Reasons to be cheerful – 2026

It can sound smart to be negative about the future; scepticism often sounds like wisdom. And so, once a year, slap bang in the middle of the “most wonderful time of the year”, lots of ‘risk-based’ forecasts drop into the inbox.

And because they’re laser-focused on the next twelve months, they miss the big picture of progress. Take solar panels, for example. Every year, they get around 8% cheaper. Not worth talking about in any given 12-months. But on a twenty-year view, solar panels now cost one-tenth of what they did in 2005.

Or take global life expectancy, which has risen by ~three months per year since the millennium. Tough to get excited about on an annual basis. But that’s an average of six years extra life, globally. Multiply that by the 8 billion people in the world. That’s a lot of extra life!

With that in mind, we want to put an optimistic spin on our 2026 outlook by picking out the changes which might be small now but could really add up in the future.

And, sorry, we won’t be forecasting where the FTSE 100 Index will finish in 2026. Not how we do things!

Broadening, not bursting

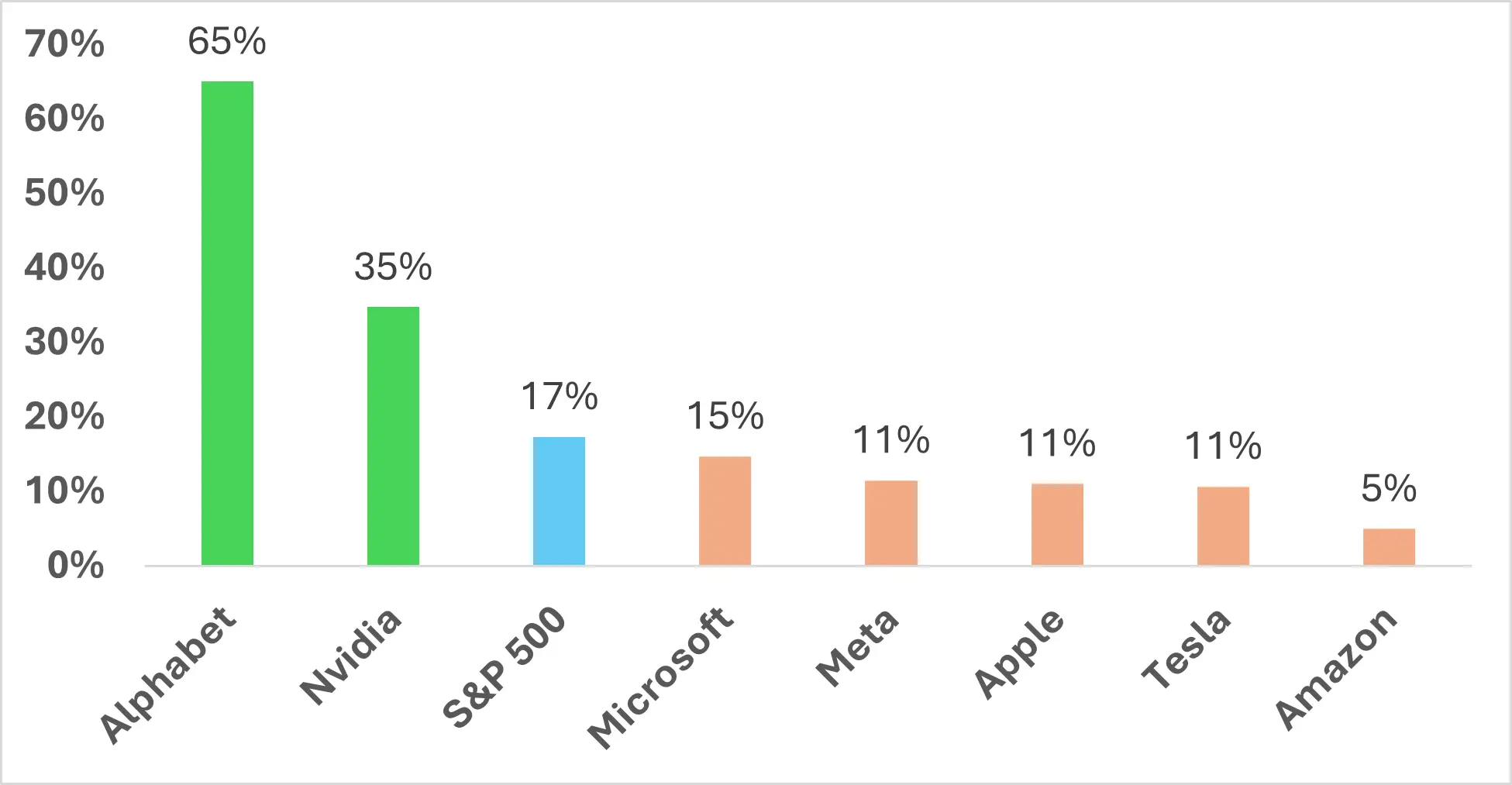

You know the Magnificent Seven, right? Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla? Are the big tech companies carrying the weight of the entire US market?

