Seven Insights from 7IM

1. Can one factor explain markets?

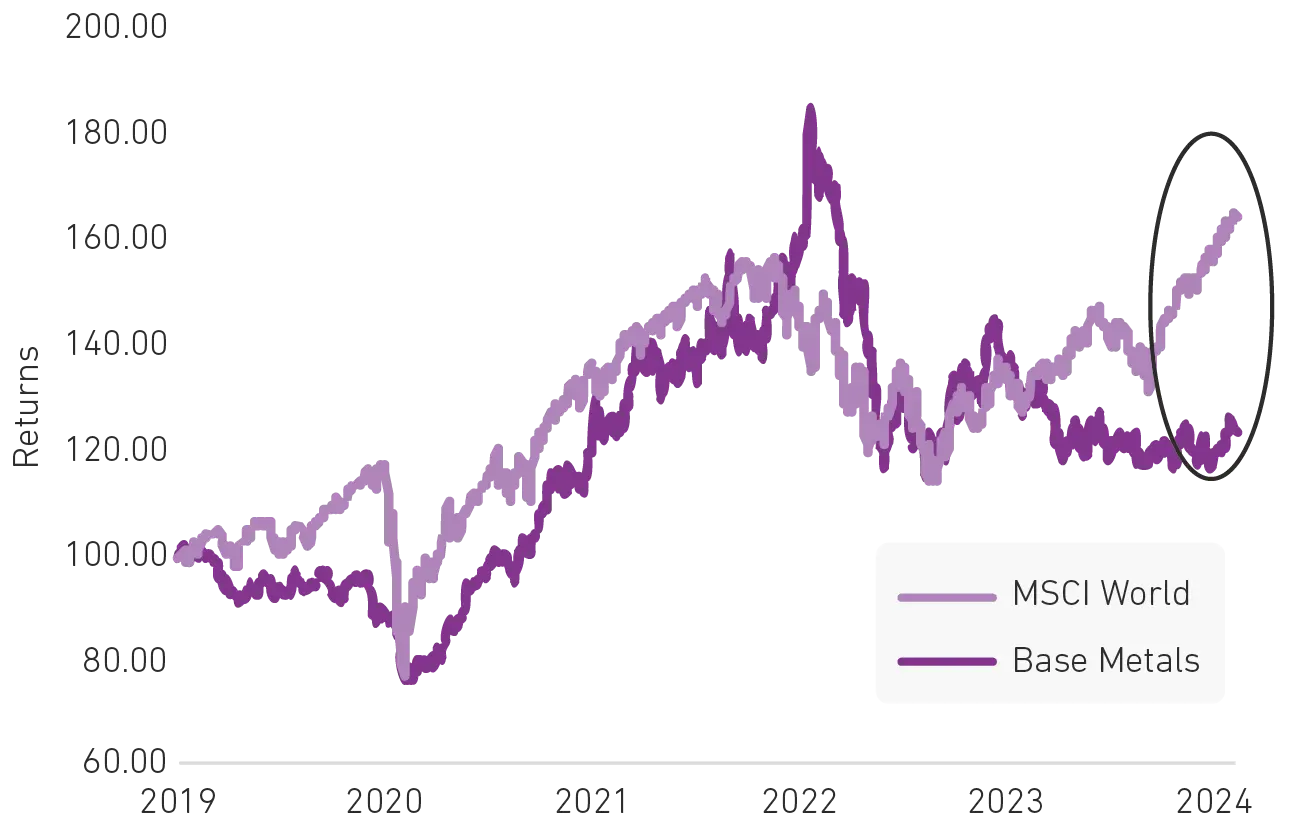

As Ahmer noted this quarter, markets are driven by a huge number of factors. This doesn’t stop investors narrowing markets down to one relationship. Take the chart below, which has been referenced in various financial media outlets. It appears to show a strong relationship between global equities and global commodity prices (excluding energy).

Theoretically, this makes sense… economic growth is a significant driver of equity market returns.

As the economy grows, so do company profits. That same growth tends to push up demand for more materials to manufacture more goods. This demand for materials leads to upward price pressures.

