Monthly commentary

Portfolio Performance

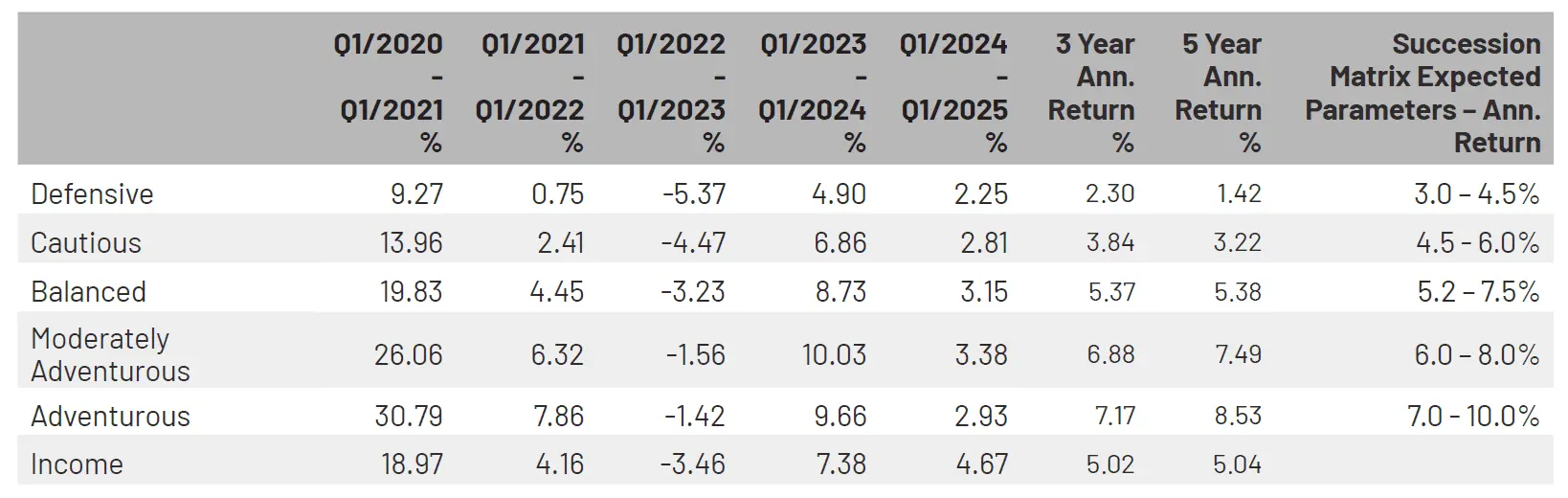

At 7IM, we believe that taking a long-term view is essential when investing. We can’t always avoid the short-term bumps and shocks that the financial world has in store, but a well-diversified portfolio goes a long way towards smoothing out some of the journey. The long-term nature of our strategic and tactical process is a good complement to the Succession Matrix Expected Parameters.

Source: 7IM/FE. Annualised return is defined as ‘Ann. Return’ in the performance table above and is as at end JULY 2025. Market returns have been poor in absolute terms since the beginning of 2020 with the Covid pandemic and then the inflationary shock of 2022. While portfolios have held up well relative to peers, the 3 and 5 year absolute returns are lower than average, even though the since inception longer term numbers are in line with expected parameters.

JULY 2025

Monthly Musings: Digital gold vs US bonds

In 2017 – the crypto breakout year – people were constantly writing books explaining how world-changing blockchain technology was. My view (after a couple of intense days’ reading) was that while new ways of managing and storing data were smart and interesting, it seemed like a pretty niche area, unlikely to capture public interest.

I reckon I was right.

Because, although I have almost daily conversations about bitcoin and crypto, no-one is talking about the technology which lies behind it.

