Monthly commentary

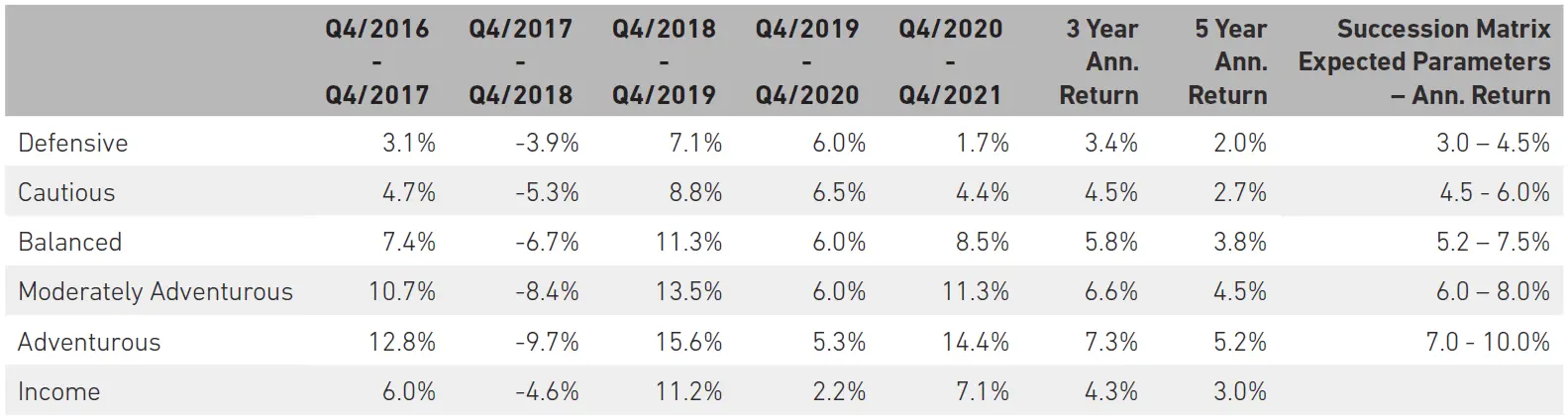

Portfolio Performance

At 7IM, we believe that taking a long-term view is essential when investing. We can’t always avoid the short-term bumps and shocks that the financial world has in store, but a well-diversified portfolio goes a long way towards smoothing out some of the journey. The long-term nature of our strategic and tactical process is a good complement to the Succession Matrix Expected Parameters.

Source: 7IM/FE. Annualised return is defined as ‘Ann. Return’ in the performance table above and is as at end February 2022. The extreme COVID-19 related drawdown at the start of 2020 means performance should continue be viewed with caution. Portfolios are towards the lower end of their ranges for the five-year returns, with the more defensive end struggling a little in the face of low interest rates.

Market and portfolio review

On Thursday 24 February, Russia launched a large-scale invasion of Ukraine. The situation has rapidly deteriorated. While the Western response has been quick and surprisingly strong, it is unlikely to bring about a swift military conclusion.

According to Vladimir Putin, “Ukraine has never had its own authentic statehood” and that it is part of Russia’s “history, culture, and spiritual space”. He claims that the invasion is an effort to “demilitarize and de-Nazify” Ukraine.

If the 1991 referendum is anything to go by, the majority of Ukrainians disagree with this - 84% of eligible voters went to the polls and 90% voted in favour of independence. A lot has happened since then, but it is clear that Putin wants to stop Ukraine from moving closer to the West and NATO, remove its statehood, and claim full control of it, as is the case with Belarus.

To know what happens next, one would need to get inside Putin’s head. That’s not easy, but Linda Thomas-Greenfield, the US ambassador to the UN, summarises his ultimate motivation well: “In essence, Putin wants the world to travel back in time, to a time before the United Nations, to a time when empires ruled the world. But the rest of the world has moved forward. It is not 1919, it is 2022.”

Despite representing 11% of the world’s landmass, Russia is not an economic superpower by any measure. Prior to the conflict, it was only producing 3% of global GDP and its share of global exports was only 2.5%. As Jason Furman, Obama’s economic advisor, put it: “Russia is incredibly unimportant in the global economy except for oil and gas. It’s basically a big gas station.”

Russia is a big gas station, but it’s not the only gas station. It accounts for around 12% of global oil production – enough to impact oil prices and possibly inflation figures (something we have a keen eye on), but not enough to derail the global economy.

So, will this change the outlook for global businesses? Probably not. Pharma companies will keep selling medicine, car companies will keep making cars and banks will keep lending money. Markets tend to remember this pretty quickly. Following some notable examples of geopolitical events, since the war, US equities tend to shrug off initial concerns and focus on what’s important.

Globally diversified portfolios such as ours had a small exposure to Russia and Ukraine even before the conflict began.

Since then, many of our managers and index providers have been taking action to reduce their weights to Russia and Ukraine even further. So, the direct impact on our portfolios is minimal.

If history tells us anything, it’s that the right strategy is to stay invested. Conflicts such as this tend not to have a lasting impact on markets, and you run the risk of missing out on returns by disinvesting. Having said that, we continue to monitor the conflict’s impact on inflation expectations, the monetary policy path, the growth cycle, as well as the impact of sanctions on investment flows.

Portfolio positioning and changes

During February, we rebalanced the Succession model portfolios and made the following changes:

- Sold out of our Asia high yield position and shifted the allocation into emerging market equity. Both Asia high yield and emerging market equity had a tough 2021, but we view the potential for a strong bounce-back greater in the equity space.