Some financial commentors have noticed a change in the relationship (see chart). Taking it through to its logical conclusion, the implication is that there might something amiss in markets. Are commodity markets suggesting the global economy is slowing? Are equity markets ignoring the messages coming from the commodity markets? Should equity investors run for the hills?

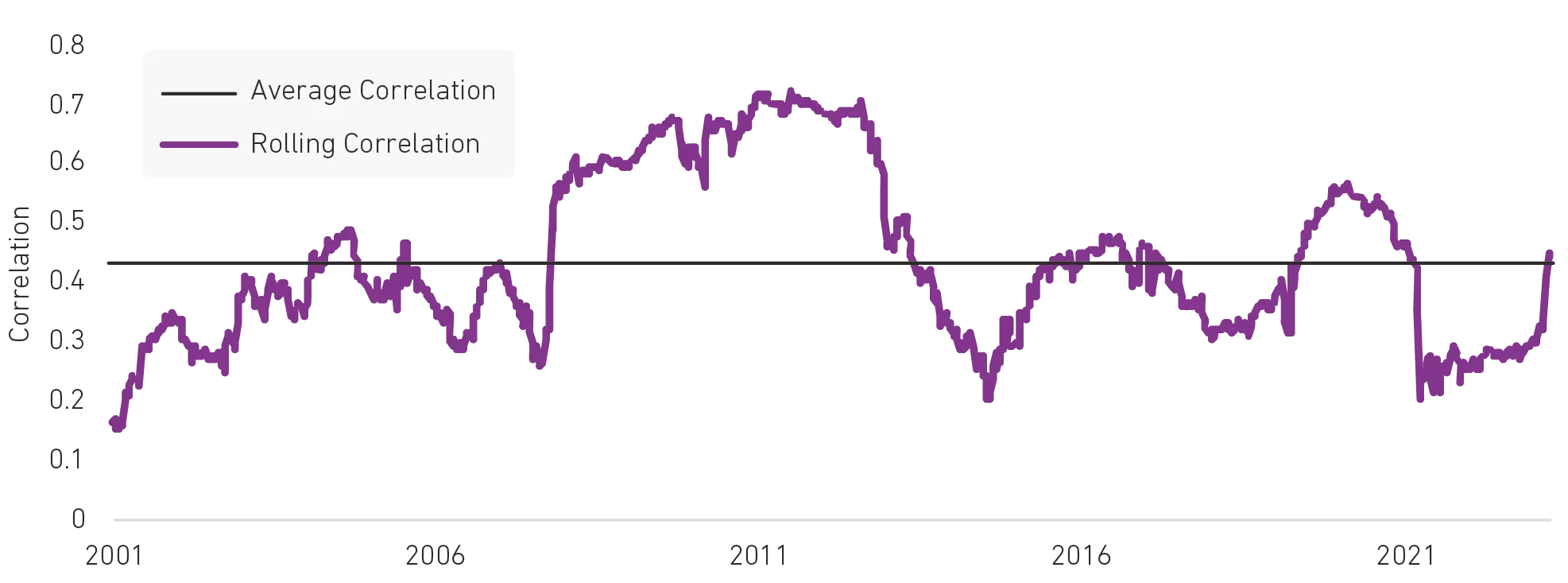

The relationship with the two is more complicated than implied. Look again, but this time a rolling correlation chart. This measures the relationship between the two over time. What you can see is how correlation can change over time versus an “average” over the whole period.

Sometimes commodities can be a significant driver of markets, other times they might not. Over the last couple of years, that relationship has moved up, but from extremely low levels. What is notable is how changeable that is. The lesson is to be wary of the claim of just one factor driving markets. In reality, it’s never that straightforward.

What leads and what follows?

Global commodities (excluding energy) vs global equities, rebased 100 = February 2019

Source: Bloomberg Finance L.P.

2. Keeping up with the Kardashians

Weight loss and obesity drugs have dominated headlines in the healthcare sector, but drugs like Wegovy are now all over popular mainstream media. What started as a research project into diabetes treatment in 1970 then led to the discovery of blood sugar regulating hormone GLP-1 in the 1980s. An unexpected side effect of this discovery was weight loss, which has led into treatments to tackle obesity… and it’s become the Kardashians’ worst kept secret.

