Monthly commentary

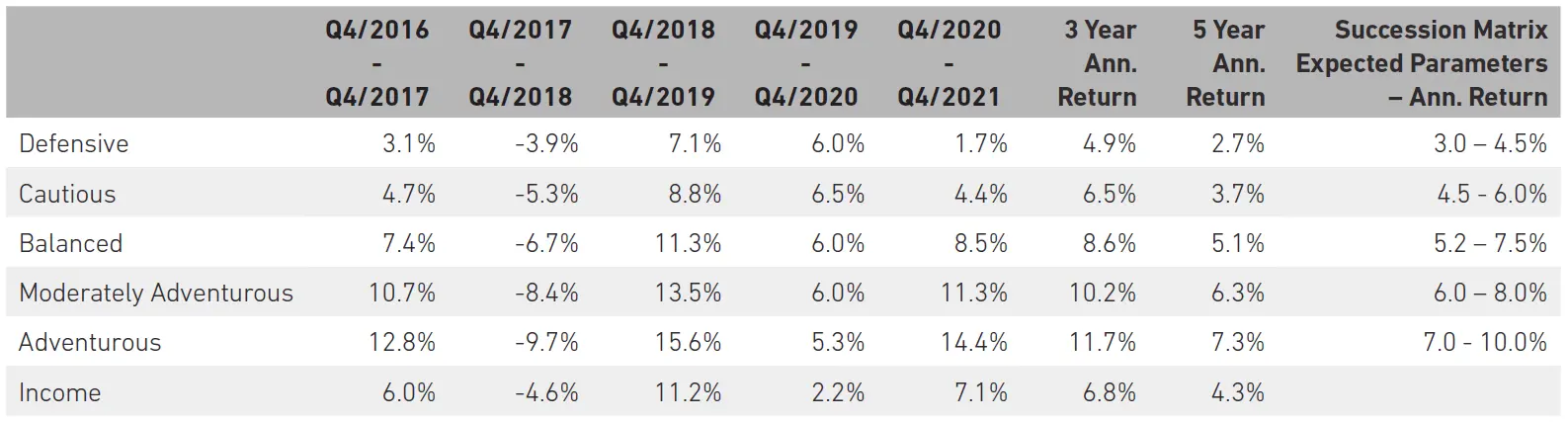

Portfolio Performance

At 7IM, we believe that taking a long-term view is essential when investing. We can’t always avoid the short-term bumps and shocks that the financial world has in store, but a well-diversified portfolio goes a long way towards smoothing out some of the journey. The long-term nature of our strategic and tactical process is a good complement to the Succession Matrix Expected Parameters.

Source: 7IM/FE. Annualised return is defined as ‘Ann. Return’ in the performance table above and is as at end December 2021. The extreme COVID-19 related drawdown at the start of 2020 means performance should continue be viewed with caution. Portfolios are towards the lower end of their ranges for the five-year returns, with the more defensive end struggling a little in the face of low interest rates.

Market and portfolio review

2021 has been a wild year in many ways. So wild, in fact, that you may have forgotten about a number of the weird and, in many cases, not-so-wonderful things that happened. Artefacts of 2021 such as the Capitol Riots and the performance of the England football team sit alongside memories of GameStop and Omicron.

Markets have had a lot to digest. They’ve had to think about the emergence of new Covid variants, asset purchase tapering, and more inflation scaremongering than anyone should ever have to deal with. Despite this unusual backdrop, many financial markets managed to look on the bright side and ended up having a very good year.

The S&P rose a staggering 26.9%, leaving the vast majority of hedge funds in the dust. And it wasn’t just US markets that had a good time. The FTSE 100 had its best year since 2016, rallying 14.3%, and Europe had its best year since 2009 with the STOXX 600 gaining 22.4% over the year. The only equity markets that have really been left behind are emerging markets – where Chinese regulatory clampdowns dominated.

So, what can we take away from all of this?

First, markets have largely got over worrying about Covid. The delta and now omicron variants have both caused huge outbreaks in terms of number of cases, but markets haven’t spent more than a week or so caring in any meaningful way. Back in July, you would’ve heard headlines about the delta variant sending UK and European stocks ‘crashing’, but this was the press overreacting, rather than investors. Yes, there were small sell-offs, but as time has passed, these have proved insignificant.

Second, (and more importantly) acting on every market signal is not helpful. Flailing around is a terrible way to manage a portfolio. There has been a lot that investors could have worried about in 2021. Inflation, tapering, and covid have all caused drawdowns at some point in the past, and many investors would have pulled out of markets in an attempt to avoid losses resulting from these factors. Doing this tends to leave investors running in circles and 2021 was a great illustration of this. When the general direction of markets is up, it is often best to sit back and do nothing.

