Monthly commentary

Portfolio Performance

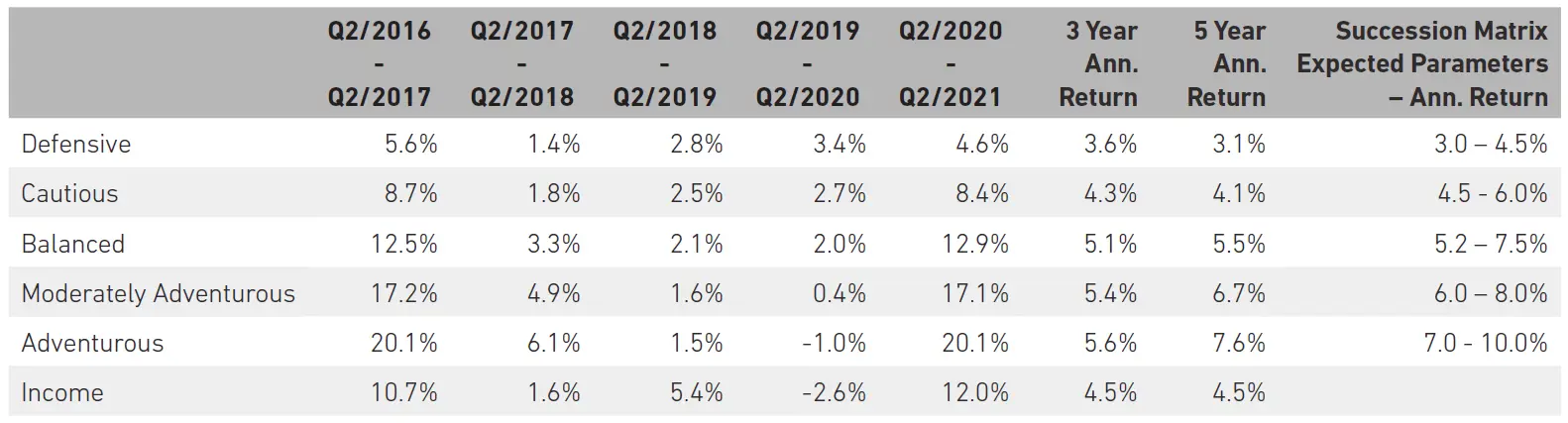

At 7IM, we believe that taking a long-term view is essential when investing. We can’t always avoid the short-term bumps and shocks that the financial world has in store, but a well-diversified portfolio goes a long way towards smoothing out some of the journey. The long-term nature of our strategic and tactical process is a good complement to the Succession Matrix Expected Parameters.

Source: 7IM/FE. Annualised return is defined as ‘Ann. Return’ in the performance table above and is as at end July 2021. The extreme COVID-19 related drawdown at the start of 2020 means performance should continue be viewed with caution. Most portfolios are within their ranges for the five year returns.

Market and portfolio review

July was a reminder that there are still a lot of unsettled issues which the financial world is trying to price. Fears and freedom are increasing together. Different variants of COVID-19 are still very much a problem – especially for countries with low numbers of vaccinations. At the same time, lots of countries are still trying to open up, and return to a more normal form of social life.

With earnings for the second quarter of 2021 starting to be reported, the news on the corporate side is positive; 85% of US companies have exceeded expectations – which were already set reasonably high. The story is the same in the rest of the developed world. Perhaps the most interesting thing though, has been the messaging from the mega-cap tech names. Apple beat estimates, but CEO Tim Cook warned of tougher times ahead, while Amazon’s warning over lower future sales caused a 7% drop in the share price; that’s $120 billion dollars lost, if you’re counting. Reactions like that are exactly why we prefer to avoid the expensive technology sector in our portfolios, tilting towards the more conventional businesses which are reporting great earnings numbers, and being rewarded for it.

The other financial headline was the sudden clampdown on certain industries in China. Or at least, the market acted as if this was sudden. In reality, it’s been clear for some time that the Chinese government isn’t too happy about some of the profits being made by some companies at the expense of the average Chinese citizen – Beijing very much reserves that privilege for itself. We never forget that China is still a controlled economy. But at the same time, we cannot ignore the second largest economy and largest consumer market in the world – investors can’t afford not to have it in their portfolios.

Portfolio positioning and changes

During July, no changes were made to the Succession model portfolios but they will be rebalanced in line with the quarterly process in August.

