Monthly commentary

Portfolio Performance

At 7IM, we believe that taking a long-term view is essential when investing. We can’t always avoid the shortterm bumps and shocks that the financial world has in store, but a well-diversified portfolio goes a long way towards smoothing out some of the journey. The long-term nature of our strategic and tactical process is a good complement to the Succession Matrix Expected Parameters.

Source: 7IM/FE. Annualised return is defined as ‘Ann. Return’ in the performance table above and is as at end March 2024. Market returns have been poor in absolute terms since the beginning of 2020 with the Covid pandemic and then the inflationary shock of 2022. While portfolios have held up well relative to peers, the 3 and 5 year absolute returns are lower than average, even though the since inception longer term numbers are in line with expected parameters.

Summary

Sometimes, deciding to do nothing is hard – but that didn’t seem to be the case for some of the major central banks (the Federal Reserve, the European Central Bank and the Bank of England) in the March rate decision. The global economy is hopeful for a soft landing, backed by resilient economic data. This is prompting more decisive action and clearer signals of rate eases from the central banks.

While the US saw a slow improvement in its economic indicators, the picture in Europe and the UK was not so clear-cut. The latter, for instance, is still grappling with a longer-than-expected slowdown in inflation, and with sluggish economic growth. The Bank of Japan’s decision to end an eight-year streak of negative rates also made headlines, marking its first hike since 2007.

But in March, none of this affected investor sentiment, which has been largely optimistic. And it makes sense; after all, this year has already seen some new records – in the Nasdaq, the Dow Jones, the S&P 500. And in some aspects, the narrative has repeated itself: for instance, fewer and fewer stocks continued to drive the S&P 500 to all-time highs.

The records are also reflected in other parts of the world – we’ve seen both Europe’s Stoxx 600 and Japan’s Nikkei 225 peak at the beginning of the month.

And of course, if central banks are expected to cut rates and inflation is expected to come down, that’s good for bond yields. UK and US government bonds are yielding above 4% attractively, which is above inflation and therefore, good for clients with lower risk appetites.

The backdrop remains stable overall, but we continue to be wary of portfolio returns increasingly being driven by a smaller number of companies. Inevitably, market leadership will eventually broaden to other markets, which is why we aim to make our portfolios ready for different environments.

Portfolio Positioning and Changes

There were no changes in March.

Core investment views

At 7IM, we have a number of long-term core views that help to guide our investment decisions and allocations within portfolios.

Over the next 12 months, we think that the global economy will slow down – prompting bouts of volatility. In this environment, it is important to rely on a stable identity. Economic uncertainty creates fear and investor sentiment tends to overreact to economic turning points. Going forward, we believe that:

- Inflation is coming down: Across the developed world, inflation has peaked, and is mostly falling. Supply-chain disruptions have eased, energy prices are a little more settled, and companies are no longer reporting issues with finding workers. Of course, slower inflation still means rising prices – so the cost of living pain isn’t going away quickly

- Interest rates are high: We’re now over a year into the rate hiking cycle. Interest rates are unambiguously high when compared with the past decade. The impact of higher rates is always the same – although time-to-effect changes in every cycle

- The economy is slowing: For consumers and companies, day-to-day life is getting harder – whether it’s rising costs or increased debt, there’s less money left at the end of the week or month. As the flow of money around the economy slows, strong growth is more difficult to achieve. The world may or may not slip into a ‘technical’ recession in the next three months, but a sluggish growth environment is already here.

Sluggish and sideways… In an environment with lots of uncertainty and a lack of confidence, we want to make sure portfolios are insulated against shocks, while still generating sufficient returns to make investing worthwhile. And we think our portfolios are set up to do just that.

There’s no one answer… When managing a diversified long-term portfolio, there shouldn’t be a single ‘big’ call. For an outlook that calls for selectivity, especially in the medium and short term, we’re finding lots of different opportunities – both to protect capital and to grow it.