Which is interesting, because it suggests that bitcoin* may have made the leap to becoming a similar asset to gold…

A stock has value because you get a slice of the business. A bond has value because you get a contractual payment. An asset like oil, steel, or wheat tends to be priced according to commercial demand. But gold doesn’t have any of those reasons. You don’t get a slice of anything. You don’t get any payments. And only about 10% of gold produced is used commercially.

Gold’s value comes from cultural psychology. Over thousands of years, we’ve all come to believe that gold is valuable. And sometimes, that’s enough. After all, human belief is pretty powerful; it’s how we end up with things like democracy, and space travel, and Father Christmas.

We appear to be approaching that tipping point with bitcoin. Bear in mind, you don’t need the whole world to agree, just enough of the world.

It’s particularly interesting (and probably related) that global belief is also, very slightly, tipping the other way on the safest of safe haven assets – US government bonds. Now, we do not believe that the US government is going to stop paying its debts. No chance. The economic rationale is as sound as ever.

But the psychology is shifting at the margin. Aswath Damodaran, a US professor, produces a semi-annual estimate of how much an investor needs to be paid to buy an average stock in each country (the equity risk premium)**. For the first time in thirty years of doing so, he included an adjustment for US bonds to reflect them no longer being the risk-free asset…

It’s worth noting that by his estimate, US bonds are still the lowest risk asset. But just not “risk-free”.

From a psychological perspective, we know that introducing extra choices can change our view of the existing options, and I wonder if that’s partly what’s starting to happen here… “US Treasuries or gold” ever so slightly becoming “US Treasuries or gold or bitcoin”.

Note on Bitcoin: Just being an asset doesn’t get you a place in portfolios. We don’t own gold. We don’t directly own oil, or direct property, or fine wine. So don’t be expecting to see a Bitcoin line anytime soon.

*Maybe a few other crypto-currencies, but let’s stick with bitcoin.