At 7IM, we continue to closely monitor the impact of factors such as inflation, tapering of covid on markets, but as long-term investors, we are not going to act on every micro signal that comes our way, instead we carefully consider our decisions and give time for our ideas to come to fruition.

Portfolio positioning and changes

During December, no changes were made to the Succession models. They will be rebalanced in line with our quarterly schedule in February.

Core views

A new wave of economic growth… For the past decade or so, the virtuous circle of consumption and investment has just not been able to get going. The scars of the financial crisis were too deep – people bought less while governments reined in spending. As a result, companies kept putting off investing in longer-term projects.

The 2020 recession hit the reset button. People are willing to spend again, while governments have ditched austerity. And so, companies are starting to invest for the future. We are now at the start of a sustained period of growth, fueled by confidence and expansion across all sectors of the global economy.

And a little inflation won’t hurt… Economists tend to dislike thinking about the psychology of inflation, but in a lot of ways, someone’s inflation expectations are a good proxy for their confidence levels. With the right amount of price and wage growth, people are encouraged to make life decisions which are positive for the economy. We haven’t heard the word “Goldilocks” for some years now, but there really is an amount of inflation which is just right to keep things humming.

7IM portfolios are positioned for a changing environment… For this coming growth phase, we believe a more selective exposure will be better than a large overweight to the broad equity market. A more robust consumer-driven cycle will see different winners emerge. Regions and industries which have struggled to attract investors over the past decade are better positioned to capitalise than the huge US tech giants (although there are lots of small US companies which will do well).

We’ve also made sure that our fixed income positioning isn’t unnecessarily exposed to rate rises, using allocations to alternatives and to non-mainstream asset classes.

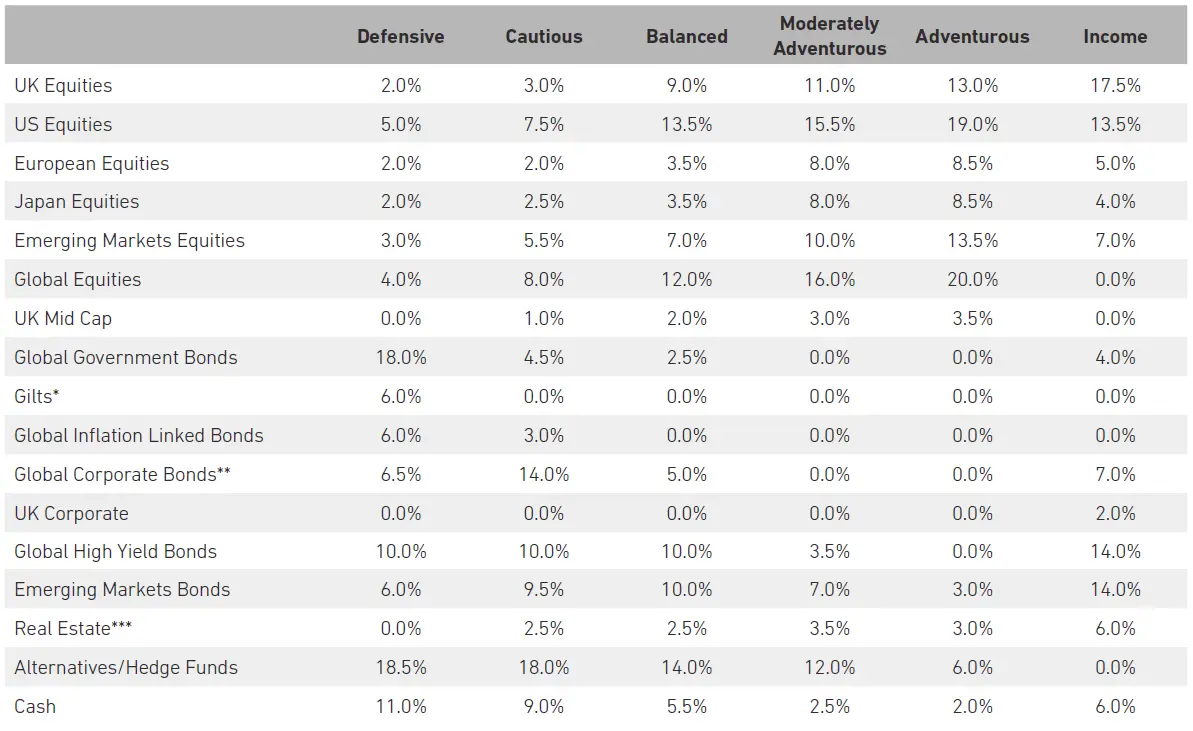

Detailed asset allocation

Source: 7IM. *Includes Short Term Sterling Bonds **Includes Convertible Bonds ***Includes Infrastructure

Read more from 7IM

7IM and Succession have come together to give your clients access to a range of risk-rated, low-cost model portfolios to help them achieve their goals.