Only six months in, 2022 is looking extraordinary

2022 has felt extraordinary for investors – no mean feat given what we’ve been through over the past couple of years.

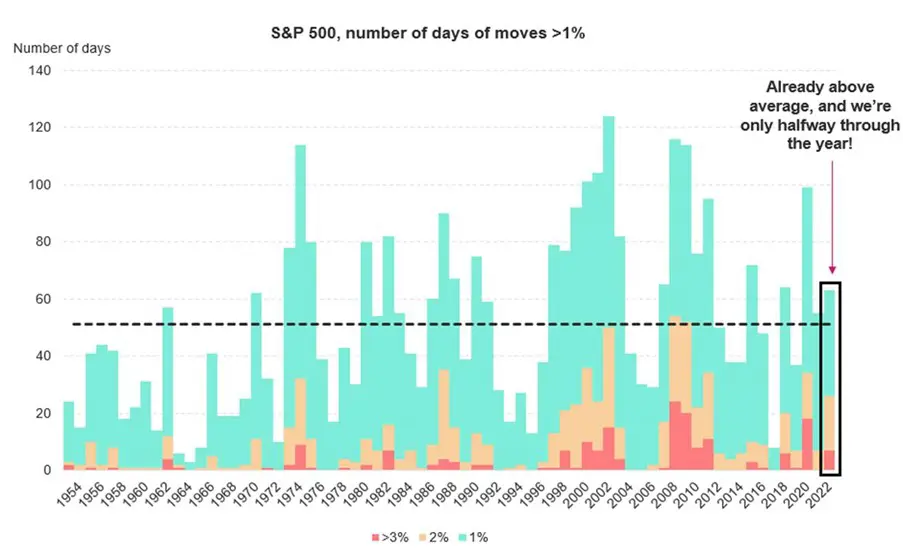

Whether it’s the war in Ukraine, the collapse of the FAANG stocks, or the rapid rise in the cost of living, every week seems to bring a shift in sentiment. There’s always something going on! So we’ve updated one of our favourite charts. It shows the number of days in a year where a market (in this case, the S&P 500) moves by more than 1% in one day – up or down.

The long term average of 50 days can be a bit misleading. There are typically long periods of calm, and then clusters of excitement. In the calm periods, perhaps 20 or 30 days a year see big moves. But when the storms hit, 80 or even 100 days of sharp movements aren’t uncommon; 2020 being the perfect example. So far, six months in to 2022, we’ve had 63 days of BIG market movements. If we continue at this rate, we’ll be on track for one of the MOST choppy years since the 1950s. No wonder it has felt so scary!

Source: 7IM, Bloomberg Finance L.P., Past performance is not a guide to future returns, chart(s)/data for illustration purposes and are not for further distribution. Returns and analysis is based on daily total returns. The chart is for illustrative purposes only.

Staying the course

Humans don’t like feeling uncomfortable. We don’t like surprises. So rapidly moving markets make us nervous. And when we’re nervous, we want to DO something to make us feel better. Suddenly, cash, with ZERO big daily movements, looks tempting. And the longer things keep moving, the worse that temptation will get.

Now, we have no idea whether things will calm down over the next six months, or will continue to be choppy. What we do know is that moving to cash is never the right long-term solution. In fact, with inflation likely to be higher in the future (if not quite as extreme as at the moment), investors’ money is likely to need to work even harder over the next decade.

Broadly diversified portfolios and robust risk management already give us comfort about the long-term outlook for our portfolios. And with a tactical investment process driven by quantitative judgement and discipline – rather than emotions – we think we’re well placed to take advantage of the opportunities which extraordinary markets often throw up.

You should be aware that the value of investments may go up and down and you may receive back less than you invested originally. Investment in the stock market is not suitable for everybody; please consult an adviser before making a decision to invest.

Find out more