** https://aswathdamodaran.blogspot.com/2025/07/country-risk-2025-story-behind-numbers.html

Chart of the month

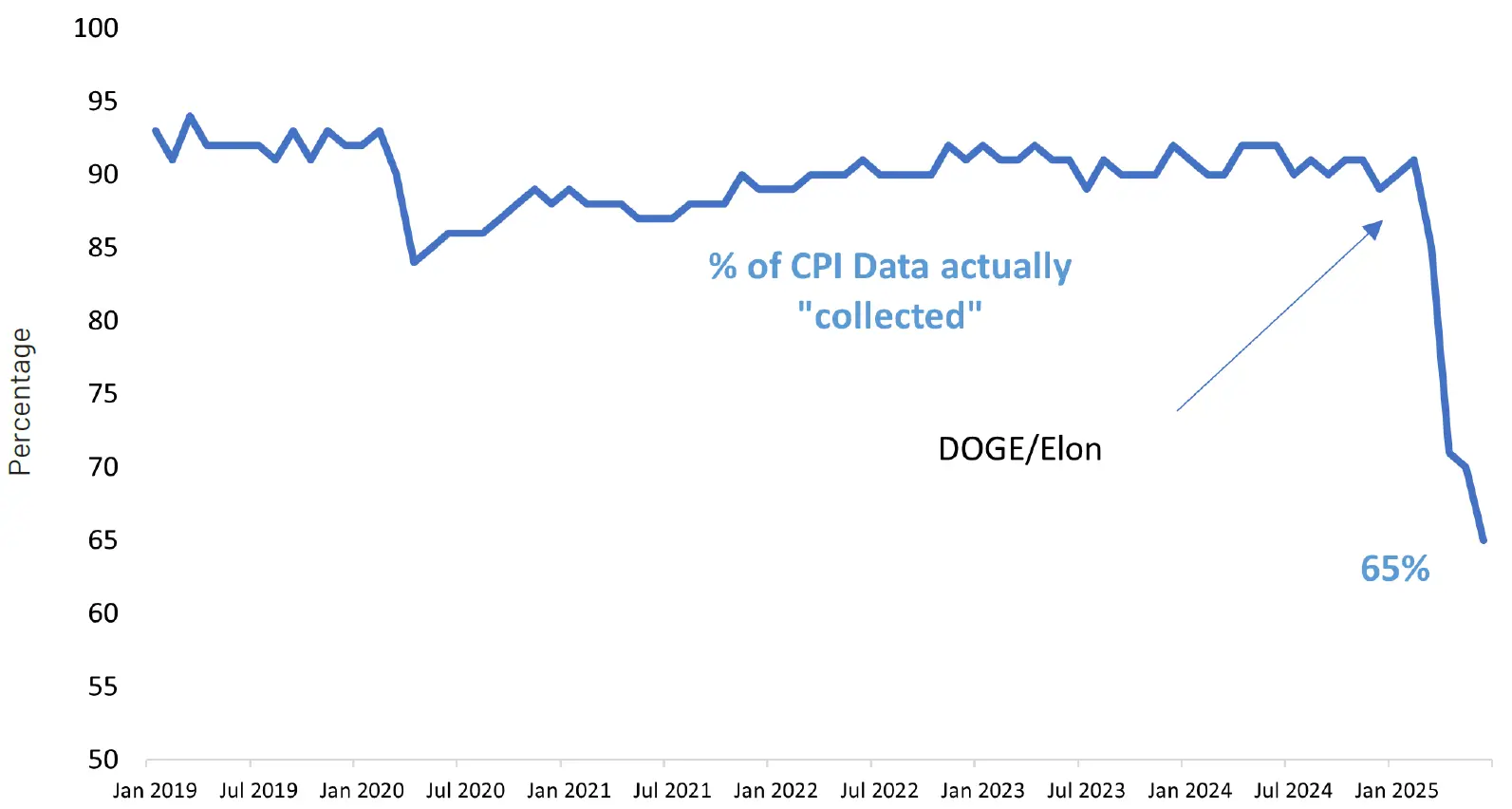

It’s tough enough trying to manage an economy. Doing it with one hand tied behind your back is even harder. And yet the Federal Reserve is, to some extent, having to do just that.

The Fed’s big worry is inflation. And their metric for this is the Consumer Prices Index, a big list of all the things that people have to buy regularly – chicken, milk, t-shirts, broadband etc. Measure the average price of these things, and you get a picture of inflation.

Source: BSL

But. CPI figures are calculated by US government employees quite literally going to their local supermarket and manually writing down the price of things.

And, thanks to Elon Musk’s (short-lived) efficiency drive, the recent government job cuts have meant some of the data is missing. There aren’t enough people to go to their local shops and record the new price of eggs…

As a result, the amount of real data being collected has gone from around 90% to less than two-thirds. The other information has to be “imputed” (guessed at). Not ideal if you’re trying to set the interest rate policy for the largest economy in the world.

July Markets Wrap

In July, we started to get some clarity about the future trade relationships between the rest of the world and the US, as countries scrambled to reach an agreement with the US government ahead of an 1 August deadline. And, in spite of most predictions, the US has reached agreements with many of its significant trading partners. The new tariff levels, while significantly higher than the past few decades, are much lower than suggested by President Trump in the Rose Garden on 2 April – perhaps around 9% on US imports.

The deals with Japan and Europe seem to give Trump the credibility to present himself as a master negotiator, based on the simple argument that ‘they pay more than we do’. China is probably the outlier, having quickly established that the US badly needs rare earth minerals. Indeed, the two countries are now embroiled in trade talks, with Trump sidelining Taiwan in order to ensure they go well.

