Monthly commentary

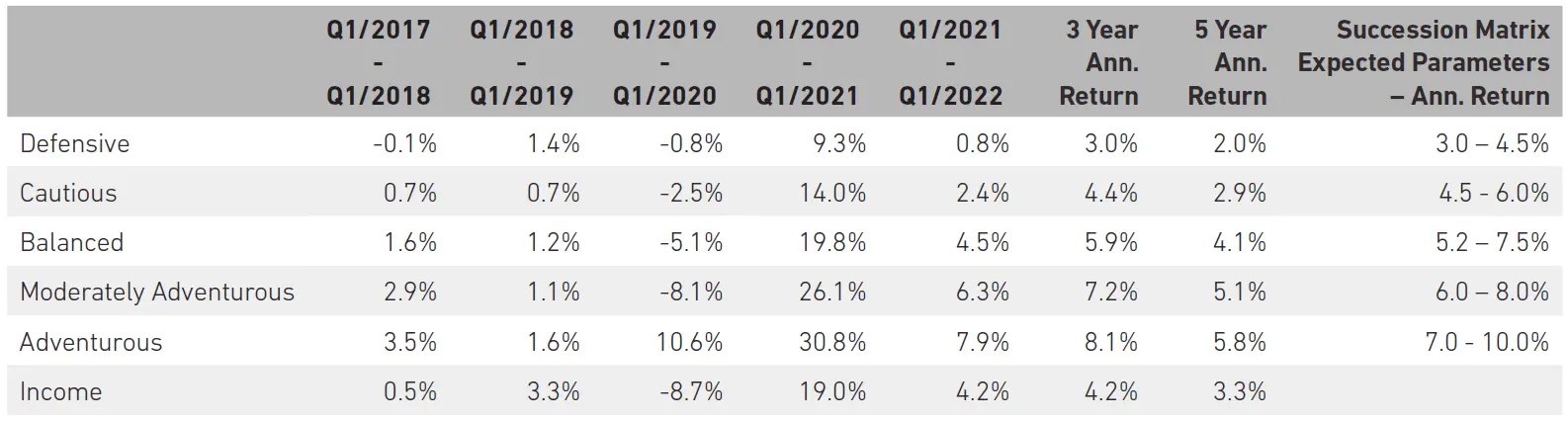

Portfolio Performance

At 7IM, we believe that taking a long-term view is essential when investing. We can’t always avoid the short-term bumps and shocks that the financial world has in store, but a well-diversified portfolio goes a long way towards smoothing out some of the journey. The long-term nature of our strategic and tactical process is a good complement to the Succession Matrix Expected Parameters.

Source: 7IM/FE. Annualised return is defined as ‘Ann. Return’ in the performance table above and is as at end March 2022. The extreme COVID-19 related drawdown at the start of 2020 means performance should continue be viewed with caution. Portfolios are towards the lower end of their ranges for the five-year returns, with the more defensive end struggling a little in the face of low interest rates.

Market and portfolio review

It’s been over a month since the unthinkable happened. But it feels like a lifetime. The human cost has steadily worsened over that time and we can only hope that it recedes soon.

Looking at markets, it would be difficult to tell anything major is going on. Most equity markets are up for the month, with China being the notable exception – isn’t it always?

Stepping back though, markets are still down on the year. There is a lot to dissect in these numbers, but two key data points explain most market moves: oil prices and US treasury yields - both sharply up.

Why is it happening?

Cutting the US equity market by sectors tells the story. All sectors are down apart from two: utilities and energy. The former is up marginally, the latter is up 36%! The IT sectors and consumer discretionary (dominated by Amazon) are lagging the market materially.

The energy sector has certainly surprised to the upside. Oil prices rising 35% since the turn of the year has caught most investors out. Commodity businesses have spent years cleaning up their balance sheet and reducing unprofitable supply. They were starting to look investible again. But now western governments have cut global supply with the strike of a pen, potentially boosting the profitability of commodity companies across the board (except those in Russia of course!). It’s not just US energy companies - Brazilian equities are up 35% this year in USD terms. And emerging market (EM) currencies (excluding the Ruble) turn conventional wisdom on its head, showing resilient performance even as the Fed turns hawkish.

Notably, financials sit in the middle pack. Growth concerns emanating from Russia/Ukraine mean returns are down, but higher bond yields support outperformance vs. those large tech companies. Part of the surge in bond yields have been driven by the rising oil prices but as we’ve said for some time, this readjustment was long overdue.

