Monthly commentary

Portfolio Performance

At 7IM, we believe that taking a long-term view is essential when investing. We can’t always avoid the short-term bumps and shocks that the financial world has in store, but a well-diversified portfolio goes a long way towards smoothing out some of the journey. The long-term nature of our strategic and tactical process is a good complement to the Succession Matrix Expected Parameters.

Source: 7IM/FE. Annualised return is defined as ‘Ann. Return’ in the performance table above and is as at end March 2025. Market returns have been poor in absolute terms since the beginning of 2020 with the Covid pandemic and then the inflationary shock of 2022. While portfolios have held up well relative to peers, the 3 and 5 year absolute returns are lower than average, even though the since inception longer term numbers are in line with expected parameters.

Monthly Musings: Dealing with volatility

We cover the March volatility in the markets wrap at the end – the first piece adds a little extra perspective.

March saw a further shift in market sentiment towards the US, and in particular the assets which performed particularly strongly just after the election in November 2024 as a result of the “Trump Trade”. The big US tech stocks, smaller ‘mom & pop’ US companies and (of course) crypto have all started to fall.

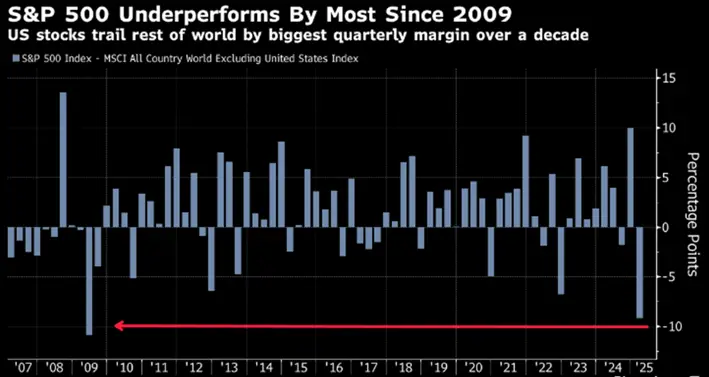

Indeed, the underperformance of the S&P 500 vs. the rest of the world has reached a scale we haven’t seen in some time:

Source:Bloomberg Finance L.P.

Of course, this doesn’t mean there’s a financial crisis brewing. It’s useful to remember that in 2000, when the dot-com bubble burst, the US economy barely blipped (and the rest of the world grew that year). It’s easy to conflate the current market turbulence with something more sinister. The reality is often simpler – after a period of extreme market performance, a group of stocks are giving back gains they probably didn’t deserve in the first place.

Our portfolios have remained relatively unaffected by the dissipation of US exceptionalism. We had never thought that history would repeat itself – that the same assets which performed last time would be guaranteed to do so again.

The last time Trump entered the White House, the US economy was booming, inflation was extremely low (due to oil prices halving in 2014 and 2015), the Eurozone crisis was still rumbling on and a Chinese equity bubble was bursting. So the first time around, Trump was cutting taxes for a confident consumer and a delighted corporate sector – with many investors also seeking to flee European and Chinese assets. Money poured into the US market.

2025 was always looking like being different. Inflation is high. Growth is middling. Consumer and corporate confidence are nowhere near previous levels. Other regions like Europe and China aren’t quite so troubled as a decade ago. And at the same time, Trump is going more extreme. More tariffs. Government job cuts. Aggressive policy changes.

While we had no idea exactly what Trump would do, we thought that diversification within the US (using an Equal-weighted index, rather than market-cap to access US equity) and outside it (FTSE 100, European Equity) made sense.

Rather than looking just at March (see below), it’s helpful to look at what’s happened so far this year. European and UK equities are up 6%, while the main US index is down 5% (and NASDAQ down 10%). Emerging Market equities and bonds are up 2.5%. We’re “missing” the fall in US assets that’s playing out, instead benefitting from the gains elsewhere. That’s the beauty of diversification. We’re not changing anything, because our portfolios have already been pointing in the right direction.

In our tactical portfolios, we’re also slightly overweight government bonds – as we believe they’re still a good defensive proposition (and at 4.5% yields, we are getting rewarded to hold).