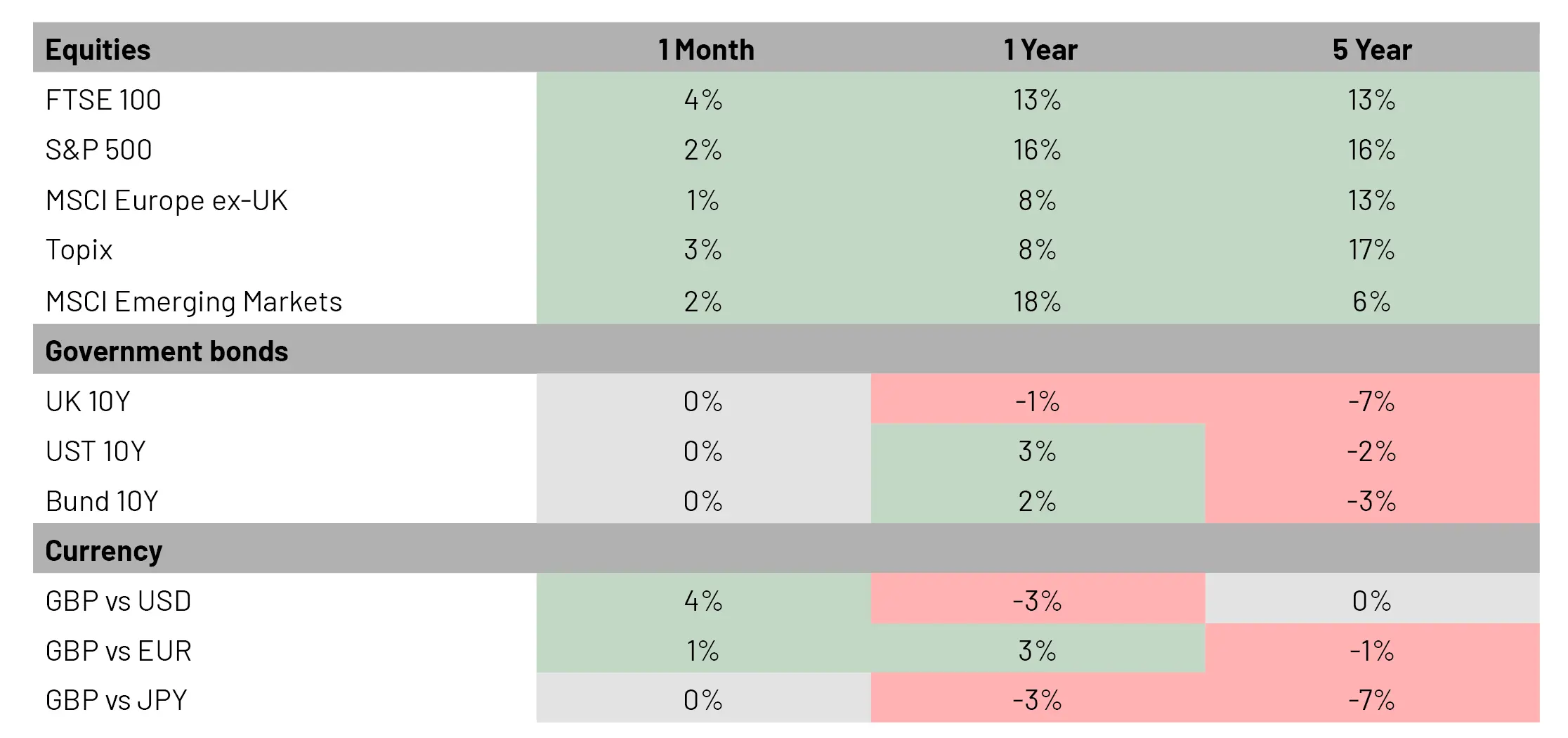

Global financial markets seem fairly sanguine about the tariff impacts – viewing the glass as half full, rather than half empty. So, we saw decent returns almost everywhere; with the FTSE 100 as a stand-out performer, rising 4%. Partly this is recognition that the UK has gotten off relatively lightly on tariffs; but a softer pound and strong earnings for Q2 no doubt helped too.

Bond markets were fairly quiet, but as longer-term yields continued to rise, shorter dated bonds and high yield corporates performed best.