The main companies operating in this area are Danish pharmaceutical business Novo Nordisk and Eli Lilly in the US. Recent announcements have also indicated these drugs can reduce the risk of heart attacks, strokes and kidney disease. The share prices of both companies have risen more than fivefold over the last five years.

This is great news for society (and shareholders of Novo Nordisk and Eli Lilly), but has been less good for healthcare businesses that make drugs and devices that treat these chronic conditions. This includes companies that manufacture glucose monitors, insulin pumps, CPAP machines for sleepapnea and dialysis machines. Share prices across the sector have been very volatile around medical updates, and even Walmart referenced the drugs and noted customers were cutting on high-calorie products.

As tempting as it is to own one of two winners, being able to predict the beneficiaries of a piece of news, or the timing of it, is difficult. This is why, as noted by Ahmer, we prefer spreading exposures rather than concentrating them. Over time, the stronger parts will counter the weaker parts, and benefit the healthcare sector as a whole.

Source: Novo Nordisk 2024 Capital Markets Day – 3rd March 2024 https://www.novonordisk.com/investors/capital-markets-day-2024.html

Rolling correlation

Source: Bloomberg Finance L.P.

3. Big Tech becoming Clean Tech

After years of flat line growth, electricity demand is spiking in the US and is expected to continue trending higher. Data centres are the main culprits, with investment likely to exceed $150bn through to 2028. And this estimate could be on the low side.

Artificial intelligence, Machine Learning, Big Data, Cryptocurrencies, and every other buzzword you’ve heard of is extremely energy-intensive. This leads to very large data centres, with the largest in the world, based in Nevada, being twice the size of Heathrow Airport!

