Proposed inheritance tax changes – look beyond the 10% rate headlines

It might sound like a tongue twister, but the All-Party Parliamentary Group for Inheritance & Intergenerational Fairness is actually a cross-party group of MPs who have been picking at the scabs of inheritance tax recently.

In January 2020, the group published a report that said the current inheritance tax regime is often criticised as: ‘complex, ineffective, riddled with anomalies, distortionary and unfair’. It also said: ‘It is unpopular and ripe for reform.’1 Nothing newsworthy there, then. But what did the report recommend as the way forward? And what could it mean for you?

Inheritance tax under the microscope

Roughly speaking, under the current system, your heirs will pay a hefty and much-begrudged 40% tax on your assets over £325,000. But it’s more complicated than that – there’s an array of tax reliefs available, and anything you give away more than seven years before you die doesn’t count. If you’d like a bit more detail on this, read our article We need to talk about death and taxes.

Discontent with the current system

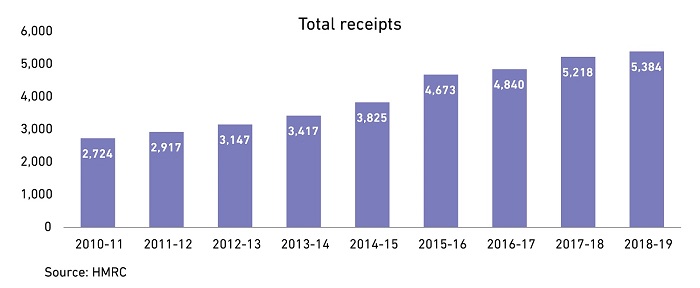

The level of resentment for the existing system has grown, as people’s assets have grown. For the past decade property prices have risen dramatically, but the inheritance tax asset threshold, where the tax kicks in, has remained frozen. For the tax year 2018/19, HMRC collected a record level of inheritance tax – £5.4 billion, with the average amount paid being £179,000.2

IHT collected by the taxman has doubled in the last decade:

It’s the sort of regime that encourages much crystal-ball gazing and general confusion. The All-Party Parliamentary Group aims to simplify the regime, dis-incentivise tax avoidance and make sure the UK remains an attractive place for wealthier individuals to live.

Sweeping changes proposed

The recommendation is pretty much to throw the whole system away and start again. The group suggests replacing it with:

- The headline inheritance tax rate could drop as low as 10% (Gasp! But keep reading…).

- Popular business and agricultural reliefs would be scrapped.

- A 10% tax charge on all lifetime gifts more than £30,000 each year would be introduced.

Capital gains tax joins the equation

It doesn’t stop there, however. The changes go beyond just sweeping away the current regime within the existing parameters, and spill over into capital gains tax territory. Instead of capital gains tax effectively dying with an individual, beneficiaries would inherit assets with their original acquisition value. So, if they later decide to sell that asset, they’ll pay capital gains tax on its value from the beginning of its life. Aside from the fact that this is obviously a tax increase, the prospect of finding the original cost of something that was bought decades earlier could prove tricky.

Look beyond the 10% rate headlines

The headlines have been grabbed by the dramatically low 10% figure. The Money Observer’s headline read: ‘MPs call for inheritance tax to be cut to 10%.’3 The Daily Mail said: ‘Inheritance tax should be cut to 10% because soaring property prices since 1980s mean more people are crossing the payment threshold, MPs say.’4

But behind the enticingly low headline rate lurk all the other changes – doing away with tax reliefs, no tax-free gifting more than seven years before you die, and tax on any gifts above £30,000 in any year.

It’s not about reducing the overall tax bill

Don’t be fooled into thinking that total inheritance tax receipts will definitely shrink if these recommendations were to go ahead. One of the core aims of the discussion is to discourage tax avoidance. The report says: ‘…larger estates could not avoid it [inheritance tax] as donors can do at present by making gifts and surviving seven years.’

Overall, the changes would likely increase the amount of tax collected in this area, which currently generates around £5 billion per year for the Treasury.

Calm down – it’s only a proposal

At this stage it’s all about recommendations, and nothing has been actually agreed. But the winds of change are obviously blowing through inheritance tax, and they could prove significant. We’ll keep you updated with any developments about whether the recommendations progress to become law. Even at this early stage of the discussion, it could be prudent to get professional advice on how these proposed changes could affect your family’s finances and existing estate planning strategies.

If you’d like a financial adviser to assess your inheritance tax situation, contact Nick Heath on 020 3823 8678.

1Source: The All-Party Parliamentary Group for Inheritance and Intergenerational Fairness

https://www.step.org/sites/default/files/Policy/Reform%20of%20inheritance%20tax%20report%20Jan%202020%20final%20ALT.pdf

2Source: The All-Party Parliamentary Group for Inheritance and Intergenerational Fairness

https://www.step.org/sites/default/files/Policy/Reform%20of%20inheritance%20tax%20report%20Jan%202020%20final%20ALT.pdf

3Source: Money Observer

https://www.moneyobserver.com/news/mps-call-inheritance-tax-to-be-cut-to-10

4Source: Daily Mail Online

https://www.dailymail.co.uk/news/article-7940751/Inheritance-tax-cut-10-cent-soaring-property-prices-MPs-say.html