We suspect that some combination of central bank and commodity uncertainty is likely to dominate market sentiment for a while. We believe our portfolios are ready for this. Whether it’s down to:

- Protection from bond yield uncertainty: underweight bonds, overweight alternatives, value equities and Berkshire Hathaway

- Exposure to commodity price uncertainty: overweight to EM equities, EM bonds, value equities.

- Immunity from both: US mortgages, European bank debt, Global healthcare equities and Global climate solutions.

Portfolio positioning and changes

During March, no changes were made to the Succession Model portfolios. They will be rebalanced in line with our quarterly schedule in May.

Core views

Growth will be stronger than the last decade:

Strong consumers, confident businesses and supportive governments mean one thing; stronger growth. The mushy, slow, volatile growth of the last decade will vanish, to be replaced with a more confident and self-sustaining growth cycle.

Inflation will be higher than the last decade:

The stronger demand does mean higher inflation too. To be sure this does not mean worryingly high, but higher, nonetheless. This will have huge implications for interest rates and savers need to be ready.

7IM portfolios are positioned for the new cycle. We are:

- Positioned away from mega-cap US internet stocks and towards cyclical companies in developed markets, and high emerging market equity allocations.

- Underweight government bonds in a rising rate environment; seeking higher returns in specialist fixed income.

- Overweight alternatives to offer defensive qualities.

- Longer-term investments in climate change and healthcare.

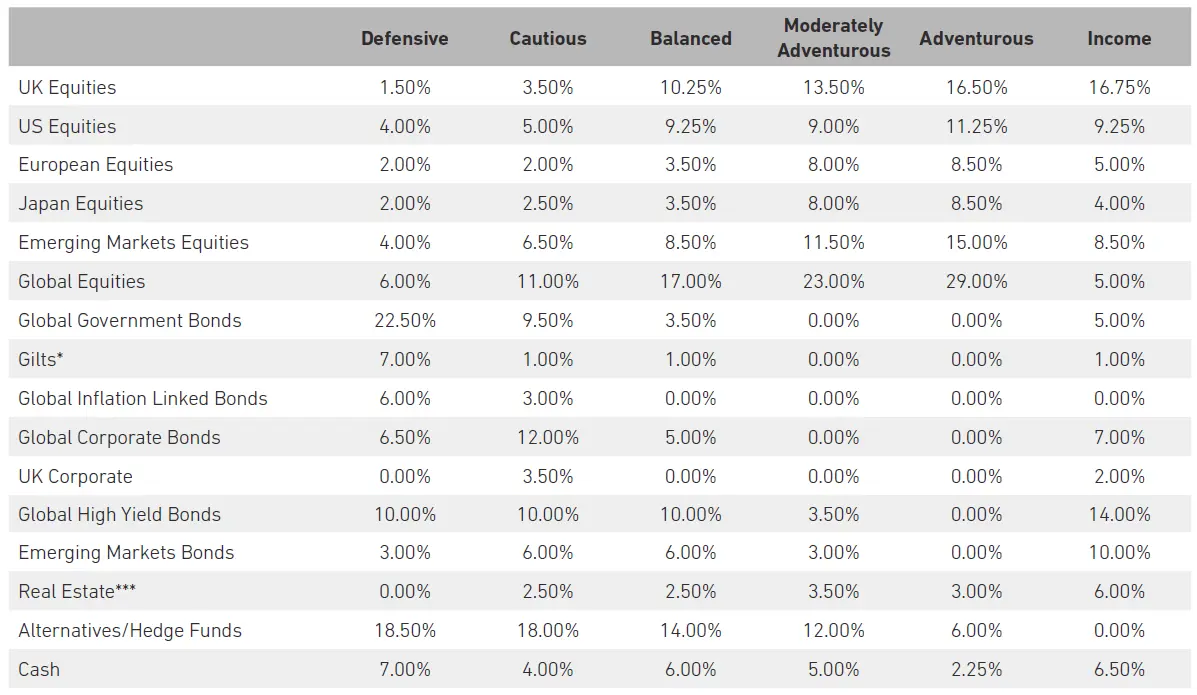

Detailed asset allocation

Source: 7IM. *Includes Short Term Sterling Bonds **Includes Convertible Bonds ***Includes Infrastructure

Read more from 7IM

You can download the commentary as a PDF here.