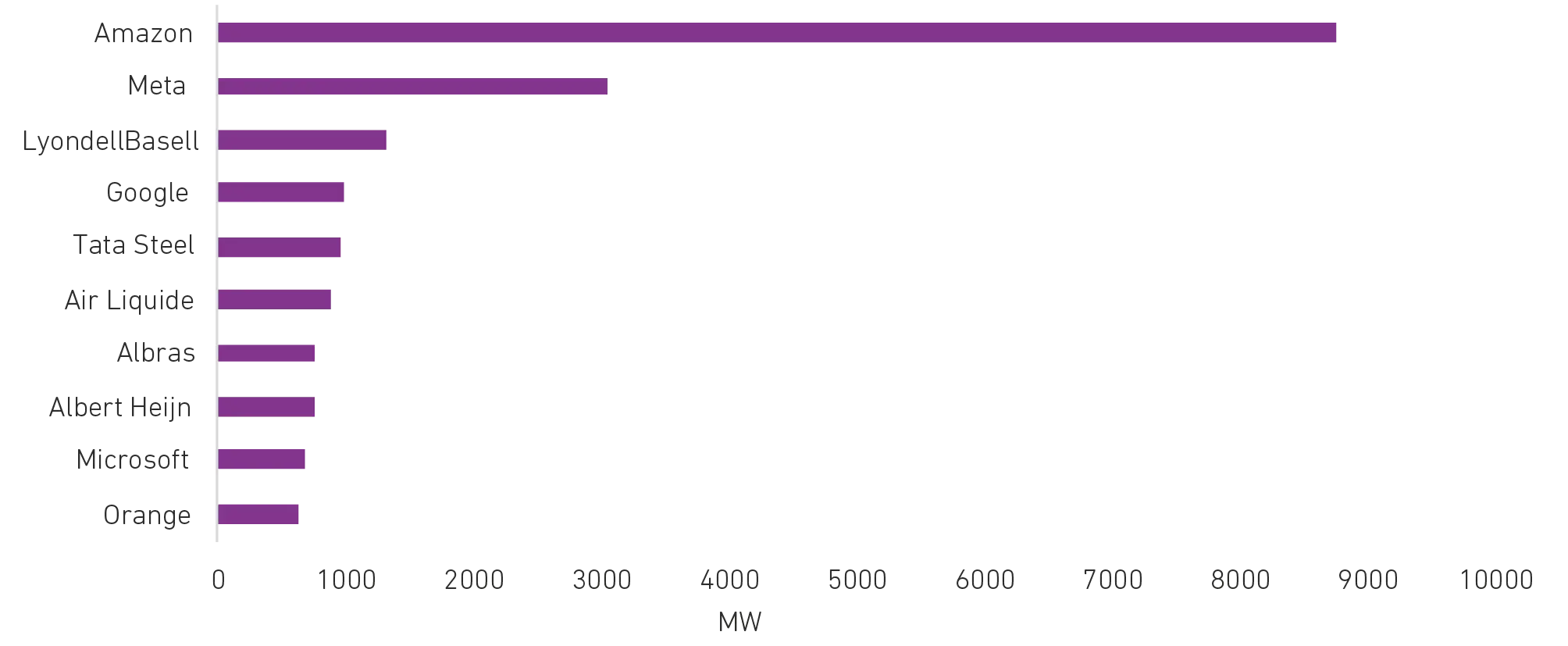

Because of where they are based, many of these data centres run on renewable energy and that means IT companies are becoming the biggest buyers of renewable energy. As the table below shows, Amazon stands out amongst other corporates, having purchased 8.8GW of electricity in 2023. This is a huge amount and means it has the eighth-largest renewable energy portfolio in the world, larger than many existing utility companies.

Top corporate clean energy buyers, 2023

Source: Bloomberg Finance L.P.

4. The internet supply chains

There’s been a large focus on global supply chains in recent years. First, Covid-19 led to a squeeze on manufactured goods. Then Russia was cut from global commodity networks. And now, conflict in the Middle East has cut shipping routes through the Suez Canal. These events have been the main reason inflation across the world has spiked and remained elevated.

No wonder that global supply chains are thought of as essential to the functioning of the global economy. What is less known is that the supply chain is not just in goods but more and more in data. 99% of the world’s data is transported via underwater cables, including some $10tr of financial transactions via the Swift system, which manages global bank transactions.

With the rise of cloud-based computing and AI data generation - transmission via the near 500 million miles of underwater cable will become even more important to global growth.

Source: www.submarinecablemap.com

What is less known is that the supply chain is not just in goods but more and more in data.

5. It's not easy being a central banker

“In many respects the things are returning more to their state in 2019, which we can think of as normal for this purpose, that's job openings and quits, and surveys of workers.” Jerome Powell, Federal Reserve Chair, 20 March, 2024

Whatever “job openings and quits” are, they must be important. After all, the chairman of the Federal Reserve mentioned it in his latest press conference. And it is what it sounds like – it’s a survey of companies reporting the amount of ‘Help Wanted’ signs they have in their shop windows.

It makes sense for Powell to be interested. After all, he is tasked with keeping inflation down while keeping employment up. He needs to know how desperate companies are for new workers. But how reliable is the data? It’s a survey of 21,000 businesses in a country made up of over 30 million. While this might sound too little, it’s understandable. After all, this helps with the data being timely – imagining surveying millions of companies every month! Great care is taken to make sure the right mix of companies are being surveyed that represent the country as a whole.

