Quarterly Rebalance Commentary

Overview

Our view of the world hasn’t changed much this quarter. Despite the emergence of new variants, the world is slowly but surely learning how to deal with COVID. The stability of our views over the quarter reflects that we run money as long-term investors. We don’t flail around, changing our view every time the market moves. Instead, we carefully consider the factors and information most relevant to us and refresh our views accordingly. As we said last quarter, we’re looking past the recovery phase, and instead positioning ourselves for the post-pandemic growth boom.

Core investment views

A new wave of economic growth… For the past decade or so, the virtuous circle of consumption and investment has just not been able to get going. The scars of the financial crisis were too deep – people bought less stuff while governments reined in spending. As a result, companies kept putting off investing in longer-term projects.

The 2020 recession hit the reset button. People are willing to spend again, while governments have ditched austerity. Policymakers around the world have made it clear that they’ll stay supportive for a long, long time. And so, companies are starting to invest for the future. We are now at the start of a sustained period of growth, fuelled by confidence and expansion across all sectors of the global economy.

And a little inflation won’t hurt… Economists tend to dislike thinking about the psychology of inflation, but in a lot of ways, someone’s inflation expectations are a good proxy for their confidence levels. With the right amount of price and wage growth, people are encouraged to make life decisions which are positive for the economy. We haven’t heard the word “Goldilocks” for some years now, but there really is an amount of inflation which is just right to keep things humming.

7IM portfolios are positioned for a changing environment… For this coming growth phase, we believe a more selective exposure will be better than a large overweight to the broad equity market. A more robust consumer-driven cycle will see different winners emerge. Regions and industries which have struggled to attract investors over the past decade are better positioned to capitalise than the huge US tech giants (although there are lots of small US companies which will do well).

We’ve also made sure that our fixed income positioning isn’t unnecessarily exposed to rate rises, using allocations to alternatives and to non-mainstream asset classes.

| TAA themes | Implementation |

|---|---|

| The world is getting older | Healthcare companies |

| Bond safety comes at a price | Alternatives |

| Go to Asia for yield | Asia high yield |

| A US housing boom is underway | US mortgages |

| European Banks aren’t scary | European alternative tier 1s |

| The COVID-19 recovery has kickstarted a new economic cycle | Growth+ basket |

| Selling equity market insurance after a disaster | US equity volatility carry |

| Investing in a cleaner future | Climate change solutions |

Asset allocation changes

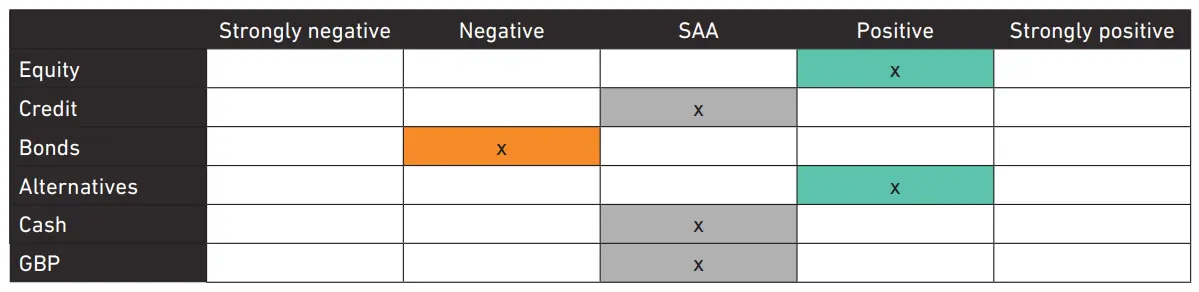

Asset allocation changes this quarter have been from our annual strategic asset allocation (SAA) refresh as well as some tactical changes. Overall, the result of this has been:

- A tactical decrease in risk, taking profits on our large equity overweight, and reducing to a more modest (but still overweight) position

- An increase in our alternatives allocation across risk profiles

- A continued focus on high conviction credit positioning and a resulting increase in our financial capital position.

We added an investment which looks to invest in companies which are involved in solving the problems of climate change. We believe there is a real opportunity for innovative companies to profit from solving some of the challenges of reducing emissions and helping the world to cope with climate change. We think many of the biggest opportunities available lie outside the “clean energy” space: with companies that are solving problems in areas like logistics, packaging and construction. We want exposure to the clean, low-impact leaders across the business spectrum, since we believe these companies are going to profit from greening the world.

Aside from these changes, we also formally integrated ESG data into our SAA process with the goal of reducing overall SAA emissions by 30% over a 5-year period. As a result, we have introduced some ESG mandate products in place of broader equity exposure.

Manager updates

NinetyOne Global Environment. This fund is our way of implementing our investing in a cleaner future theme into our active and blended models and has replaced a passive S&P tracker. The fund invests in companies that are well placed to benefit from the shift towards a greener world.

iShares MSCI USA ESG Screened. This fund is our way of implementing our investing in a cleaner future theme into our passive models and has also replaced a passive S&P tracker. This new index excludes companies that are associated with controversial, civilian and nuclear weapons and tobacco, that derive revenues from thermal coal and oil sands extraction and that are not compliant with the United Nations Global Compact principles. We retain exposure to the biggest US companies whilst reducing exposure to those companies that carry the largest ESG risks.

Brook Absolute Return. This is a concentrated long short equity strategy focussed on UK value stocks that we have added to our active models. Historically, this fund has performed very well, and we believe that it provides a strong, diversifying addition to our alternatives basket.

Man GLG UK Income. This is a value focussed UK equity fund that seeks undervalued assets, undervalued cashflows or the ability to pay above average dividends. This has replaced the Majedie UK focus fund in our active models. We believe this value-oriented fund complements the more growth oriented NinetyOne UK Alpha fund to create a well-diversified active exposure to the UK equity market.

PIMCO Asia High Yield. We have added this fund to our active models reflecting our ongoing conviction in the Asia high yield space. We believe that the fund benefits from a very well-resourced centralised team that manages the headline risks of the funds well.

BNYM Efficient Global High Yield Beta. This is a fund that we are using in our passive models in order to gain exposure to a corporate global high yield index at a low cost. The fund has a small budget it can use to deviate from the benchmark that it tracks. These “micro-allocations” are driven by a quantitative model and aim to offset fees and dealing costs.

Please note: All of the comments in this document refer to the models we run on the 7IM platform, but the models are also available on a range of other platforms. As much as possible, we try to replicate the models we run of the 7IM platform across all platforms, but due to differing security availability, not all of the points outlined in this document may be relevant across these platforms. If you are unsure whether certain changes apply to models on a specific platform, please reach out to a member of the team.

The past performance of investments is not a guide to future performance. The value of investments can go down as well as up and you may get back less than you originally invested. Any reference to specific investments are included for information purposes only and are not intended to provide stock recommendation or investment recommendations to individual investors.

Read more from 7IM