Monthly commentary

Portfolio Performance

At 7IM, we believe that taking a long-term view is essential when investing. We can’t always avoid the short-term bumps and shocks that the financial world has in store, but a well-diversified portfolio goes a long way towards smoothing out some of the journey. The long-term nature of our strategic and tactical process is a good complement to the Succession Matrix Expected Parameters.

Source: 7IM/FE. Annualised return is defined as ‘Ann. Return’ in the performance table above and is as at end June 2025. Market returns have been poor in absolute terms since the beginning of 2020 with the Covid pandemic and then the inflationary shock of 2022. While portfolios have held up well relative to peers, the 3 and 5 year absolute returns are lower than average, even though the since inception longer term numbers are in line with expected parameters.

JUNE 2025

Monthly Musings: Tranquillity and fragility

If you had perfect foresight on the events of June 2025 – “Israel will launch a surprise attack on Iran, Iran will respond, and the US will engage in a tactical strike on Iran’s nuclear facilities” – and then you’d been given the chance to do something in your portfolio… there’s almost zero chance you’d have chosen to buy the global stock market. You might well have sold some stocks, and bought bonds or gold; maaaaaybe you’d have bought some oil stocks?

Yet at the end of June, US equities are hitting new all-time highs, the Israeli stock market is up double digits, bonds are flat, and gold and energy companies have lost money. Commentators might point to the deescalation in the final week of the month, but it’s not just the end point which is key. It’s the fact that during the geopolitical panic, without a clear end in sight, markets didn’t respond. Investors saw the terrifying headlines, the videos of missiles in the night sky, and then simply went out and kept investing in stocks.

I think there are three behavioural reasons for this sangfroid, this supreme calm. The first (optimistically) is that the drumbeat of messaging from the financial industry (us!) over the last decade – hold your nerve, don’t panic, ignore the noise – has started to permeate into the general consciousness. Panic spreads socially. Fewer panicking people means less spread.

The second is that there are a lot of investors out there who are passive. Not in the contentious sense of tracking an index, but in the sense that they are automatic investors. It’s the same sort of psychology which makes running a gym profitable – lots of members pay their monthly subscription and then don’t attend… but nor do they cancel their membership! A decent chunk of the US and UK population put money into their pensions each month, and then get on with their lives.

The third reason is habit. For those investors that do look at the market, recent experience has been that any fall in markets is a good time to buy, and that the market will bounce back quickly. The COVID sell-off in 2020, rebounding in a couple of months. Russia invading Ukraine in 2022, back to normal by summer. The Liberation Day sell-off done in a month. We learn best from living. And the recent lesson has been “buy, don’t sell”. Hence, in June, no one even sold…

Lots of human behaviours are very difficult to change. We like sweet things because millions of years of evolution tell us they’re nutritious. We like being around other people because society offers protection. And when we get scared of something, we run for safety, without thinking too much about it.

Now, I don’t think that human psychology has changed. And in fact, I find this current lack of worry a little concerning! It’s not that I think a big economic upheaval is around the corner (our economic models suggest the world is actually in pretty good shape – not booming, but certainly not struggling).

It’s just that an environment where a majority is expecting one thing is more susceptible to a different outcome occurring. Shouting in a library is disruptive. Chucking a stone into a still pond has more impact than throwing one into the sea. Turning up to watch a Tottenham Hotspur football match expecting to win, is me setting myself up for disappointment1. The worst might never happen, but relying on the best is a risk too.