Well. That might be how you remember them. But in 2025, only two of the seven have beaten the wider US market (in the film, only three cowboys survived the shootout …).

Source: FactSet/7IM, data to 12/12/2025

That’s good news, though! Because it suggests that there IS a world in which the US stock market can keep moving upwards – powered by banks, and utilities, and miners, as well as smaller tech companies – rather than being on the edge of some sort of downturn.

After all, a much nicer way for valuations to normalise is for everything else to do better, rather than the existing leaders suddenly failing.

If you seek peace, prepare for … peace

Donald Trump will be entering the “lame duck” period of his Presidency by the end of 2026. And if the mid-term elections leach away some of his domestic policymaking ability, there’ll only be one thing he can realistically focus on.

Winning the Nobel Peace Prize.

It sounds like a flippant thing to say – but the world has made a habit of underestimating how much of American policy is dictated by the President’s ego (not just with Trump, by the way!).

A further de-escalation of conflicts everywhere? Regardless of the reason, surely that’s something to hope for?!

Japan’s rise of the robots

Imagine if Japan finally puts the last four decades behind it. It’s not necessarily a pipedream. Public approval of the government is above 70%, so there’s enough runway to really change things for Sanae Takaichi (the first female leader). Foreign investors are already getting interested again, with a record $55.6 billion in inflows so far in 2025, so there’s money flying around.

And perhaps most interestingly, there’s the ability for Japanese industrial know-how to solve a problem which is going to be cropping up all over the world in the next few decades. Specifically, how to use technology to tackle the issues created by a shrinking workforce and a growing number of ageing retirees.

Japanese society is slightly odd, in that while adoption of digital automation is low (payments and online government), adoption and acceptance of physical automation is extremely high. A perfect testing ground for how far robotics can help across the range of human society. And, conveniently, many of the top-quality robotics firms in the world are based in … Japan.

Modern Chinese Medicine

Chinese medicine gets a bad rap. Understandably so if you’re a rhino or a tiger – or indeed, someone with some medical training.

But that’s ancient Chinese medicine. The modern stuff is worth taking seriously.

Our favourite example of a breakthrough this year is from Zhejiang University. “Bone-02” is a revolutionary bone glue. The problem with gluing bones together is that it all takes place inside the body; it’s tough to get the glue to dry. But by studying how oysters stick to rocks (a very wet environment!), they worked out a way to produce a compound which takes just three minutes to set, requires no surgery, and is completely absorbed by the body after six months.

China had more biotechnology IPO’s than the US in 2025, and Chinese medical universities publish roughly the same number of articles/clinical trial results per year as their American counterparts. More medical miracles in 2026? Absolutely!

