Thinking differently about… US equity markets in 2022

Every six months or so, the Investment Management Team puts a presentation together called ‘Thinking Differently’. Our aim is to outline a view of the world, usually by contrast with the prevailing investment wisdom.

Sometimes, our disagreements with the consensus are minor – slightly differing views on the outlooks for certain sectors, or growth rates, or trends. Other times, we find we’re much more… different.

‘US mega-caps are a concentration risk’

November 2021 was one of those times. We were encouraging investors to challenge the mega-cap dominance in the US equity market.

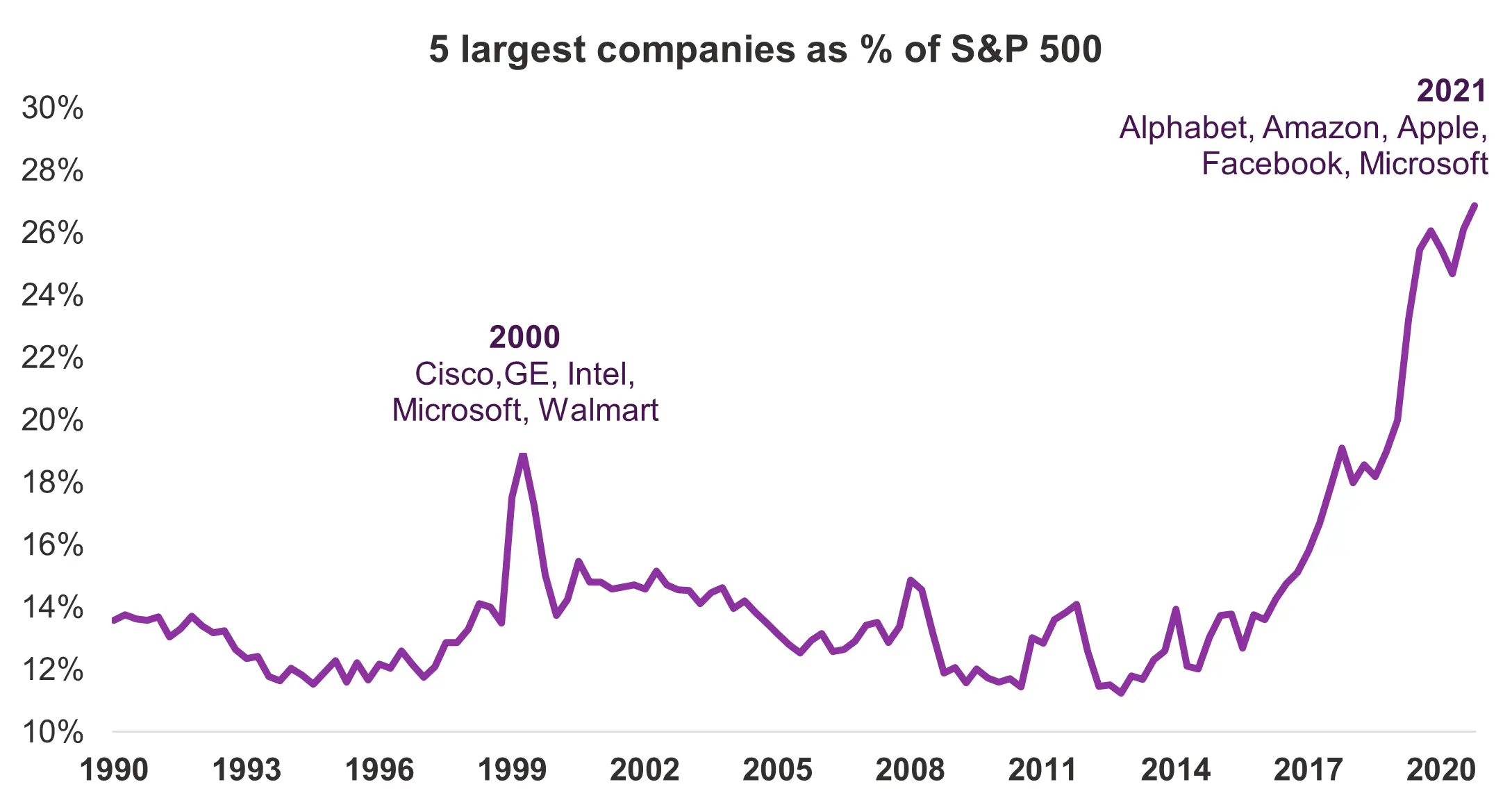

We showed the graph below. We said that such a heavy concentration in so few stocks was unlikely to end well. And that historically, the bigger a company is, the harder it is to stay at the top.