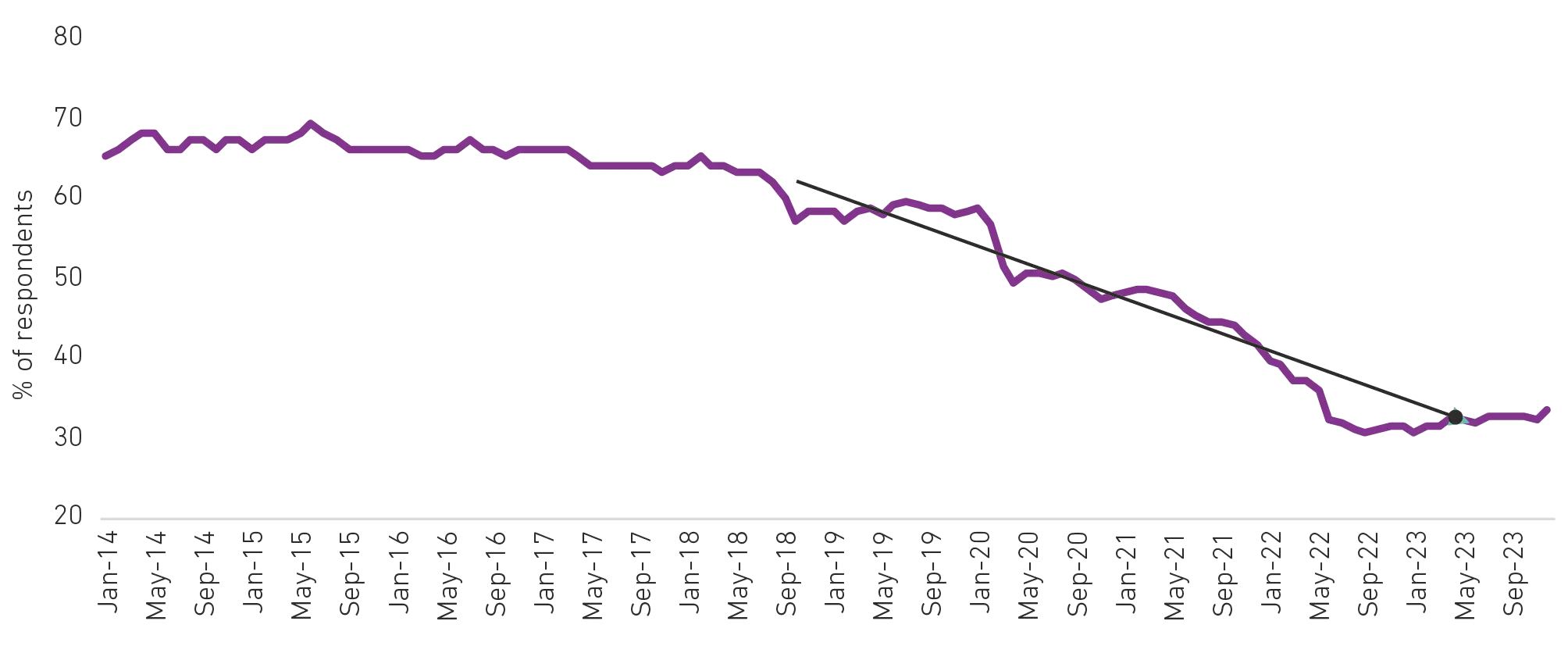

But something curious has happened recently: the portion of respondents has fallen dramatically. A decade ago, around 70% of those surveyed were informing us of their job openings data. This has now fallen to around 30%. The reasons for this are unclear, but it seems to have taken a step-change after Covid-19. Whatever the reason, though, this signifies how difficult it is for central banks. Trying to predict the future impact of monetary policy on the economy is hard enough as it is. But understanding what the impact of it is in real-time is also extremely difficult, especially if the data is based on a smaller and smaller sample of the population.

Job openings and labour turnover survey

Source: Bloomberg Finance L.P.

6. A new new normal?

Some investors can be led to believe that what is happening today is the best predictor what will happen tomorrow. There’s some sense to this – after all, it’s difficult to predict the future. But you can see how this might come unstuck. In the 70s, it felt like inflation was never coming down. In the 80s, it seemed Japan’s economic and business customs were going to change the world. The 90s became synonymous with ‘.com’ bubbles. The 2000s convinced investors that China’s economic growth miracle would go out as far as the eye could see. We all know how those assumptions ended.

They all appear ‘normal’ until they don’t.

In the 2010s? The new normal was that low interest rates would continue ad infinitum. Inflation was permanently low and central banks would never hike again. So much so, that some countries even dabbled with negative interest rates. This year, as of March, Japan finally hiked interest rates above zero, taking up the remaining few negative-yielding bonds with it.

What will be the new new normal 2020s? We’re only four years in, so we’ll have to wait to find out.