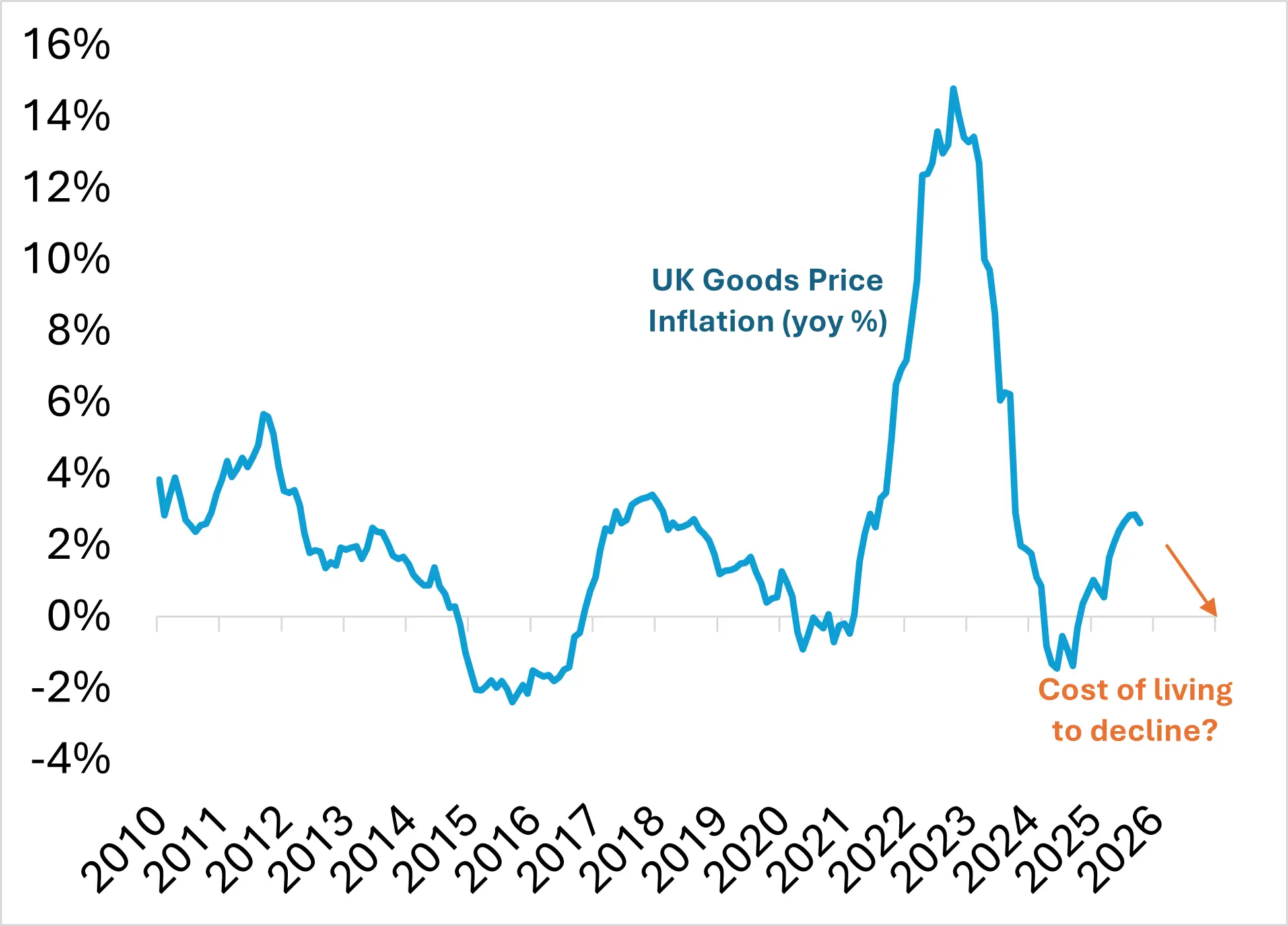

Prices feeling lower

Inflation is all about emotion. We don’t tend to spend our days recording price increases to track the cost of living. Instead, we feel it when something’s expensive. Everyone has their own internal sense of what something should cost, and when it turns out to be more expensive, we’re annoyed.

And we feel it most with things we buy regularly. Petrol. A sandwich. A coffee. Then we extrapolate it into “everything’s getting more expensive.”

In recent years, there’s been a lot of high-price feeling. But 2026 could be different. Lots of consumption commodity prices have fallen sharply this year. Sugar prices have fallen by 20%. Cocoa beans and olive oil are about half the price they were a year ago, and orange juice is down 70%. All things which feed into regular shopping trips. With crude oil prices down 20% (and a serious supply glut), even petrol is unlikely to jump up.

Economists might not like low inflation, but for beaten-up consumers, it would be a welcome change!

Source: ONS/7IM

Unexpected UK boom

Maybe the tallest order of the lot. But, we can dream!

We can probably all agree on one thing – an economic boom in the UK doesn’t feel likely right now. Business and consumer confidence indicators are firmly stuck on “bleak”. But (and stick with us here) the route to growth is plausible, particularly if the rest of the world is in good shape. Some may argue it might need a change of chancellor, but we’ll leave that to other pundits.

Build. Build big. And build everywhere. Make it visible! Nuclear power stations, and new electric grids, and upgraded railway lines, as well as houses. Economically, construction creates lots of jobs (not just construction workers but truck drivers, and caterers, and hoteliers, and surveyors, etc). Psychologically, nothing is more tangible than a construction site as a sign of economic growth – something to point at as a symbol of good, rather than bad.

Oh. And of course. One of England or Scotland will win the FIFA World Cup 😉.

More from 7IM