Source 7IM/Bloomberg

We met some scepticism.

In November 2021, Amazon, Apple, Google, Microsoft and Facebook seemed untouchable. The five companies had delivered staggering returns since the start of 2020: an equally weighted basket of those five stocks would have delivered 97%, compared to the US equity index, which gained 47%1 (still impressive given the pandemic!).

People could not look past the strong recent performance and couldn’t resist extrapolating it into the future. We heard all sorts of justifications for why the trend was likely to continue. These companies weren’t like the dotcom bubble businesses – they had real revenues and made real profits. The rise of passive investing would keep prices high. The intangible parts of the businesses were still undervalued. These companies and their products were so entrenched in our lives that they seemed to be unaffected by economic cycles.

Lots of sensible-sounding reasons, given by intelligent people, often with skin in the game. But we disagreed.

Thinking differently…

We weren’t convinced by the arguments in favour of further US mega-cap outperformance. Our investment identity – the way we think about the world – means we tend to dislike concentration, whether in our portfolios, or in the wider market.

We also don’t have much time for ‘fashionable’ investments. So, when single-idea fund managers like Cathie Wood are seeing huge inflows and are being hailed as all-seeing superstars, we’ll be nervous of what they’re holding.

Because while billions of dollars of profits are great, they’re less impressive if the company is already valued at a couple of trillion dollars. For example, Amazon made $33 billion of profit in 2021. Between them, HSBC and Shell made about the same profit; $33 billion. But Amazon is worth $1.5 trillion, more than five times as much as Shell and HSBC, with a combined value of ~$300 billion.

And most of the arguments in favour of the mega-caps were likely to become far less convincing in the higher growth and higher interest rate environment we saw coming. Passive investors wouldn’t stay passive. The economic cycle would still matter.

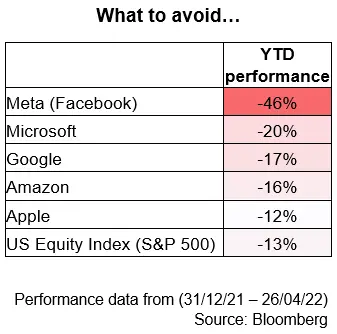

Nearly four months into 2022, and the situation has changed drastically. For many of the reasons we believed in, investors have begun to abandon the large tech companies – and that’s dragged the US index down, too.

…and positioning accordingly

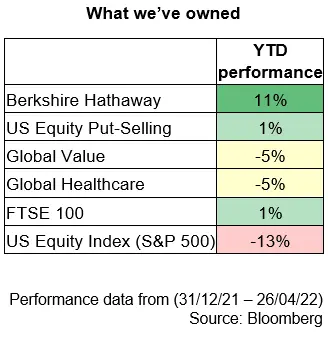

Having an investment idea is one thing. Reflecting it in portfolios can be another matter. We’ve had a few ways in which we’ve reduced our exposure to the US equity market and its collection of mega-cap companies.

First, we have our Strategic Asset Allocation, which is already properly diversified. For example, the US makes up less than a third of the equity allocations in our strategic neutral portfolios, compared to around 70% in most global equity indices. As areas such as the globally diversified UK market have done well, we have benefitted.

On top of that excellent starting point, we’ve overlaid our tactical views. Since before the start of 2022, our pure US index exposure has been closer to 10% of our total equity allocation.

We’ve put the money in a number of different places, e.g., the cheaper areas of the US equity market such as Berkshire Hathaway, global healthcare or value companies, and in some systematic investment strategies, like US equity-put selling. We’ve been very pleased with the results.

What’s next?

We don’t think that this anti-concentration trend is finished. Those five companies are still around 27% of the US equity index! The stock values of Amazon, Apple, Google and Microsoft could halve, and they’d still be in the top five US companies. Facebook has essentially fallen by half already this year; and yet remains the seventh biggest company in the index. The pain is not over.

1Performance data from 31/12/21 to 29/10/21. US Equity index is S&P 500. All returns are total return. Source: Bloomberg

Find out more