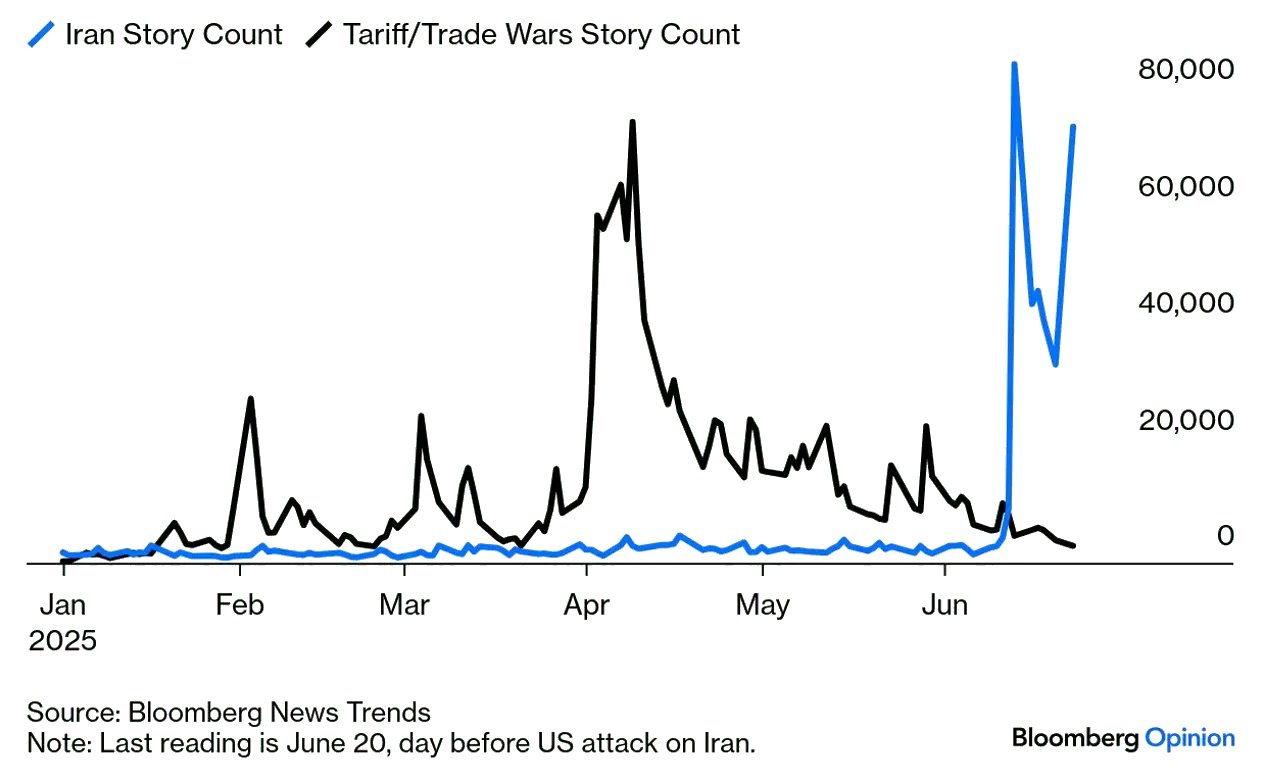

Chart of the month

The global attention span is getting shorter and shorter. The TikTok effect?

Source: Bloomberg News Trends

June Markets Wrap

Looking at the healthy portfolio returns during June, you might be forgiven for thinking that the month was fairly uneventful from a news flow perspective.

However, it won’t have escaped anyone’s notice that tariff news was pushed out of the headlines, as Israel and Iran entered a full-blown war and, latterly, the US entered the fray by bombing a number of nuclear infrastructure sites within Iran. Historically, such events would have seen the oil price soaring and equity markets falling, but on this occasion, we saw a relatively muted rise in the oil price, which didn’t even exceed the 12-month high set in 2024 and, conversely, the S&P 500 rose the day after the US bombing raids.

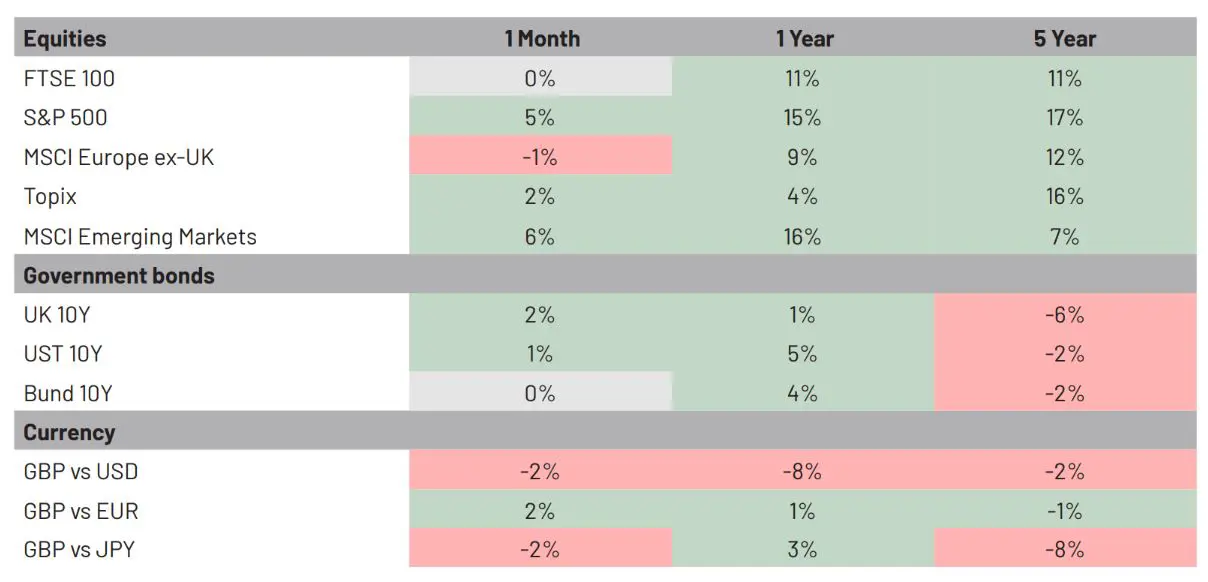

Indeed, from a market sense the US market led the way. The S&P 500 rallied 5% in June, setting new all-time highs and shrugging off any uncertainty. In the UK, the FTSE 100 also managed to achieve an all time high before, oddly, falling as events in the Middle East resolved and dragged down some of the larger, oil sensitive businesses within the sector.