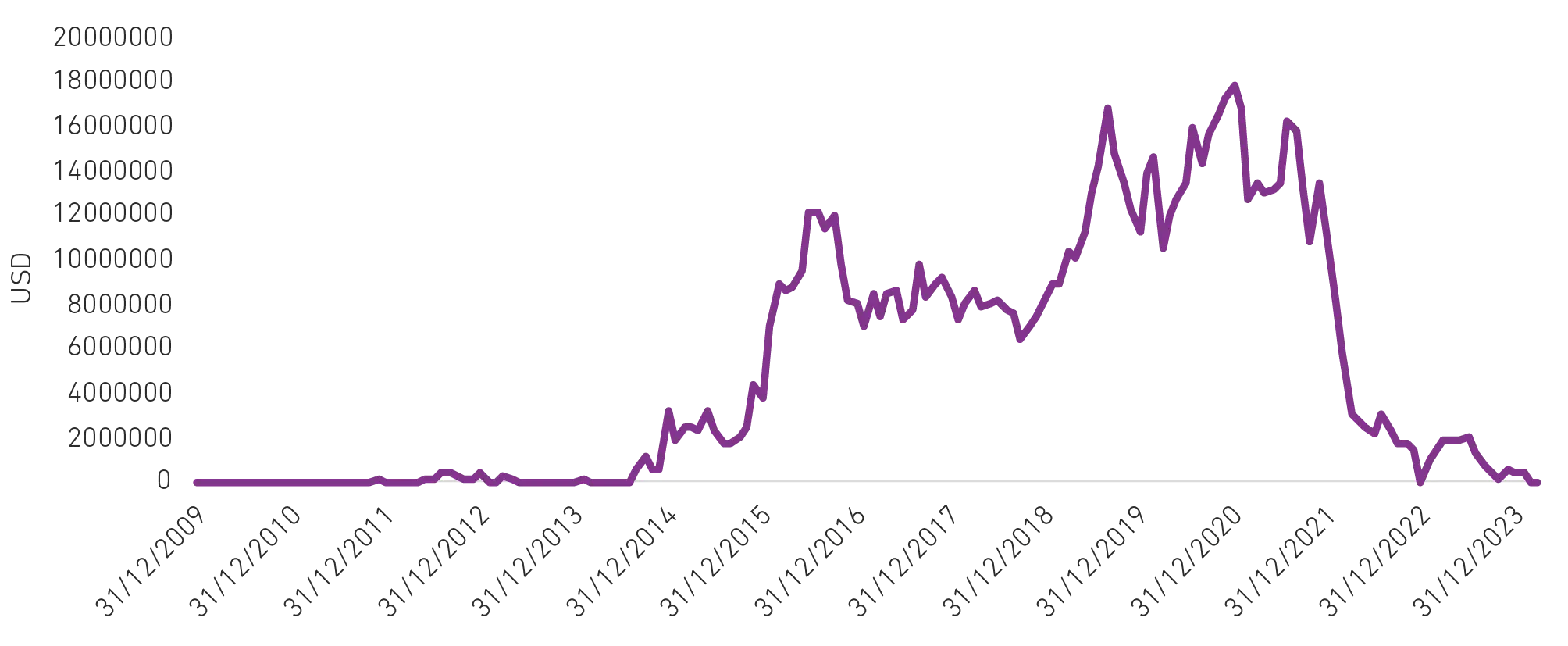

Market Value (million, USD) of global negatively yielding debt

Source: Bloomberg Finance L.P.

… and now, for something completely different.

7. Novel ways to use AI

Einar Felix Hansen is a marvel, a wonder of the modern world. Between March and September 2023, he and his collaborators published a phenomenal 124 history books on Amazon. That must be the most productive seven months for any historian ever.

Except… his writings are vague, repetitive and vacuous! Look at some titles:

The History of Japan: Contrasts and Similarities Between Traditional and Modern Japan [ouch]

The History of the Maldives: From the Ancient Buddhists to the Modern Tourists [snore]

The History of Romania: From Vlad to Dracula [they’re the same person]

I suspect the mysterious Einar asks ChatGPT for big themes in the history, geography and culture of a country, then requests a two- page essay on each. He pastes them into a document and voilà!

Amazon is flooded with nonsense books produced with AI. Before you buy, it’s more important than ever to check the publisher, author, reviews, and writing samples. Einar gonna get you otherwise!

Amazon is flooded with nonsense books produced with AI. Before you buy, it’s more important than ever to check the publisher, author, reviews, and writing samples.

More from 7IM