- Added a healthcare innovations position to moderately adventurous and adventurous risk profiles using the Baillie Gifford healthcare innovation fund. We see this as a higher risk, higher reward subsector of healthcare that is structurally in a good place and makes a good addition to our healthcare position in higher risk portfolios.

- Introduced the ASI Global Inflation-Linked Bond tracker to portfolios. This is a cheaper way to allocate to inflation-linked bonds than other passive options available in the market.

- Introduced the Invesco MSCI USA ESG Universal Screened UCITs ETF to portfolios. This vehicle helps to move portfolios closer to our decarbonisation targets by screening out the more egregious polluters from the US equity market. It is provided on a GBP hedged basis which also helps manage currency exposure for portfolios.

Core views

Growth will be stronger than the last decade:

Strong consumers, confident businesses and supportive governments mean one thing; stronger growth. The mushy, slow, volatile growth of the last decade will vanish, to be replaced with a more confident and self-sustaining growth cycle.

Inflation will be higher than the last decade:

The stronger demand does mean higher inflation too. To be sure this does not mean worryingly high, but higher, nonetheless. This will have huge implications for interest rates and savers need to be ready.

7IM portfolios are positioned for the new cycle. We are:

- Positioned away from mega-cap US internet stocks and towards cyclical companies in developed markets, and high emerging market equity allocations.

- Underweight government bonds in a rising rate environment; seeking higher returns in specialist fixed income.

- Overweight alternatives to offer defensive qualities

- Longer-term investments in climate change and healthcare.

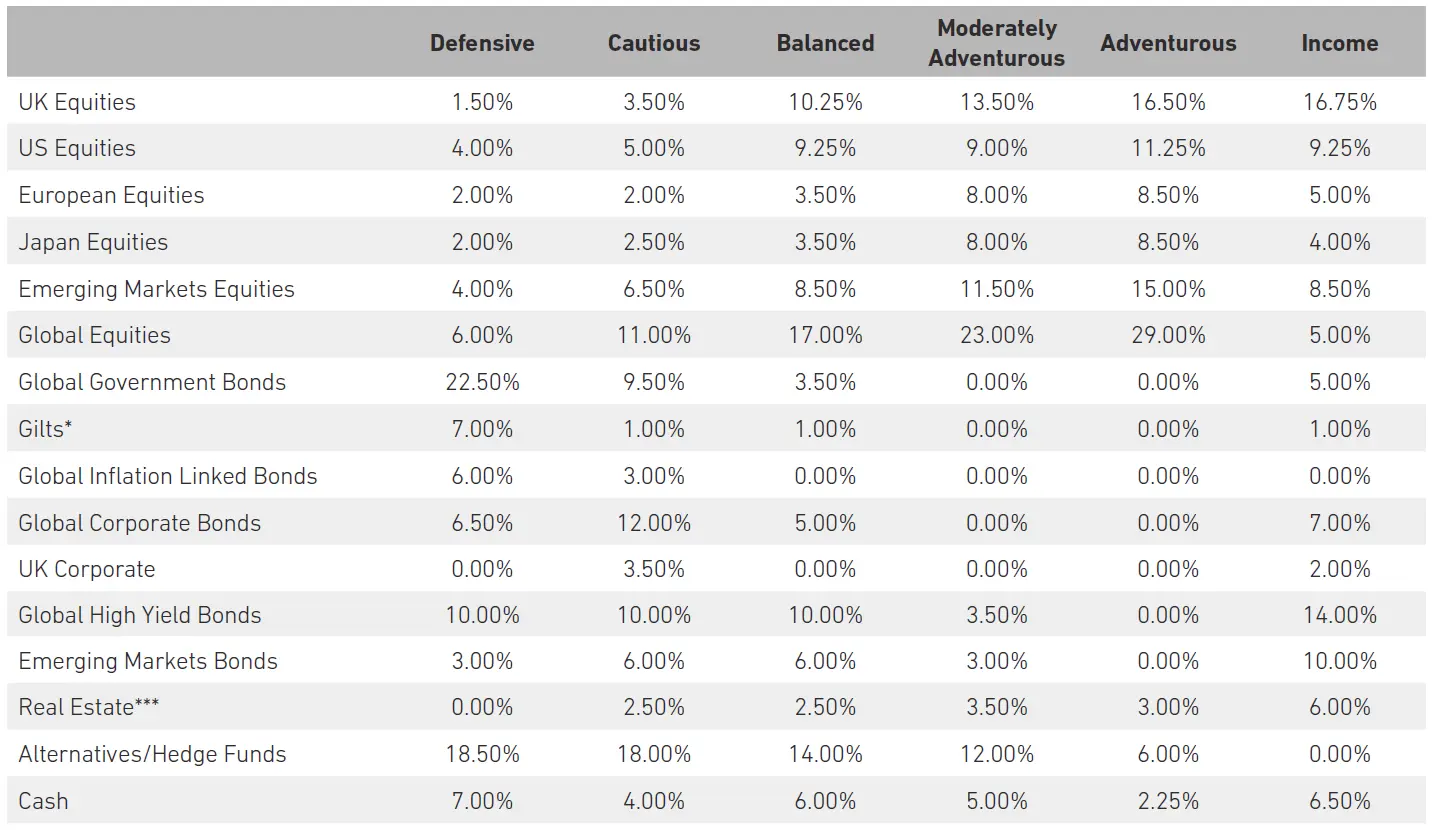

Detailed asset allocation

Source: 7IM. *Includes Short Term Sterling Bonds **Includes Convertible Bonds ***Includes Infrastructure

Read more from 7IM

You can download the commentary as a PDF here.