Looking ahead, despite sentiment being the touch paper for some of the market sell-off, the real economy remains the key driver for portfolio positioning – especially when we have diversified allocations that don’t just rely on a few big tech stocks.

Chart of the month

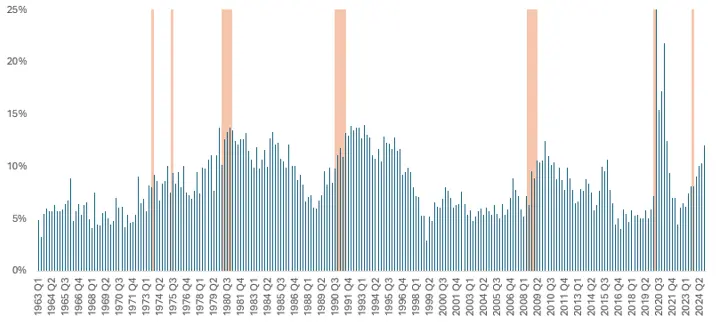

UK households are seeing income growth equivalent to nearly 5% a year… but it all seems to be going into savings, now at 12% of household resources. On the chart below we’ve shaded UK “technical” recessions (two quarters of negative growth) in orange with household savings as the blue bars.

Typically (excluding the high inflation in the early 70s when no one had any cash), high savings rates tend to align with a period of difficult economic growth. People who have cash hoard it due to a lack of confidence. And despite the UK economy not shrinking in 2024, there’s a real recessionary air permeating. Political uncertainty at home and abroad, plus lingering effects from Covid-19/inflation shocks/foreign wars. People are behaving like they’re in a recession, households are saving.

But. Don’t lose heart. That same cash hoarding sets the stage for periods of HIGH growth – the 80s, the 90s, the pre-crisis 2000s. It’s the fuel for the next economic boom. So with a small shift towards positive confidence, the UK economy might actually find itself unleashing its growth potential earlier than expected. The money’s there!

UK Household Savings (as % of total resources)

Source: ONS/7IM

March Markets Wrap

In March, equity markets across the world have sold off (not just the US, as discussed above). It’s always difficult to attribute exact reasons to short-term market moves. Partly, of course, it will be nervousness about there being no last-minute reprieve on a trade war; we’re running out of ‘last-minutes’.

