Responsible investing

In both the way we invest money and the way we run our business, we know the importance of sustainability.

See The Difference CalculatorFrom David Attenborough’s Life on Our Planet to the shock of Covid-19, we know the impact humanity is having on the world – as consumers, homeowners, travellers, firms and countries.

It’s time for us all to think responsibly, make responsible choices and take responsible action. Acting responsibly towards the world and its people is not just the right thing to do but will lead to better outcomes for everybody in the long run.

At 7IM we stand behind this sentiment and are positioned to provide investment solutions and support financial advisers and their clients wanting to be part of a better future.

Come and find out what ESG investing is, what it means to us at 7IM, why we’re well positioned to support those interested in responsible investing and take a look at the potential positive impact your investments could have on the world we live in.

Please contact your financial adviser and they will be able to share more information about our approach and products.

What is ESG and responsible investing?

Making sense of financial jargon and acronyms is sometimes difficult. Take ESG for example – it’s a frequently used term but what does it actually mean?

In this helpful guide we aim to explain some of this terminology and outline why our approach to investing is more than just ESG.

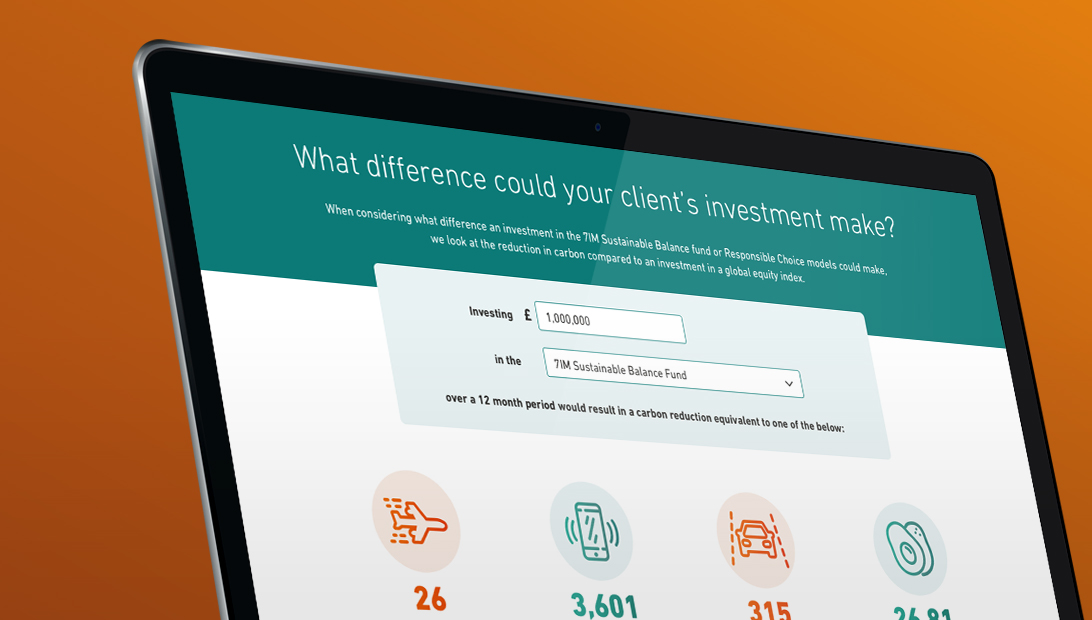

What difference could your investment make?

When considering what difference an investment in the 7IM Sustainable Balance fund, or the 7IM Responsible Choice Model Portfolios will have, we look at the reduction in carbon compared to an investment in a global equity index.