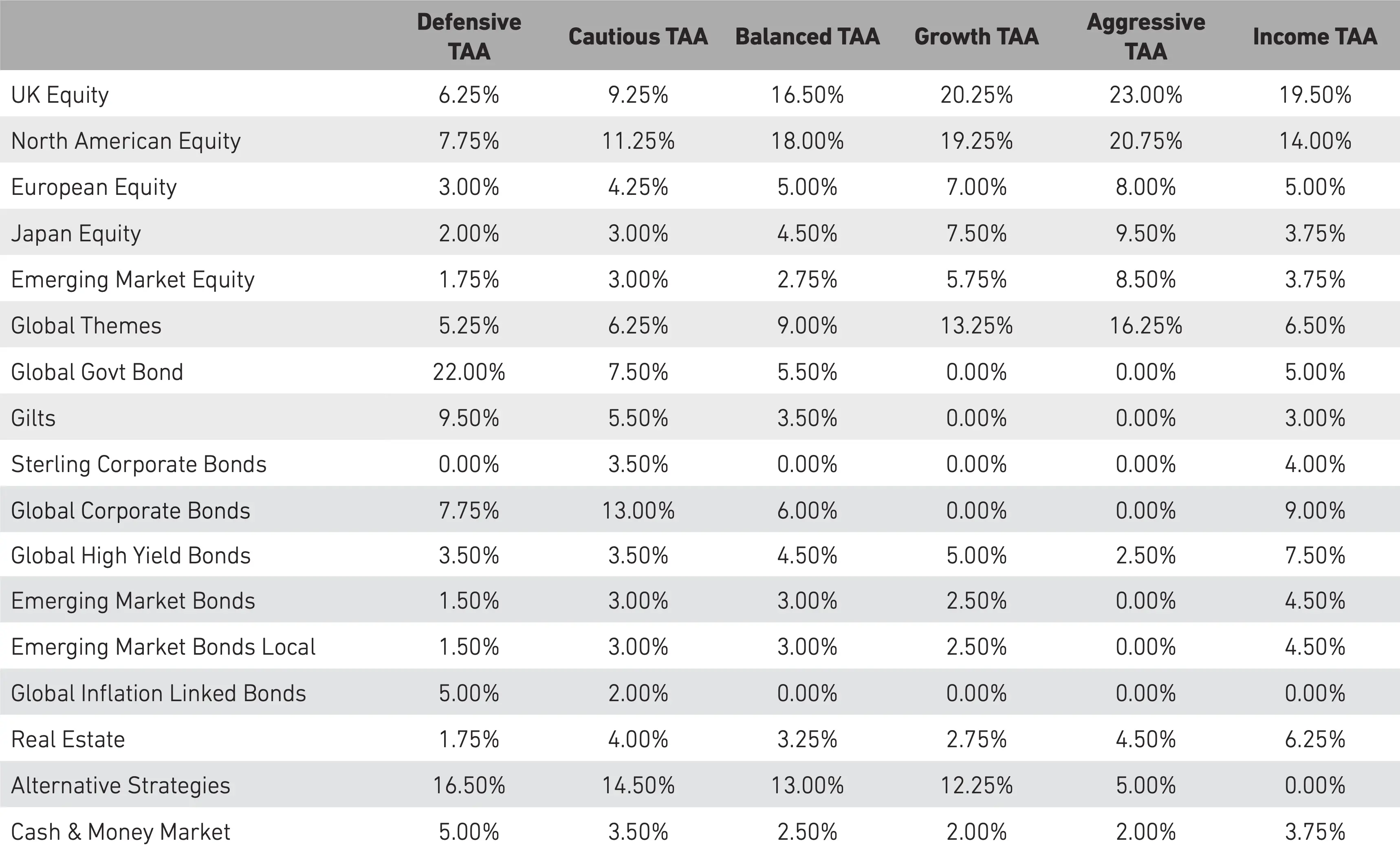

Asset allocation

Detailed asset allocation

Source: 7IM

You can download the commentary as a PDF here.