Monthly commentary

Portfolio Performance

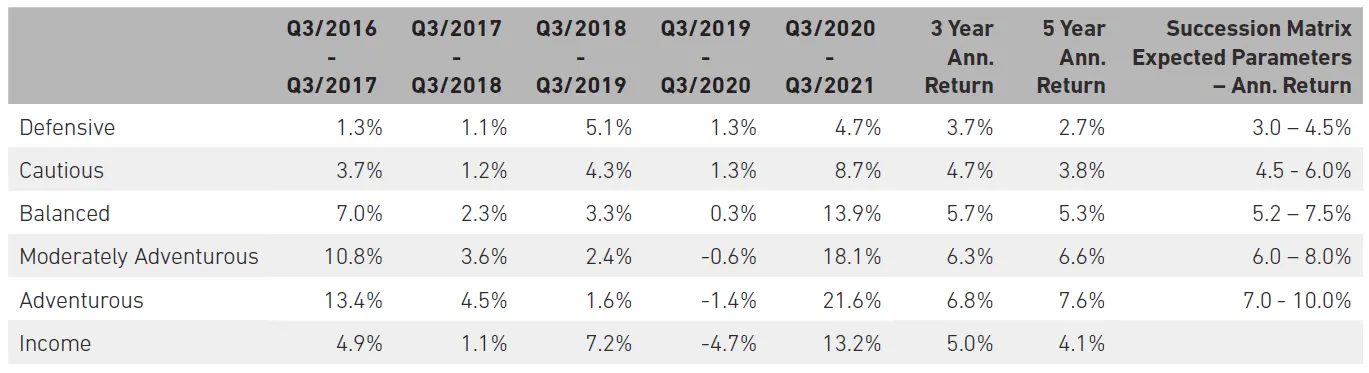

At 7IM, we believe that taking a long-term view is essential when investing. We can’t always avoid the short-term bumps and shocks that the financial world has in store, but a well-diversified portfolio goes a long way towards smoothing out some of the journey. The long-term nature of our strategic and tactical process is a good complement to the Succession Matrix Expected Parameters.

Source: 7IM/FE. Annualised return is defined as ‘Ann. Return’ in the performance table above and is as at end August 2021.

The extreme COVID-19 related drawdown at the start of 2020 means performance should continue be viewed with caution. Most portfolios are within their ranges for the five year returns.

Market and portfolio review

August has been a quiet, but good, month for markets, and 2021 continues to be a bumper year. Although the delta variant put some question marks over our social lives, markets aren’t really worried about it. As we’ve said before, all-time highs shouldn’t usually be a cause for celebration as markets should go up. However, this year, the S&P has already hit 53 all-time highs. That’s more than any year since 1964. And it’s not just the US that has been doing well, the MSCI World index is up 16.2% this year. Almost everywhere (with the exception of China), things have been positive.

As explained in our “core views”, we think that strong growth will continue, which is what ultimately drives returns. The Covid recession hit the reset button. People and governments are willing to spend and confidence should continue to grow. However, in August, there has been some noise around “tapering”, and this noise will get louder before it gets quieter. So, (1) what is “tapering”, (2) should we be worried about it, and (3) what can we do to prepare ourselves for it?

1. What is “tapering”?

After Covid hit, central banks started buying securities through asset purchasing schemes at a faster rate than ever before. This isn’t a normal state of affairs and can’t go on forever, so with markets looking in good shape, there will be pressure on central banks to slow down – to taper – their asset purchasing programmes.

2. Should we be worried?

In short, not really. The last time tapering made headlines was in the 2013 Taper Tantrum. The Federal Reserve announced the slowing down of their asset purchasing programme, and markets were surprised, so certain assets sold-off quite aggressively. But part of the reason for that sell-off was the shock-factor. This time people are talking about tapering already, and the Fed are being clearer with their messaging than they were before. When the taper does come, it should be less of a surprise than it was in 2013, and hence markets shouldn’t react as badly.

3. What can we do to prepare ourselves for it?

Diversify, diversify, diversify. There’s still a lot of uncertainty surrounding a taper. We don’t know exactly when the taper will come, how severe it will be, or even which asset classes will be most impacted. By having a well-diversified portfolio, you are prepared for every eventuality and you don’t have to second guess exactly what central banks will do next. Our portfolios are highly diversified, so as a house, we don’t need to second guess.

Portfolio positioning and changes

During August, the Succession model portfolios were rebalanced, and the following changes were made:

Asset Allocation Changes

Asset allocation changes this quarter have been from our annual SAA refresh as well as some tactical changes. Overall, the result of this has been:

- A tactical decrease in risk, taking profits on our large equity overweight, and reducing to a more modest (but still overweight) position.

- An increase in our alternatives allocation across risk profiles

- A continued focus on high conviction credit positioning

- Adding an investment which looks to invest in companies which are involved in solving the problems of climate change.

Aside from these changes, we also formally integrated ESG data into our SAA process with the goal of reducing overall SAA emissions by 30% over a 5-year period. As a result, we have introduced some ESG mandate products in place of broader equity exposure.