Core views

A new wave of economic growth… For the past decade or so, the virtuous circle of consumption and investment has just not been able to get going. The scars of the financial crisis were too deep – people bought less stuff while governments reined in spending. As a result, companies kept putting off investing in longer-term projects.

The 2020 recession hit the reset button. People are willing to spend again, while governments have ditched austerity. And so, companies are starting to invest for the future. We are now at the start of a sustained period of growth, fueled by confidence and expansion across all sectors of the global economy.

And a little inflation won’t hurt… Economists tend to dislike thinking about the psychology of inflation, but in a lot of ways, someone’s inflation expectations are a good proxy for their confidence levels. With the right amount of price and wage growth, people are encouraged to make life decisions which are positive for the economy. We haven’t heard the word “Goldilocks” for some years now, but there really is an amount of inflation which is just right to keep things humming.

7IM portfolios are positioned for a changing environment… For this coming growth phase, we believe a more selective exposure will be better than a large overweight to the broad equity market. A more robust consumer-driven cycle will see different winners emerge. Regions and industries which have struggled to attract investors over the past decade are better positioned to capitalise than the huge US tech giants (although there are lots of small US companies which will do well).

We’ve also made sure that our fixed income positioning isn’t unnecessarily exposed to rate rises, using allocations to alternatives and to non-mainstream asset classes.

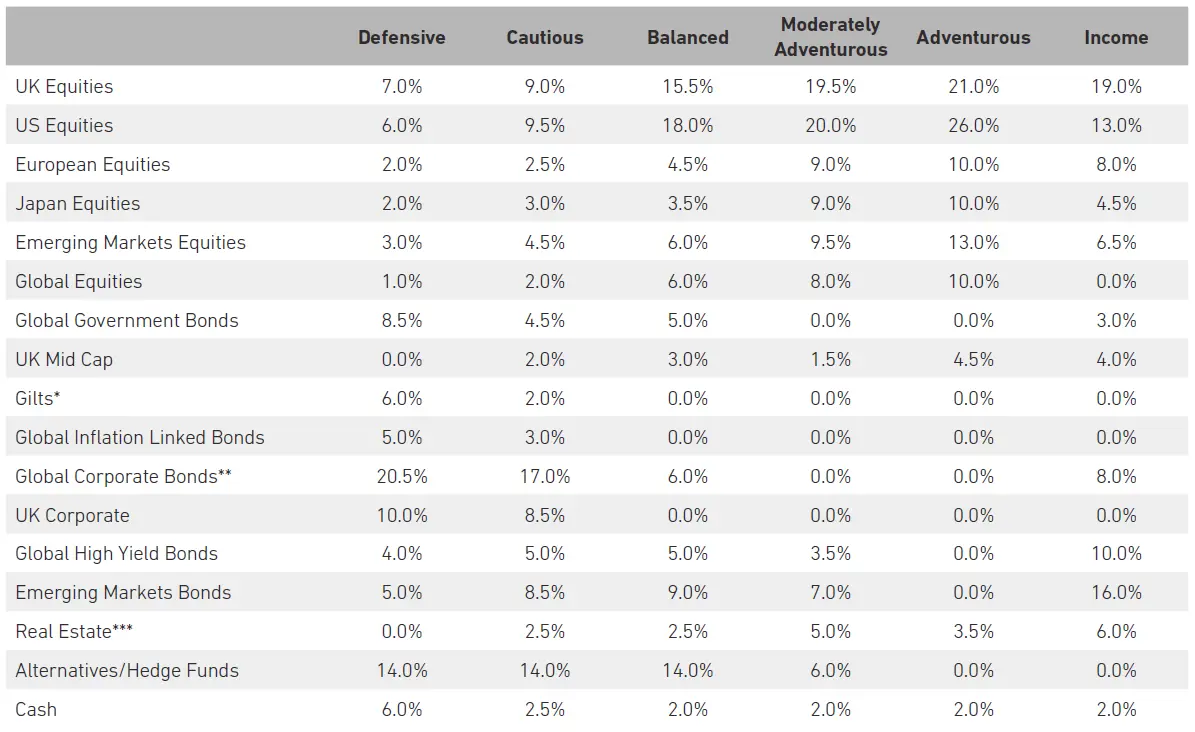

Detailed asset allocation

Source: 7IM. *Includes Short Term Sterling Bonds **Includes Convertible Bonds ***Includes Infrastructure

Read more from 7IM

7IM and Succession have come together to give your clients access to a range of risk-rated, low-cost model portfolios to help them achieve their goals.