilter with your risk profile. Alternatively, your goals might have changed and the risk you are taking in your pension investments may no longer be appropriate.

It’s therefore important to regularly review your pension to ensure your investments remain in line with your appetite for risk and continue to meet your objective; an annual review should be sufficient. We suggest speaking to a financial planner, who can assist with this review and help keep your pension on track. To speak to one our Financial Planning Directors, give us a call on 020 3823 8678.

Tax rules are subject to change and taxation will vary depending on individual circumstances.

Find out more