Regardless of the motivational forces driving markets, the net result was another positive month for portfolios and returns since the start of the year, which certainly doesn’t reflect the stress of living through it!

Market Moves

Source: Bloomberg Finance L.P. Data as of 31 July 2025. Past performance is not a guide to future returns.

What we’re watching in August:

- 4th – Berkshire Hathaway results; always worth hearing Warren

- 5th – BP earnings results; can they fend off merger speculation

- 6th – Disney/McDonald’s/Costco earnings; key consumer indicators

- 7th – Bank of England Rate decision; expecting to see a cut, but could go either way

- 27th – Nvidia earnings. The big one.

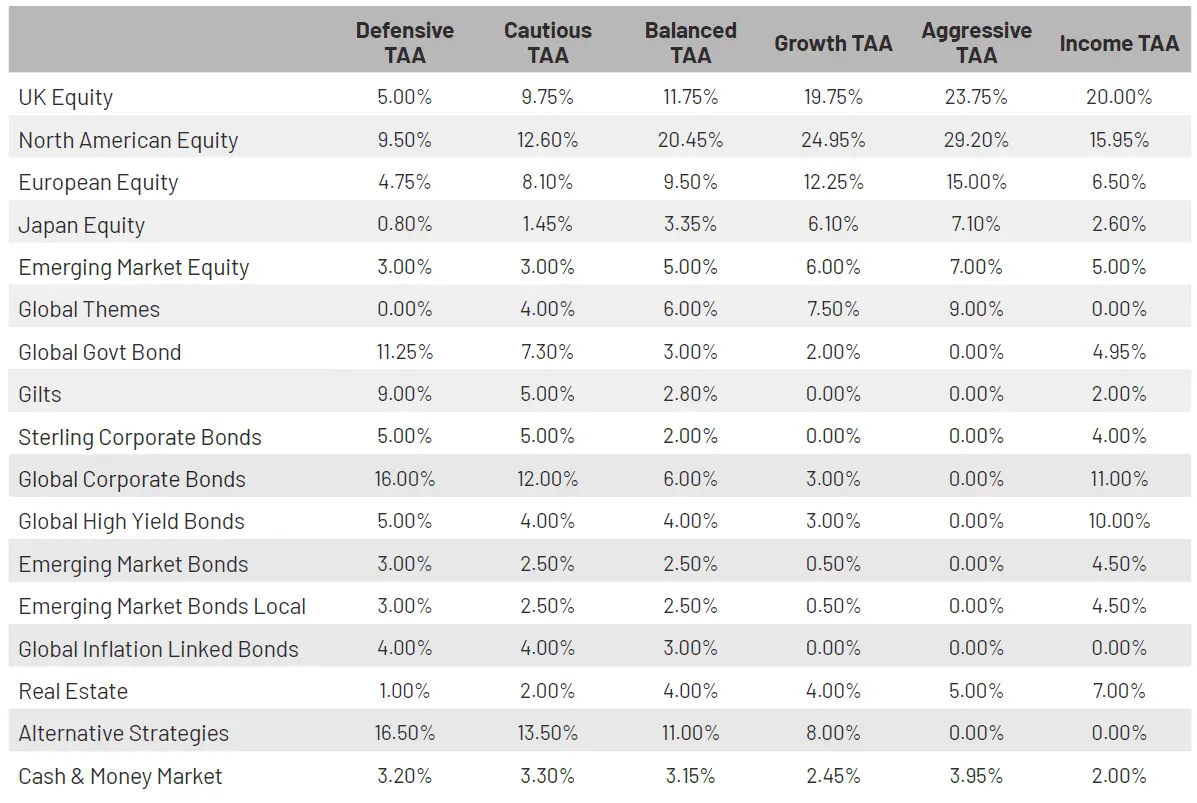

Asset allocation changes

No changes this month.

Manager changes

No changes this month.

Asset Allocation

Detailed asset allocation

More from 7IM