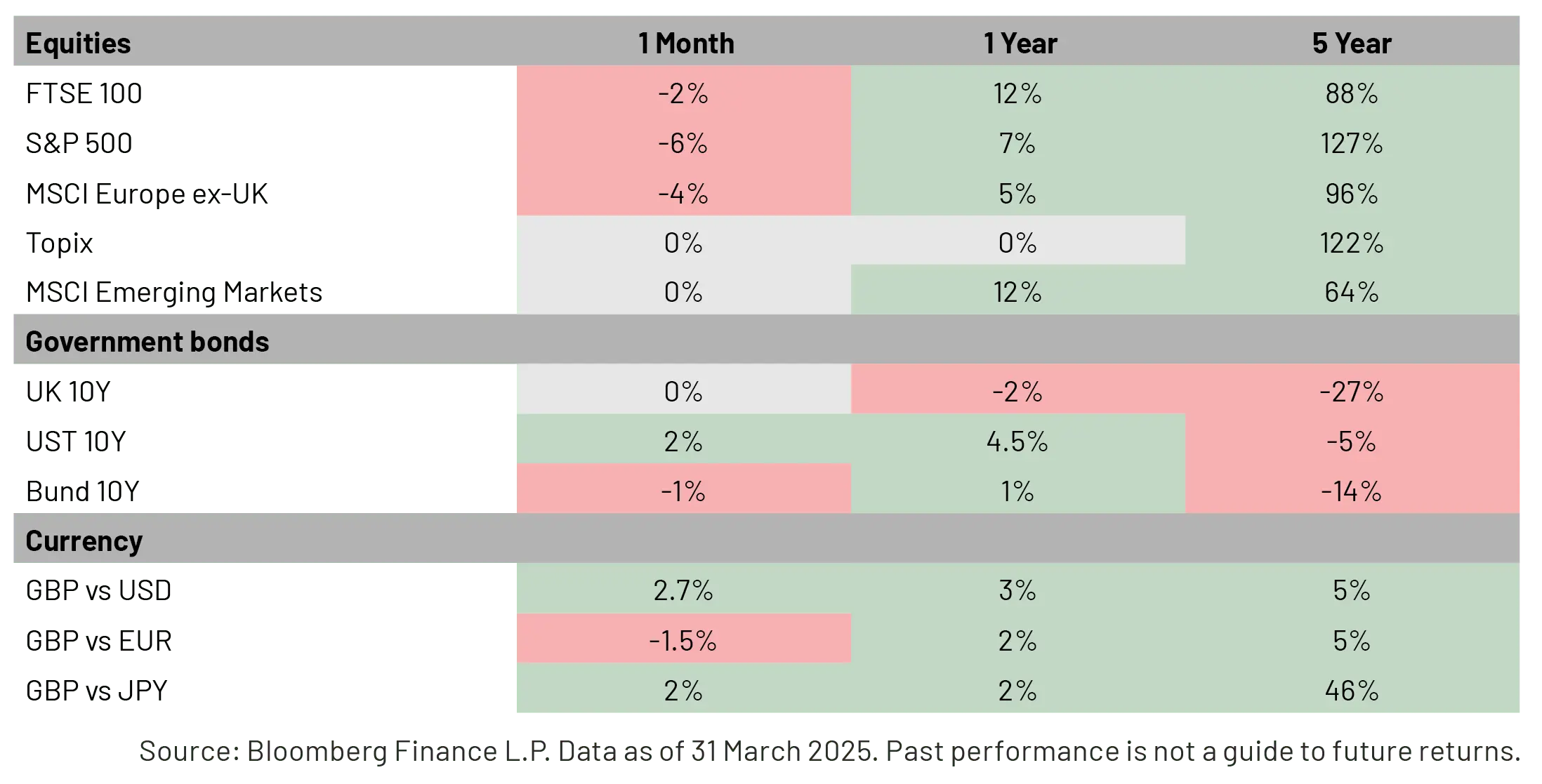

But there are other, less obvious reasons too – end-of-quarter rebalancing from large institutions can mean reallocating capital, taking profits in equities and moving to fixed income, for example. When the global equity index is down 5% for a GBP investor, we’re comfortable that our diversified portfolios are protecting capital – most of our portfolios are roughly flat YTD.

In the UK, FTSE 100 & FTSE 250 finished the month lower on account of domestic growth fears, with the UK economy slowing in month-on-month data by 0.1%. This came as a shock to many, with forecasters expecting modest growth in the UK given a resilient consumer and manufacturing tailwinds.

For Europe, the future impact of a trade war remained a key talking point. In France, the combination of internal political issues and global trade concerns led to the Bank of France reducing its 2025 growth forecast to 0.7%, down from 0.9% previously, marking the weakest annual growth since Covid-19.

Across the pond in the US, similar fears hampered market returns. The S&P 500 continued its downward trajectory, led by significant losses in the technology sector.

Yet during difficult times for stock markets, government and corporate bonds have done their job –nothing spectacular, simply paying coupons as expected.

We expect to see more volatility in the next few months, as investors reprice the risks and opportunities available to them. We firmly believe that diversified portfolios are likely to smooth the journey and maximise return potential over the longer term.

Market Moves

What we’re watching in April:

- 2 April – “Liberation Day” where US tariff policy comes into play

- 10 April – Tesco earnings, a good indicator of consumer sentiment in the UK

- 11 April – US big banks report Q1 earnings: JPM, Morgan Stanley, Wells Fargo

- 17 April – Governing Council of ECB Meeting

- 23 April – Tesla reports Q1 earnings

Asset allocation changes

At the March model rebalance, 7IM has undertaken the following changes to portfolios:

- Closed out the allocation to Healthcare companies

- Closed out the Metals & Mining position

- Initiated an overweight position in Global Financial companies

- Initiated an overweight position in Global Communication Services companies

- Added to the US Equal Weight position.

Manager changes

This quarter, the following holdings have been introduced to portfolios:

- A number of Xtracker MSCI World Sector ETFs to implement the updated Global Sector positioning.

Asset Allocation

Detailed asset allocation

More from 7IM

You can download the commentary as a PDF here.