Quarterly Rebalance Commentary

Overview

Over the past three months, our positive outlook has continued. The world is now moving past COVID-19, in both an economic and epidemic sense. In the last twelve months, there was one simple question for investors to answer: how long would it take before lockdowns finished, and the economy could be taken off pause? As the world moves past this stage, we’re looking ahead of the global economic recovery, to instead position ourselves for the post pandemic growth.

The global vaccination effort has been incredible. At the beginning of the calendar year, around 9 million vaccine shots had been given globally. That number is around 1.5 billion. The world is starting to feel the benefit of these vaccines and with the vaccine rollout, an end to lockdowns as we know them is in sight.

When this does happen, consumers are primed to spend. Global economic stimulus has been larger and more coordinated than anything we have seen before in history, and this has left money in peoples bank accounts. At the start of 2020, the US consumer had $1 trillion of savings. In 2021, that number is around $4 trillion. This money will be spent, and we are positioned to benefit from the resulting growth.

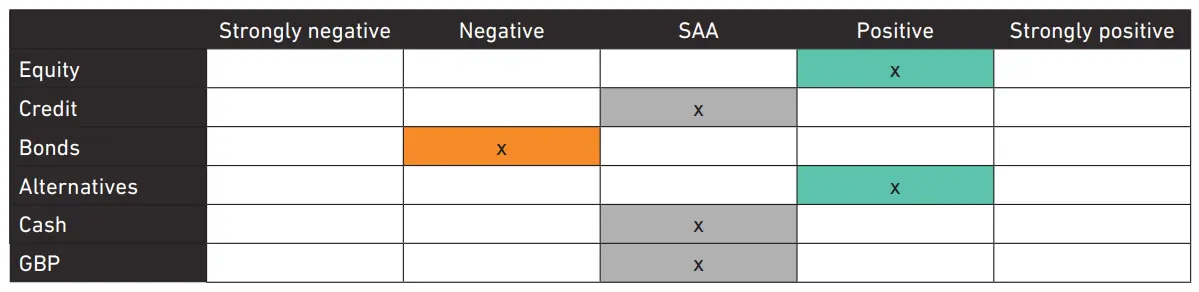

To capitalise on this, we have a decent allocations to equities. Eventually, growth will become really embedded and central banks will have to begin raising rates. However, central banks have reaffirmed their commitments to expansionary policy, and the hiking cycle is still some way off. This is why we still think government bonds are unattractive relative to alternative assets.

Core investment views

Policymakers will stay supportive… The world has never seen as much coordinated stimulus as in the past year– and the impact is yet to come. We believe this sets the stage for a strong economic recovery across the world in 2021. The return to growth will occur at slightly different paces in different places – much of Asia is already back on track, the US should have a vibrant start to the year, with Europe (we hope) finishing strongly. As the recovery continues, and turns into an expansion, we want to be exposed to it.

The post-COVID consumer will make up for lost time… Vaccination rollouts make the end of lockdowns real, and people are making big plans. Through a combination of savings, government support and job growth, consumers have never had more firepower following a crisis.

Our portfolios are positioned for the new economic cycle… We think that the new cycle will require new leaders. Large US technology companies will still be crucial as part of the growth cycle, but other regions and industries are now better positioned to benefit, as economies re-open and consumers are desperate to spend. We think that smaller, more nimble businesses can ride the wave best.

Inflation won’t derail growth or portfolios… As the economy reopens, there are fears that price pressures will spread through the economy – not enough hairdressers, restaurant tables and plane seats to meet the pent-up demand. The reality is that people adjust if prices rise – they buy clippers, get a Deliveroo or go on a staycation instead. We expect price increases to be temporary rather than sustained, but our portfolios are prepared nonetheless.

| TAA themes | Implementation |

|---|---|

| The world is getting older | Healthcare companies |

| Bond safety comes at a price | Alternatives |

| East Asia is returning to normal | Asia high yield |

| Don’t bet against the US consumer | US mortgages |

| The financial crisis is over | European alternative tier 1s |

| The COVID-19 recovery has kickstarted a new economic cycle | Growth+ basket |

| Selling equity market insurance after a disaster | US equity volatility carry |

Asset allocation changes

Headline risk. We have slightly increased the headline risk of portfolios this quarter in order to ensure that portfolios reflect our conviction in strong economic growth.

We have increased our equity and alternatives allocations by 3.5% and 2% respectively in balanced risk profiles. This has been funded by a 6.5% reduction in credit allocation in balanced risk profiles.

From V+ to Growth+. Our V+ basket was positioned to take advantage of the V-shaped economic recovery the world saw. As the world is now moving past COVID-19 in both an economic and epidemic sense, the basket needs tweaking slightly. Cyclical sectors look well placed to benefit from this, which is why we have added more of a value tilt to portfolios.

Increase alternatives. Interest rates are still historically very low, and we don’t believe that bonds provide adequate protection to portfolios. This has led us to reduce our allocation to credit and further increase our allocation to alternatives since the February models rebalance. We believe that a well-constructed alternatives basket will generate higher returns than corporate bonds, whilst providing strong defensive properties through drawdowns.

Manager updates

Fund addition – Xtrackers MSCI World Value UCITS ETF. In passive models, we have added this product in order to get the exposure to global value stocks that we require from the growth+ basket. In active portfolios, no new product has been added since we are able to get enough exposure to value by reallocating towards to more value-oriented holdings we already have.

Fund addition – Neuberger Berman US Equity PutWrite Fund. By selling puts, this strategy benefits from nervous investors fearing another equity market pullback. Right now, investors are paying historically high insurance for this protection. We think this is a slightly contrarian way to express our view on the continued cyclical recovery, through an alternative type equity replacement.

Please note: All of the comments in this document refer to the models we run on the 7IM platform, but the models are also available on a range of other platforms. As much as possible, we try to replicate the models we run of the 7IM platform across all platforms, but due to differing security availability, not all of the points outlined in this document may be relevant across these platforms. If you are unsure whether certain changes apply to models on a specific platform, please reach out to a member of the team.

Read more from 7IM