Other than a bullish sentiment, it is probably the fact that the US is relatively self-sufficient in crude that both oil and equity markets were apparently sanguine about the Middle East. It should also be remembered that whilst there is a threat to oil supplies delivered through the Straits of Hormuz and any escalation that may disrupt that supply, one of Iran’s biggest customers is China and delivery is via the Strait. Therefore, it’s not in Iran’s interest to disrupt supply to a country that’s also one of its few political allies. Israel has also been careful, thus far, of not targeting Iran’s oil infrastructure.

Bond markets also had a good month, even as President Trumps’ potentially budget deficit enhancing ‘Big Beautiful Bill’ made some progress in the Senate. US Treasuries finished the month positively (+1%) with inflation remaining steady, highlighting that tariffs may not be as inflationary as once feared (we will have to wait and see).

Market Moves

Source: Bloomberg Finance L.P. Data as of 30 June 2025. Past performance is not a guide to future returns.

What we’re watching in July:

- 1st to 13th – Wimbledon Tennis (Can Alcaraz get three in a row? Will we have a third different female Slam champ in 2025?)

- 9th – Costco earnings – just how is the US consumer doing?

- 15th/16th – US big bank earnings. Did they make money in a wild second quarter?

- 23rd – Apple, Meta and McDonald’s earnings. Different types of consumption. Worth watching!

- 24th – ECB rate setting meeting

- 29th – Alphabet, Tesla and Microsoft earnings. How’s the AI pivot going?

- 30th – Federal Reserve rate decision.

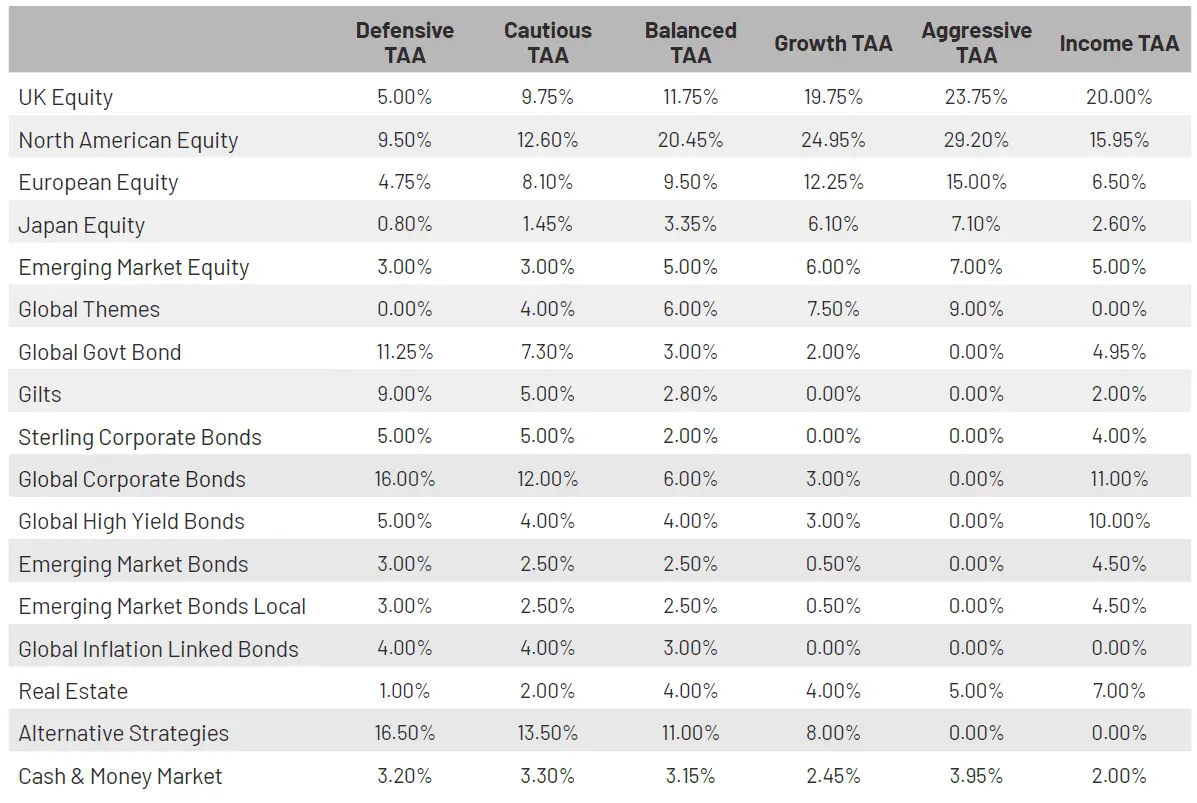

Asset allocation changes

At the June model rebalance, 7IM has undertaken the following changes to portfolios:

- Small reduction to equities

- Closed out the Credit underweight

- Initiated an overweight position in Global Utilities companies.

Manager changes

This quarter the following holdings have been introduced to portfolios:

- Added the Xtracker MSCI World Utilities Sector ETF to implement the new allocation to this global equity sector.

Asset Allocation

Detailed asset allocation

1 Pretty much every match last season, except for one key night in Bilbao!

More from 7IM