New Managers

NinetyOne Global Environment. This fund is our way of implementing our Investing in a Cleaner Future theme into our active and blended models and has replaced wider global equity exposure. The fund invests in companies that are well placed to benefit from the shift towards a greener world.

PIMCO Asia High Yield. We have added this fund to our active models reflecting our ongoing conviction in the Asia high yield space. We believe that the fund benefits from a very well-resourced centralised team that manages the headline risks of the funds well.

BNYM Efficient Global High Yield Beta. This is a fund that are using in our models in order to gain exposure to a corporate global high yield index at a low cost. The fund has a small budget it can use to deviate from the benchmark that it tracks. These “micro-allocations” are driven by a quantitative model and aim to offset fees and dealing costs.

Core views

A new wave of economic growth… For the past decade or so, the virtuous circle of consumption and investment has just not been able to get going. The scars of the financial crisis were too deep – people bought less stuff while governments reined in spending. As a result, companies kept putting off investing in longer-term projects.

The 2020 recession hit the reset button. People are willing to spend again, while governments have ditched austerity. And so, companies are starting to invest for the future. We are now at the start of a sustained period of growth, fueled by confidence and expansion across all sectors of the global economy.

And a little inflation won’t hurt… Economists tend to dislike thinking about the psychology of inflation, but in a lot of ways, someone’s inflation expectations are a good proxy for their confidence levels. With the right amount of price and wage growth, people are encouraged to make life decisions which are positive for the economy. We haven’t heard the word “Goldilocks” for some years now, but there really is an amount of inflation which is just right to keep things humming.

7IM portfolios are positioned for a changing environment… For this coming growth phase, we believe a more selective exposure will be better than a large overweight to the broad equity market. A more robust consumer-driven cycle will see different winners emerge. Regions and industries which have struggled to attract investors over the past decade are better positioned to capitalise than the huge US tech giants (although there are lots of small US companies which will do well).

We’ve also made sure that our fixed income positioning isn’t unnecessarily exposed to rate rises, using allocations to alternatives and to non-mainstream asset classes.

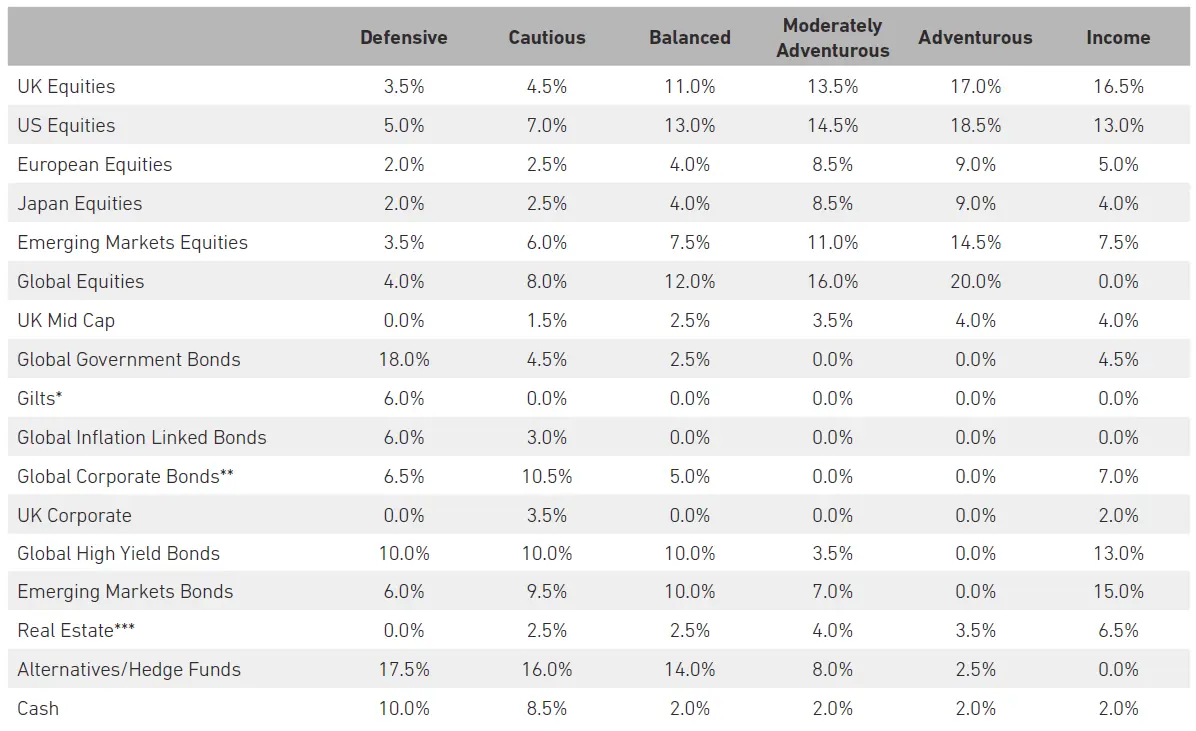

Detailed asset allocation

Source: 7IM. *Includes Short Term Sterling Bonds **Includes Convertible Bonds ***Includes Infrastructure

Read more from 7IM

7IM and Succession have come together to give your clients access to a range of risk-rated, low-cost model portfolios to help them achieve their goals.