Quarterly Rebalance Commentary

Overview

Markets have been buoyant since our last model portfolio rebalance in May.

May was all about the mega cap tech. The theme of mega cap tech propping up the world feels familiar, especially since 2020, but this year the narrowness of US stock performance has been even more extreme. This positive S&P 500 performance has been driven by a small number of stocks and NVIDIA really shot the lights out during May, accounting for most of the S&P’s performance.

Financial markets were relatively well behaved in June, bringing to a close a very positive first six months of the year. Despite the most forecasted recession in history supposedly being just around the corner, stock markets indices have performed very well over the first half of 2023. Strong index-level performance continued to be driven by a small number of stocks, with Apple being the largest contributor to S&P 500’s performance in June. This was due to highly mixed economic data combined with a huge amount of excitement around AI/tech. The best-performing regional equity index was the Topix, mainly due to a weak Yen that has helped many Japanese stocks. June also saw more positive news headline figures as rates rose, meaning US inflation fell from a high of 9% in 2022 to 3%.

July was another busy month. The financial markets have also been dealing with lots of events. In line with market expectations, central banks continued their fights against rising inflation. The FED and ECB raised rates, and the Bank of Japan also joined the tightening wave after decades of monetary stimulus. There have also been some positive economic rumbles in Beijing as China signalled more support for the real estate sector and to boost domestic consumption. Global equity markets have had another month of gains, showing the market remains bullish following a stronger than expected growth data, corporate earnings, and cooling inflation. The AI mania remains a driver of performance of US stocks. As the Q2 earnings start to come out in August, the mega-cap Magnificent Seven will have to show they’re worth the hype.

Core investment views

At 7IM, we have a number of long-term core views that help to guide our investment decisions and allocations within portfolios.

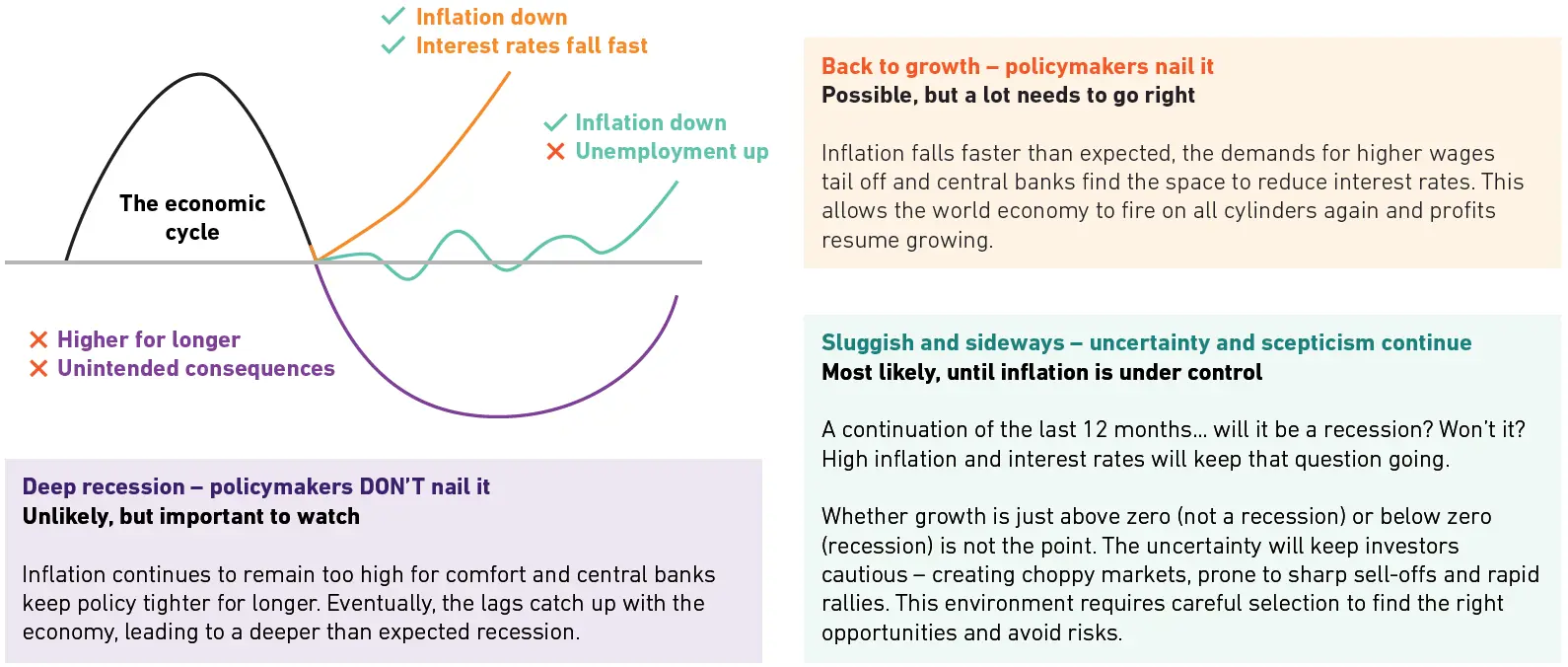

Over the next twelve months, we think there are a range of possible outcomes that investors will need to contend with. The possible scenarios are laid out below:

Tactical Asset Allocation

Headline Asset Allocation

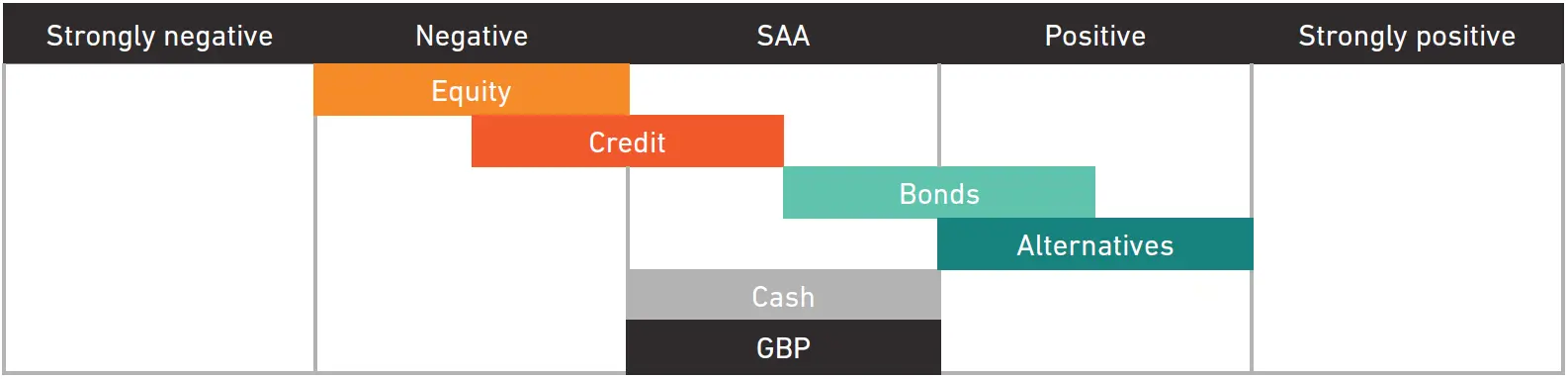

In an environment with lots of uncertainty and a lack of confidence, we want to make sure portfolios are insulated against shocks, while still generating sufficient returns to make investing worthwhile. And we think our portfolios are set up to do just that.

Portfolio positions

There’s no one answer… When managing a diversified long-term portfolio, there shouldn’t be a single ‘big’ call. For an outlook which calls for selectivity, especially in the medium and short term, we’re finding lots of different opportunities – both to protect capital and to grow it.

| Long term: Thematic | |

|---|---|

| Healthcare companies | Stable earnings when others are seeing uncertainty |

| Climate transition leaders | Uncorrelated to short-term economic cycle |

| Alternatives | Defensive and diversifying |

| Metal & mining companies | Cheap and stable businesses. Short-term volatility, but profitable long-term |

| Medium term: Opportunities | |

|---|---|

| Finding pockets of value in the US | Thinking differently about US Equity |

| Tilt to UK Large Cap | Reduce domestic UK exposure while the economic uncertainty remains |

| AT1s | Attractive returns despite recent pain |

| Short term: Portfolio risk appetite | |

|---|---|

| Underweight equity risk | Reduce equity exposure as returns will be limited for the time being |

| Overweight bond duration | Bonds can do well if inflation continues to fall |

Asset allocation changes

We have made the following tactical changes to portfolios in this quarterly rebalance:

- Introduced US Equal Weight Equity. We have shifted into a more diversified approach to US Equity, which dilutes the mega-cap tech names.

- Adding to Healthcare and Large Cap UK. We believe the defensive Healthcare earnings should weather the profits downturn better than most sectors. And while the energy and materials exposure in the FTSE 100 will not be immune to a slowdown, the operating leverage these companies should have come out of a slowdown means these are among the most attractive equities around.

Manager changes

This quarter, we have:

Added XTrackers S&P 500 Equal Weight UCITS ETF to Blended and Active portfolios. This position has been added to portfolios to implement our new tactical position in taking a more diversified approach to US equity.

Please note: All of the comments in this document refer to the models we run on the 7IM platform, but the models are also available on a range of other platforms. As much as possible, we try to replicate the models we run of the 7IM platform across all platforms, but due to differing security availability, not all of the points outlined in this document may be relevant across these platforms. If you are unsure whether certain changes apply to models on a specific platform, please reach out to a member of the team.

You can download the commentary as a PDF here.